You could have an accumulated sum of $1 million, and still that doesn’t mean you’re rich.

According to a survey by Charles Schwab, you’re considered rich today if you have a total of $2.3 million in the United States.

In 2005, if you have a net worth of at least $1 million, you’re as rich as the top 5% of households. ($1.9 million in 2012)

A million dollars is worth a lot less today than it was in the past.

Unfortunately, you’re not going to get rich renting out your time. The money you earned, depreciates faster than what you can make in your lifetime.

While the rich are getting richer, everyone else is actually losing ground.

The disparity between the super rich and the ultra poor is shocking. According to Oxfam:

- World’s 26 richest people own as much as poorest 50%.

- The world’s richest man, Jeff Bezos, the owner of Amazon, saw his fortune increase to $112bn. Just 1% of his fortune is equivalent to the whole health budget for Ethiopia, a country of 105 million people.

- The poorest 10% of Britons are paying a higher effective tax rate than the richest 10% (49% compared with 34%) once taxes on consumption such as VAT are taken into account.

- The average laborer in Ghana would have to work 200 years to earn just $32,000, an annual income to achieve the top 1% of wealth globally.

But there is another driver of income inequality that those in power don’t like to talk about — inflation.

The lack of conversation around inflation’s impact on income inequality makes all the sense in the world because it is not as well understood, along with the fact that governments have grown used to enjoying a monopoly over currency that they could depreciate at will.

This arbitrary inflation is a prominent feature of all 21st century economies.

It has the same effect as tax on all who hold any form of government money, whether they choose to hold, spend or save it for their future.

Its invisible. It happens quietly, slowly and then suddenly all at once.

This invisible inflation is quietly eating away our finances. The finances of ordinary people, working ordinary jobs to feed their family.

Inflation is used to defraud savers by expanding credit at will through captive banking systems. The banks in Denmark for example are even paying you to take out a loan today.

They’re effectively monetizing debt with compounded interest. It’s the multiplier effect of the fractional reserve banking. The banks will still be profitable with negative interest rates because the principal payments are created from nothing. Money for nothin’ and your chicks for free!

The best way to print your own money is to own a bank.

Or you could learn to generate returns like Wall Street investment bankers who drive Bentley’s to work, but you’re more likely to lose all your money to con artists dressed up in sheep clothing promising you the world.

We are living in the La-La land of a fiat Ponzi scheme.

Creating more debt at this point is just simply buying themselves more time.

They’re penalizing all of us who save money in banks for our future, yet rewarding those who consume conspicuously.

It just highlights how broken our financial system really is.

People work 40 – 90 hours a week, sacrificing their lifetime to procure enough savings to retire.

Time that could be better spent with their family and loved ones or doing activities they love.

All that time for a weekly $500 paycheck to put food on the table and a roof over the head.

The US central bank swoops in and snaps the finger, prints $2,800,000,000 in a single week.

This is completely mind-boggling to me.

What do they have to do to sacrifice for their paychecks? Nothing.

You may not see the invisible hyperinflation monster yet, but trust me; its lurking around the corner. And it would not be a pretty sight as this will affect every single one of us, including the savers.

For all their grotesque numbers, for all the utter nonsense that they knowingly disseminate to justify a stimulus plan for the banks, for all the arguments published that were ignored, the fact is that the public gobbled all this up — or large sections of the public, anyway. And it’s great for the wealthy but it drives the poor into deeper poverty.

Inflation steals wealth from the poor through two main factors — the lack of inflation-adjusted wage contracts and the loss of purchasing power from cash reserves.

You see what matters in money isn’t about price stability. It is about Purchasing Power!

In a free market economic system, prices are knowledge, and the signals that communicate information. (For more understanding about Capitalism’s Information System, refer The Bitcoin Standard – Chapter 6)

No central authority could ever internalize all the information that goes into forming a price or replace its function.

Consider this scenario:

A deadly earthquake damages the infrastructure of the world’s major producer of copper in Chile 2010.

The earthquake damages the mines and seaport which is used to export the commodity.

This meant that the supply of copper in the world markets will drastically experience a huge shortage.

This instantly resulted in a 6.2% rise in the price of copper.

Anybody in the world involved with copper would immediately recognize the shortage of copper without even needing to know anything about the disaster.

The rise in the price itself reflects the conditions of the market and help people decide how to react efficiently.

Companies that demand copper would have to demand a smaller quantity because of the rise in cost. Or they may have to find substitutes. On the other hand, the high price gives producers of copper in other parts of the world an incentive to create more and to capitalize on it.

With this simple increase in the price, everyone involved in the copper industry around the world has all the information to react efficiently in a way that makes the situation less devastating to the whole market.

Prices are a way of communicating knowledge and no centralized command center can ever coordinate or come up with the most efficient answers to a problem.

Price controls that governments are so used to employ are nothing but a hindrance to the natural dynamics of an economy – The Bitcoin Standard

The Functions of Money

Money is just a medium in which we all use to measure, store and communicate value.

What happens when it’s all too easy to keep expanding the monetary supply? You can no longer effectively measure the price of goods.

It destroys the “store of value” feature which we hold so dear in money.

Gold used to be the standard because it is exceptionally hard and incredibly expensive to inflate the supply no matter how hard people try to do so.

And in the real world, humans will use all sorts of power within their reach to expand the source of something valuable.

Scarcity ensured that gold cannot be easily obtained or produced in large quantities. So they were the money of choice in the past to preserve value over time.

Anytime society dictates their choice of money as an effective measure to store future value, they’re increasing the demand for it beyond the regular rate of demand.

For example, a billionaire would like to store $10 billion of his wealth in copper.

As he tries to purchase 10% of the copper production, they would inevitably cause a price surge in copper.

Sounds good right? The asset he chose to buy just appreciated in value before he even completed the purchase.

Because of this price increment, more and more people started buying copper, bringing up the price even further.

But as the price continues to surge, the billionaire is now facing a dilemma. Should he sell to make a profit from copper. If he does that, it only proves that copper isn’t the best store of value in the market.

Now the multiplier effect from the price increment happens, and everyone in the business of producing copper is having a field day. We do not know how much copper is under the earth, but one thing we can be sure of is that more copper can be produced at a higher price.

The supply of copper is expanded to meet the demand until the demand subsides below the break-even point. Holders of copper begin to sell their accumulated holdings as the price of copper will now drop significantly below the original price.

The billionaire will have lost his wealth by trying to preserve his wealth in copper.

New supply is constantly being generated as long as it’s lucrative to do so.

As revenue of the producers of money increases, they will continue to invest in its creation, bringing the price crashing down again, robbing the savers of their wealth.

The misguided notion of saving wealth in anything other than the hardest money in the market will lead to devaluation and impoverishment in the long run. As it is with the case of silver holders who made their bet against gold.

40 Years of Gold Confiscation

In 1933, it was a criminal offence for U.S citizens to own or trade gold anywhere in the world with exceptions for some jewelry and collector’s coins.

Franklin D. Roosevelt (FDR) was elected president to end the Great Depression.

Unemployment rate was at a staggering 25%.

FDR promised to lower government spending and taxes to balance the budget, but when he got elected, he did the exact opposite.

They started spending more to create new jobs and increase consumer spending.

FDR needed to print enough money to pay for his new stimulus plan but it wasn’t enough as “The Federal Reserve Act of 1914″ prevented him from doing so.

The money had to be backed by 40% gold that they have in the vaults of the Federal government. ($1 printed required an equivalent of 40 cents of gold in the bank)

So he declared a national emergency and outlawed the ownership of gold. Executive Order 6102 made gold ownership illegal for all Americans and anyone caught with it would be fined and imprisoned for up to 10 years.

The entire nation started lining up taking turns to give up their gold by May 1st 1933. The Federal Reserve would exchange $20.67 per troy ounce of gold.

If you did not turn in your gold, you would be arrested, imprisoned up to 10 years and fined twice the amount of gold you held.

This photo was often cited as one of the many examples of Americans lining up to withdraw money from their bank accounts, but actually, they were simply turning in their gold at the Federal Reserve.

Gold and money was officially separated

Systematically, FDR had successfully allowed himself to create debt and fund his expedition on many new government programs as part of his stimulus plan.

Even after the entire ordeal he put his people through, his strategy still didn’t work. In fact, the stock market fell by 90% and unemployment reach 25% at certain points.

Why didn’t his intervention policy work?

Well, the root of the problem lies in artificial and counterproductive price controls.

A central governing body isn’t all-knowing. They can never understand the intricacies of each specialized market to make an inform decision about setting the right price.

Doing so would only result in surpluses and shortages in the market.

Fixing wages and prices in a depressed economy worsen matters as high wages resulted in very high unemployment while price controls in agriculture for example, resulted in deliberate destruction of crops.

People were hungry, with no where to work. While crops had to be burned in order to keep the price high. All in hopes that injecting new fake money into the system would help regain confidence to pre-1929 boom levels.

This assuming that the dollar still maintained its value compared to gold.

Now the real problem starts as inflation caused large asset bubbles to form in the housing and stock markets. The rise in prices were all artificial and ended up correcting in a major way.

Instead of allowing the economy to heal itself naturally like antibodies counteracting with foreign contaminants in the bloodstream, government economists of the era decided that they can find a cure by simply experimenting with monopoly money.

1944 Bretton Woods Agreement

The United States held the largest gold reserves in the world because of the events that unfolded. Many foreign nations use the Federal Reserve Bank of New York to secure their gold reserves.

Developed nations met at Bretton Woods, New Hampshire and agreed to back their currencies with the dollar instead of gold.

This agreement bestowed the dollar with a new status of privilege. As the U.S. dollar went on to become the principal international reserve currency.

For the most part, the dollar’s global reserve status does help to smooth international transactions.

Americans enjoyed 47 years of hegemony as a result of this outcome.

Countries With Largest #Gold Reserves pic.twitter.com/ROJS2ZcDU9

— Ron Loewen (@ronloewen) January 7, 2019

This privilege however came with unbridled consequences.

As a global reserve currency, it isn’t neutral, borderless and censorship-resistant.

Three of which are highly important attributes to every nation partaking in the use of the dollar

The French were one of the first to publicly criticize that status.

They labeled it as an “exorbitant privilege“. In 1965, French president Charles de Gaulle said that it was impossible for the dollar to be “an impartial and international trade medium…It is in fact a credit instrument reserved for one state only.”

France would later send a warship to New York harbor with instructions to bring back its gold from the New York Federal Reserve bank,

By the early 1970s, other countries began demanding gold for the dollars they held.

Inflation was highly rampant. Gold was the only anchor nations had in their economic arsenal.

To put a nail in the coffin, President Richard Nixon ended the “Gold Standard” by giving a public televised speech to the nation fearing the depletion of gold from their vaults.

Doing so would allow the dollar to float freely against other currencies and remove the final obstacle to ballooning federal deficits and trade imbalances.

Other nations followed suit and gold was forever banished from becoming the monetary standard of the people.

Even after unpegging the dollar from its value in gold, nation states continue to buy and hoard gold within their reserves as an anchor for their fiat (experimental) currency.

Without the golden fetters of scarcity, governments all over the world had immense power and an unrestricted access to commandeer resources and wealth of the people while creating the illusion that a dollar would still be a dollar (Unfortunately, since that time, the U.S. Dollar has lost 98% of its purchasing power).

It wasn’t until 1974, 40 years after gold ownership was outlawed that President Gerald Ford lifted the ban on owning gold. He did it after he saw sound-money advocate Jim Blanchard on TV raising a bar of gold asking the question: “Why can I not own this?”

Unfortunately, he failed in reestablishing gold as the monetary standard of the country. The monopoly on money was far too enticing for governments to give up.

The Victims of Inflation

With a currency that depreciates in value, people are constantly in search of returns to beat inflation. These returns come with a risk, and so it leads to an increase investment in risky projects and an increased risk tolerance leading to more losses and malinvesments.

Not only that, people start to spend more, taking on more credit card debt to fund short-term activities that satisfies their immediate wants.

Inflation addicts us to spending money today.

Gambling addicts us to taking uncalculated risks.

Marketing and social media tells us we need more plastic crap.

Sugar ignites our desire to overeat. Diabetes is growing our economy twice over.

Everything around us is highly addictive in order to get us to react impulsively.

This is known as a “High Time-preference mentality.”

When the alternative to spending money is witnessing your savings lose value over time, you’d probably would enjoy spending before your money loses its value.

Even at a 2%, inflation would erode your savings by 50% within 34 years. Wealth is therefore redistributed from the less to the more politically connected. It’s parasitic.

“As the money is spent more, the price level rises, until the later recipients suffer a reduction in their real purchasing power. This is the best explanation for why inflation hurts the poorest and helps the richest in the modern economy. Those who benefit the most are the ones with the best access to government credit, and the ones who are hurt the most are those on fixed incomes or minimum wages.” – The Bitcoin Standard”

On the other hand, a currency that appreciates in value incentivizes saving, as savings gain purchasing power over time. It encourages deferred consumption, resulting in a lower time preference.

Societies with money that appreciates in value over time will develop a sense of delayed gratification, learning to save and think for their future. The Stanford Marshmallow experiment gives us this indication that delayed gratification is critical to success in every aspect of life.

A New Kind of Money

The industrial-era of the printing press brought us paper money issued by governments ruling over territories that were confined by borders. Without the golden tethers on the money we use, society grew restless.

When the internet came along, a new cyber-economy emerged. Suddenly, the world’s money started to transcend beyond physical existence.

Money turned into bytes of digital data.

But when the new infrastructure was laid on top of the old, friction began.

Not only is it messy, slow and inefficient; the elaborate framework of central planning and its accompanying rituals got in the way of economic activity happening on a global scale.

Perhaps one of the most glaring facts about the modern economy today is the size of the foreign exchange market. The Bank of International Settlements estimates that the size of the foreign exchange market to be $5.1 trillion per day for April 2016 ($1,860 trillion per year).

The World Bank estimates that the GDP of all the world’s countries combined is $75 trillion in 2016. This means that the foreign exchange market is 25 times as large as all the economic production that takes place in the entire planet.

It’s important to understand that the foreign exchange market is like a middle man.

An intermediary that was born out of this friction.

It isn’t a productive process for the world economy flowing on the internet.

There is no economic value being created in transferring one currency to another. It is a cost and a huge inconvenience to be paid by the people.

Economist Hans Hermann Hoppe calls this “a global system of partial barter“. It cripples global trade by exacting high transaction costs.

Not only is the world wasting large amounts of capital, energy and labor attempting to improve this inconvenience, (energy that could be put into better use in other areas of the economy) businesses and individuals worldwide frequently incur significant losses.

Think about each time you make a PayPal transaction on a foreign website with your local currency. The fees from swiping your credit card overseas.

Think about each time you send money abroad to your family or the potential customers who are reluctant to buy your product because of the exchange rate.

All of this add up over time.

A borderless economy requires a borderless currency. Bitcoin is governed by mathematical algorithms that have no physical restrictions.

Someone moved $300M worth of #bitcoin for an unfairly cheap fee of 4 cents. 👇🤔 pic.twitter.com/SbpNMTaKch

— A v B ⚡ (@ArminVanBitcoin) June 28, 2018

It is:

- open,

- public,

- neutral,

- borderless and

- censorship-resistant.

Bitcoins are easily verifiable, highly portable, infinitely divisible and designed to have a finite supply.

If you treat money as a way of storing your wealth for future use, scarcity should be its main attribute.

It’s also highly secured by the decentralized network of nodes (more than 9,000 separate computers are validating transactions on the Bitcoin blockchain.)

Money shouldn’t be easily produced or left in the hands of the select few in power.

We run into scarcity because while resources are limited, we are a society with unlimited wants. Therefore, we have to choose. We have to make trade-offs. We have to efficiently allocate resources. We have to do those things because resources are limited and cannot meet our own unlimited demands.

Without scarcity, the science of economics would not exist. Economics is the study of production, distribution, and consumption of goods and services. If society did not have to make choices about what to produce, distribute, and consume, the study of those actions would be relatively boring. Society would produce, distribute, and consume an infinite amount of everything to satisfy the unlimited wants and needs of humans. Everyone would get everything they wanted, and it would all be free. But we all know that is not the case. The decisions and trade-offs society makes due to scarcity is what economists study. Why are certain decisions made and what is the next best alternative that was forgone? – Study.com

Pre-Programmed Scarcity

Bitcoins are pre-programmed to create a set amount of coins. Once this limit is reached, no new coins will ever be created. This creates absolute scarcity. The algorithm that governs Bitcoin will create no more than 21 million bitcoins (BTC). You’re choosing purchasing power over price stability.

Think about this… There are 35 million millionaires in the world. That means if every millionaire wanted to own an entire bitcoin, they wouldn’t be able to.

There literally is not enough to go around.

Contrast that with fiat money, there’s no limit to how much it can be created. Many of the super-rich families are beginning to realize this.

You can see that Bitcoin actually have more in common with gold than with fiat money. One bitcoin will always be one bitcoin out of 21 million BTC. You also don’t have to own one full bitcoin (1 BTC).

The smallest denomination of Bitcoin, a single satoshi, is now worth more than some national currencies.

0.00000001 BTC is worth more than the:

– Iranian Rial

– Vietnamese Dong

– Indonesian Rupiah

In a highly inflationary world, this can easily happen over time. You can own fractions of bitcoins up to 8 decimal places, with 1 Satoshi being 0.00000001 BTC.

This new kind of money is meant to be deflationary.

It will make you think twice before spending. Instead of upgrading to that new iPhone or selling your old but working car, you get put into a new perspective because you know that spending it today – it might go up in a week.

Do you really need that new plastic crap? It really makes you reconsider your spendthrift ways.

So this is a new paradigm shift in thinking about wealth and money. It requires you to shift your thinking in a way that lowers your time-preference.

If you’d like understand that a little better, you can always access our Bitcoin ecosystem of resources right here. It’ll explain to you how Bitcoin works in a way that you can understand.

I believe Bitcoin is the future of money. It is new and it is different.

What a great interview with @jack. 💯

“We need a currency for the internet. And the internet being an entity that isn’t controlled by any company or any one government, that is for the world and for the people of the world.”https://t.co/8vViZXfO2e

— Steve Lee (@moneyball) June 14, 2019

In a world where Bitcoin is our store of value and medium of exchange, we would be incentivized to save rather than spend.

In a world where conspicuous consumption is killing our environment, I believe that this is a net positive for all of us.

Skeptics like to point out that bitcoin has no intrinsic value. They assert that the only reason people refer to it as a store of value is because the price keeps going up.

Let’s see…

Bitcoin experienced 5 major catastrophic corrections in the past decade. It only has a 10 year history. When compared to other classes of wealth, it’s like a 5 year old kid trying to impress his 80 year old grandpa, but not getting the amount of respect or attention he deserves.

To put things into perspective, the world’s GDP is at $80 trillion, gold: $7.5 trillion, wealth and real estate combined is at a whopping $545 trillion.

Bitcoin’s current market value is only at $0.2 trillion. This would give you an indication that Bitcoin is still at a very early stage, and has a lot of room to grow.

Last year when I experienced an 85% drop in the value of Bitcoin in terms of the dollar, skeptics would come on and say, “If bitcoin is such a good store of value, why was it worth $19,000 last year and now its worth $8,000?”

For the same reason it didn’t crash to zero when Bitcoin held from $1147 to $177 in 2015.

For the same reason it also held from $259 to $68 in 2013.

For the same reason it held from $29 to $2 in 2011.

Even the most technically expert observers of the past have frequently failed to grasp the implications of new technologies. Refer “The Sovereign Individual – The Error of Minimal Expectations”

At the moment, 60% of all bitcoins have not moved in an entire year.

That’s 10.5 million bitcoin, or $94,500,000,000 being held as a store of value in the last 12 months alone. That’s enough proof that money is just a belief system.

For skeptics, the geographical tether on imagination is still so tight that they sound like the same experts examining the potential of the internet in 1995 and concluding that it has little commercial potential.

I pointed out the: 11 Pieces of Bad Advice I Wish People Would Stop Spreading about Bitcoin (It includes lazy pieces of arguments ranging from tulips to ponzi schemes and the bubble theory)

Do we need inflation?

- Has there ever been a deflationary currency experiment before? Do we need inflation?

- Why would you buy anything if you would increase your purchasing power by holding? We need inflation!

- How do we create that within Bitcoin?

ANSWER by Andreas Antonopoulos

There have been deflationary economies, but most of the ones being studied by economists are facing… deflation in the [midst] of the government’s unlimited ability to print more money.

That deflation is not caused by a restriction in supply, but instead by a collapse in demand in the economy.

Deflation is a symptom.

The question is, what is it a symptom of?

If the only economies you’ve studied with deflationary characteristics are in fiat, then deflation is always… the symptom of a collapse in demand because the [currency] supply is infinite.

If you have a deflating economy, then [they will] print more money.

We have seen this example in Japan, even in the United States. When you have deflationary tendencies, the government starts printing more money. The only way it would still be deflationary, while you are printing unlimited amounts of money to increase supply, is because there was a collapse in demand.

A collapse in demand is a bad thing, but deflation is not the bad thing.

In traditional economics, deflation is always seen as a bad thing because it is the result of demand collapse, where supply is not limited in any way.

Deflation in Bitcoin is a very different thing. It is caused by a reduction in supply, not a collapse in demand.

It is caused by very robust demand meeting limited supply and technological advancements.

That form of deflation is qualitatively very different from deflation due to a collapse in demand.

Without a collapse in demand, deflation isn’t a bad thing.

Allow me to demonstrate: I currently have a computer… that I purchased for about $1,500. It contains many orders of magnitude more processing power than the supercomputers of the 1980s.

Over that time, the cost of this technology (laptops, phones, cameras, etc.) that we use… has collapsed in [price].

This deflationary collapse was not driven by a drop in demand, but by a very robust demand.

Technology is offering better and better products where Moore’s Law applies, supply is restricted, but demand is very robust.

That is a deflationary environment caused by a healthy market, not a recession or depression.

In that environment, why would I buy a laptop now if I could wait three years [to buy a much better laptop]… for the same amount of money? Presumably, then I would never buy a laptop. I would just keep the same one forever.

This applies to every technology out there. Why would I buy a device now when I can just wait two years for an even better one? But we see that, in technology, people don’t [usually] postpone purchases like that.

Instead, they [take] advantage of the deflationary system: spend some money now, but also save for the future.

The money they save for the future maintains value, while [the money they spend] on a laptop or mobile… becomes a better purchase in the future.

Saving isn’t necessarily the same as hoarding.

In my experience with bitcoin, I have become a better saver, but I have not stopped spending. I still spend in bitcoin on a regular basis in order to use it as a currency, because I work with it every day. I also earn it as a currency every day.

My “hoarding” instinct isn’t as acute. I am in the economy of cryptocurrencies, I am not just buying it as an investment, burying it in cold storage.

I am earning and spending it for my business every single week, so my attitude is very different. I don’t find that I am restricted in my spending by the idea that it will have greater value in the future.

Deflationary economies are bad when currencies have infinite supply and a catastrophic collapse in demand.

That is not the case with cryptocurrencies like bitcoin, which has a limited supply. It is a very different thing. – Andreas Antonopoulos

Bitcoin can put a dent in income inequality

While Bitcoin’s price have always been deeply fascinating, offering frissons of thrill to day traders, glimpses of a glorious future, juicy opportunities for getting rich quick and delivering overnight fortunes, its speculative prices have gradually turned it into pure theater — sometimes of the slapstick variety.

Bitcoin’s poetic justice: the more a person suffers from easy money, the easier it is to understand bitcoin, and the earlier they join it. The more they benefit from easy money, the harder to get them to understand it, the later they join.

SV will be last, with central banks!— Saifedean Ammous (@saifedean) May 28, 2019

For people who benefit from the current monetary policy of easy money or having substantial disposable income, Bitcoin can be exceptionally difficult to understand.

Bitcoin is about individual wealth liberation and autonomy from the authorities. It’s so easy to fall into the trap of thinking in terms of bitcoins purchased as a % of the dollar, rather than in terms of ‘absolute BTC bought per capita’.

Capital controls, seizing of assets, hyperinflation, predatory taxation and financial censorship are just some of the highlights why such a technology is so important in the coming decades.

People who live in countries like Turkey, Argentina, Zimbabwe, Venezuela, Brazil and Columbia are among the first to adopt BTC as their go-to method of preserving their savings because the U.S. dollar isn’t as neutral or permissionless as it should be.

Imagine losing 98% of your wealth in 7 months. It’s impossible to fathom the implications of political instability and government incompetence.

There is an obvious need for a new currency that does not rely on the government.

Even a fiat currency like the dollar is highly subjected to the whims of political forces and economic sanctions.

In March 2009, even China and Russia called for a new global currency. They’re concerned that the trillions they hold in dollars would be rendered worthless if inflation sets in.

The U.S. Dollar is a political instrument of its administration. It is weaponize to bully nations into submitting to the will of the government of the United States.

Greed tends to destroy fiat money because it is nationalized and used as means to redistribute income.

That same Greed would secure bitcoin as digital gold and will serve consumers far better than nationalized money ever did.

A decade ago, 10,000 bitcoins bought you a pizza.

Today, 10 bitcoins would buy you a high performance Tesla Model X.

In the next decade, with 1 bitcoin (BTC) you’d be considered pretty wealthy.

I have for years believed that I experienced a watershed moment but didn’t appreciate its overall significance. Until now.

It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy. Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine. – Satoshi Nakamoto.

Shaking Up Old Monetary Tradition, Literally!

Did you know that if you bought just $1 of Bitcoin every day for the last 9 years you would have turned ~$3,285 into over $18M by accumulating 2189 BTC? Just launched a tool to explore how DCA strategies would have performed using historic btc prices! https://t.co/DohCQ7C9S8

— John Cantrell (@JohnCantrell97) June 14, 2019

This is a rare opportunity for ordinary people to flip the status quo without having to take life-changing risk.

Setting aside a small amount of money each month for Bitcoin (Dollar-cost averaging – DCA) could turn out to be the simplest yet most profound investment strategy ever devised.

The best part is that the world has yet to wake up to the idea that Bitcoin is here to stay. History has shown that it isn’t possible to insulate yourself from the network effect of hard money.

China and India were the last to adopt gold from silver as the monetary standard and they end up suffering huge losses as silver-holders experienced a sharp demonetizing of their asset. People woke up one day to discover this rude awakening.

This isn’t a pleasant situation to wake up to especially in this day and age with the wide accessibility to information and knowledge at our fingertips.

In a race to become the new monetary standard of the world, there’s no silver medal for coming in second place.

Right now, the entire Bitcoin market is valued at about $200 billion. Venture capitalists and billionaires I mentioned here, sees the entire market growing to trillions of dollars. That’s 3,000+% upside ahead.

Well known venture capitalists (VC) like Fred Wilson, a prominent Bitcoin bull, “all of the gains are captured among [early investors].” But usually the bulk of stock returns (pre-IPO) are out of public investors’ reach.

With crypto assets though, Wilson explained that this market is more about picking the networks that will win rather than the businesses built on top of them.

“The value is going to ultimately…accrue to the token, not necessarily to the operating business that you build on top of these networks” said Wilson.

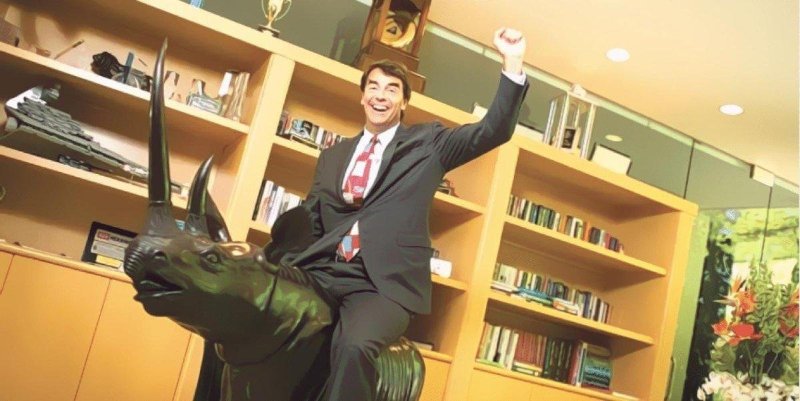

Tim Draper is another prominent tech VC who is going long on Bitcoin because he believes that it is the future currency.

Draper reasoned, “People ask me, ‘Are you going to sell your bitcoin [for fiat]? and I say, Why would I sell the future for the past?” Fiat is highly subjected to the whims of political forces while Bitcoin is secure, neutral, distributed and global.

Marc Andreessen share Draper’s vision. He restructured his entire VC firm so that they can invest directly into Bitcoin and cryptocurrency without any restrictions.

Like the internet, he’s betting that in 20 years, we’ll talk about Bitcoin like we talk about the Internet today.

Andreessen made headways by the age of 24, when Netscape, a company he backed, made the first breakthrough on the internet. Now he’s betting on Bitcoin.

Marc Andreessen’s a16z crypto fund:

a16z crypto is a $350M venture fund that will invest in crypto companies and protocols. Our fund is designed to include the best features of traditional venture capital, updated to the modern crypto world:

- We are long-term, patient investors. We’ve been investing in crypto assets for 5+ years. We’ve never sold any of those investments, and don’t plan to any time soon. We structured the a16z crypto fund to be able to hold investments for 10+ years.

- We have an “all weather” fund. We plan to invest consistently over time, regardless of market conditions. If there is another “crypto winter,” we’ll keep investing aggressively.

- We are flexible with respect to stage, asset type, and geography. One reason we created a new fund is to have maximum flexibility. We invest at all stages, from early stage projects to fully developed later-stage networks like Bitcoin and Ethereum. We’ll invest in traditional financial instruments like equity or convertible notes, and new instruments including the direct purchase of coins/tokens. Crypto is a global phenomenon, with great projects all around the world, and we’ll invest accordingly.

That means you have to take the opportunities presented in front of you to make life-changing gains.

So get out there. At the very least, buy some Bitcoin.

Remember, you don’t have to own a whole Bitcoin. You can own just a fraction of a coin.

Only a Poor Man Sells His Prized Assets

The filthy rich seek wealth, not fiat money.

The common man trade-in their time in exchange for fiat money.

Wealth are assets that appreciates over time even while you’re asleep.

You’re not going to get rich one day working for your boss. You must own an equity, a piece of business or an asset in order to gain your financial freedom.

In the 18th century, Yeoman farmers who own acres of land experienced unsettled conditions like clustered crop failures, cold winters, famines and plagues.

When crop yields failed to recover, the landowners faced a desperate situation. Continue to hold on to their land for dear life (HODL) or give it away to the Church in preparation for the telling disaster.

Many landowners, large and small gave them away.

For centuries, markets have always placed the greatest pressures on the weakest holders.

Our new report “Bitcoin in Heavy Accumulation” is out. Read here: https://t.co/DkjedcF3RG pic.twitter.com/UpQotZUTdW

— Tuur Demeester (@TuurDemeester) April 18, 2019

Dire situations and an impending collapses create conditions that centralizes wealth.

It has happened to land.

It has happened to gold.

It has happened to bitcoin.

During the last Bitcoin bull run in 2017, many retail investors bought bitcoin at higher than average prices during the fear of missing out (FOMO) run. The new highs triggered a feeding frenzy.

With all the media attention, new entrants got attracted by the allure of quick profits, driving prices higher at an accelerated pace.

Eventually, all the hysteria reached a crescendo at around $19,500 per BTC.

Traders who got in early wanted to cash out some profits and started selling. A little push was all it took to trigger a sell-off. The ones who got in much later got their hopes pitilessly crushed.

The price of Bitcoin crashed to a low of $3,200 in 2018 because new entrant mom-and-pop investors didn’t fully comprehend the long term value of Bitcoin.

Bitcoin vs Top Performing Stocks. pic.twitter.com/ee0MgJNAPo

— Wayne Vaughan (@WayneVaughan) June 21, 2019

Bitcoin’s yearly lows:

2012 – $4

2013 – $65

2014 – $200

2015 – $185

2016 – $365

2017 – $780

2018 – $3200

Bitcoin is a long-term investors’ dream.

You cannot find another store of wealth such as Bitcoin that combines both exceptional rate of returns with a highly secure decentralized payment network that’s free from government control.

It is technology that enables individuals to accumulate wealth in a realm that cannot be bent easily to the demands of systematic compulsion. It renders every government’s capacity to monopolize money obsolete.

That is why, when retail investors drove the price up, institutional investors used their capacity to drive the prices back down. After that, they gradually began accumulating Bitcoin at very low prices.

If you invested $1,000 in Amazon 10 years ago, you’d make about $20,000 today.

Even Warren Buffett himself admitted he was too dumb to realize Amazon would succeed at this scale. He opted not to invest in Amazon when he had plenty of opportunities. He did not understand or appreciate the value of technology.

$1,000 in Microsoft 10 years ago = ~$8,000

$1,000 in Netflix 10 years ago = ~$100,000

$1,000 in Apple 10 years ago = ~$9,000

$1,000 in Bitcoin 10 years ago = >1,000,000,000 ( 185,185 bitcoins at $9,800 per BTC)

Based on an account of a Norwegian man buying 5,000 bitcoins for $27 in 2009. I had to recheck my calculations 3 times to make sure I had the right figures which amounted close to $2 billion. Note: Of course in those days, it’s extremely difficult to find and buy bitcoins.

If only the majority of investors were patient enough… Food for Thought!

In Bitcoin’s 10 year-long history, no single asset, startup, stock, precious metal or commodity has even come close to providing better returns than investing and HODLing bitcoin (BTC) itself.

It has been the best performing asset over the last decade.

The only exception: if you bought during the high of Dec’17 and sold it on Feb’18 (if those investors did some homework and held on to their BTC, they would’ve been in the net positive again.)

Could Bitcoin Be Worth Zero One Day?

I can say with 90% certainty that Bitcoin would go all the way up to $1 million or more rather than just go (back) to zero. (But don’t take my word for it, what do I know)

You have to do your own research (DYOR) and come to your own conclusions.

As time passes on, the idea that Bitcoin would go to zero seems more and more far fetched.

Skeptical media whores like to predict that Bitcoin would inevitably crash to zero, but that would also mean you have to counter punch all the positive strides that Bitcoin has been making for the past 10 years.

Furthermore, the Lindy effect suggests that the longer Bitcoin remains in existence the greater society’s confidence that it will continue to exist long into the future.

Besides, there are too many vested parties involved. Too much money, confidence and hard-core believers who care about building a better future with hard money.

To totally oust Bitcoin, would be equivalent to seeing a company like Nike, a $140 billion dollar company collapse overnight. But it would be unfair to label Bitcoin as a company.

It isn’t one. It’s much like a protocol similar to the internet’s TCP/IP.

A set of rules that governs the exchange of bitcoins over the internet using cryptography and consensus algorithm. Everyone participating in the network has a vested interest to keep Bitcoin running smoothly.

Just like nobody owns TCP/IP. No one owns Bitcoin.

This is becoming scary: using Oct instead of Dec data, Stock-to-Flow model fit improves to 99.5% R2! Model error was mainly caused by Nov2013 and Dec2017 ATH, so sampling without ATH gives less noise. Predicted #bitcoin prices increase: $100K (2020+), $1M (2024+), $10M (2028+)… pic.twitter.com/1WX6LOVxZW

— Plan₿ (@100trillionUSD) July 14, 2019

But imagine if someone did. How valuable would the protocol be?

Think about this…

According to a Harvard Business Review article, more than half the world’s most valuable public companies have built business models on TCP/IP.

That’s $5.4 trillion dollars in value traced right back to TCP/IP.

Think of the biggest names in the internet space: Amazon, Google, Facebook, Priceline, eBay, Netflix, Uber, etc… They are applications, not protocols.

Bitcoin is the first among protocols to incentivize its users with bitcoin (BTC).

Many will compare Bitcoin to a company or stock, which can go to zero, as a reason not to invest in it. However, Bitcoin is decentralized and autonomous. There is not one man, group or board of directors that can run it into the ground.

Regulators trying to ban Bitcoin in China and India are also finding this out the hard way. Banning it only creates more public intrigue.

“Bitcoin will never go to zero because it is a hedge against falling currencies, inefficient economies and increasingly systemic inequality. Bitcoin represents the currency of a better future for society, and people will always invest in their future.” – Jehan Chu, co-founder of Kenetic Capital

I believe that irrational fears and inclinations are more costly in life.

Fewer than four people die on average each year from spider bites, and yet we all fear that a spider would bite and kill us. On the other hand, donuts increases the risk of heart disease and causes hundreds of thousands of deaths each year, and yet we aren’t afraid of donuts.

This is a blind spot in our collective consciousness.

We’re hardwired to be incompetent at understanding probability. And this creates dire practical consequences.

Like with all things in life, there’s no reward without any risk involved.

So before investing in Bitcoin, ask yourself, what’s your risk appetite? Can you tolerate the amount you have just invested only to lose it all? Would it be devastating?

Bitcoin going to zero actually means that the internet no longer exists.

You would have to erase every copy of the Bitcoin whitepaper held in every server, computer, pen drive, destroy the 9,000+ computers running the Bitcoin protocol and wipe out the memories of owners from their private keys.

Which implies that some form of terrible tragedy has occurred and mankind would return to the stone age.

So it is more likely that Bitcoin would continue to outlive you, me and everyone else alive today and for the foreseeable future very much like the internet.

Short Term Vs. Long Term Thinking On Bitcoin

Your mind works in two different ways.

One works quickly and intuitively, but is often wrong half the time. (Higher Time-Preference)

The other is methodical and has a longer time horizon (Lower Time-Preference), but is lazy and loves to take shortcuts. It will only be undertaken with an expectation of a much better reward, or else it will hand things back to the ‘short term‘ system.

Short term thinking makes up the majority of people in the world. Watch the Stanford Marshmallow Experiment.

This higher time-preference originates from our hunter-gatherer days more than 100,000 years ago.

Instinctive and animalistic impulses allow us to survive better in conditions that are harsh especially in environments where predators exist.

Animals’ time preference is far higher than us humans’.

But every now and then, our animal instinct kicks-in as well.

It isn’t a bad thing. Our fight or flight response is built-in to keep us alive.

We all act to the satisfaction of our immediate needs such as hunger and aggression.

Two characteristics which we all still exhibit today.

But there’s always a trade-off.

The few who were able to defer their immediate needs and consumption had a bigger conception of the future.

We differentiated ourselves from animals by spending time developing tools for hunting.

We used our time, time that can be used to hunt more preys to develop and maintain ever more sophisticated tools for long-term use.

Building things that can last for the future requires a much lower time-preference.

It takes a shift in cognitive evolution for humans to one day decide to take time away from hunting and dedicate that time to building a fishing rod that cannot be eaten itself, but to allow us to hunt more proficiently.

Money is one of the tools we use as a store of value, to preserve our fruits of labor far into the future.

Imagine storing your wealth in apples, in hopes of exchanging it for a car.

- First, it is not easy to accumulate enough apples for that.

- Second, the apples would rot before the deal can be completed.

- Third, the apples are difficult to transport to another buyer in another location.

This system of barter and trading is highly inefficient and archaic.

Over time, technology provided us with a far more efficient solution for money. Money that is:

- Scarce

- Portable

- Fungible

- Verifiable

- Divisible

- Durable

- Established history

- Censorship-resistant

Civilization started the moment we understood the superiority in playing the long term game.

That is the essence of delayed-gratification.

When i first came across an article suggesting that we’re entering a new stage in the history of money, I was downright skeptical.

Read into Bitcoin a few months later and I got hooked forever once I understood this technology had the power the liberate individuals at the expense of centralized power.

At first, it was the possibility of getting rich that attracted me, but like many others, it’s not the only reason I continue to HODL.

I stuck to learning about Bitcoin, even when nobody else around me saw it the same way I did. They still think it’s a get rich quick scheme.

Consider the early days when electricity was first introduced to the public.

Prominent people including the Mayor of Paris were calling it a fad. He said, “As soon as we close the fair and take down the Eiffel Tower, electricity will vanish in history.”

Newspapers wrote about houses that got burned down because crazy people were putting electricity in their homes. “This will never happen.”

Today the Eiffel Tower is still standing and electricity is powering the world.

When automobiles were invented, did you think the whole world raised their hands and thought, “Yay! We don’t need horses anymore.”

No, that’s not what happened. Instead, they said, “Those machines are crazy! These noisy, disgusting machines will probably kill us all.” “Why would anyone want to drive these horrible machines when we have perfectly good horses?”

That’s what the majority of people thought when someone comes along and introduces a new disruptive technology to the world.

First, there’s always huge resistance.

It’s the same with the airplane, electrification, the internet and Bitcoin.

It is the same story rhyming itself over and over again.

History’s great transitions are seldom spotted as they happen.

But hindsight provides clarity.

When you read it 20 years from now, it will all seem like a smooth transition.

But in the meantime, dramatic changes will neither be welcomed nor advertised by conventional thinkers.

The more apparent it is that a system is nearing an end, the more reluctant people are in admitting it.

The Romans for example were reluctant to acknowledge the fall of their mighty empire even after generations.

Many centuries passed before there was a common acknowledgement that the Roman Empire in the West had no longer existed.

We’re still very early when it comes to replacing our old archaic forms of centralized monopoly money. But therein lies a huge once-in-a-lifetime opportunity staring us in the face.

As a newcomer, it’s easy to get overly excited about Bitcoin, thinking it will change the world tomorrow and that adoption will happen overnight.

Investors who entered Bitcoin at $200 saw it rise to over $1,000 in 2013 thought it would reach $10,000 in no time at all.

That however took 4 years to materialize.

Not only that, but it started with a 2 year downtrend, during which Bitcoin lost nearly 90% of its value.

And just when you thought all is well seeing Bitcoin rise from $10,000 to $19,800 within a space of a month; it suddenly free falls in the next 6 months to a low of $3,200.

Imagine trying to hold on to your beliefs when the price moves so dramatically. It’s not an easy feat.

That’s why it’s important to not try to out-predict Bitcoin’s price movements in the short term.

When you hold on to your bitcoins (HODL) over a very long time horizon, you’re taking advantage of market inefficiencies and the lack of understanding.

This gives you a competitive advantage. Being right and patient is what matters.

Play your cards right, and Bitcoin won’t just be another investment scheme, it would be “The Currency for the People.” It would be money itself.

If you wish to understand the great transition now under way, you have little choice but to figure it out for yourself. You cannot depend on conventional information sources to give you an objective and timely warning about how the world is changing and why.

Why You Shouldn’t Trade Bitcoin

Don’t trade, it’s a trap! Just hold on to Bitcoin for the long term. I would love to send you a copy of my book to explain the economics behind it!

— Saifedean Ammous (@saifedean) May 14, 2019

According to Credit Karma, Americans lost $1.7 billion and $5.7 billion in unrealized losses from trading Bitcoin in the crash of December 2017.

Trading Bitcoin is not for everyone.

It’s risky! And you’re trading in a highly unregulated exchange fraught with all kinds of manipulators.

For you to outperform, many others must underperform. And that is a simple mathematical fact when you’re trading.

Sure, you might be able to make some money in a bull market. Almost anyone can make money in a bull market. It’s easy. But the cryptocurrency market is still the wild west.

People don’t play fair when there are no rules.

The market is full of bullies who will use strong-arm tactics to pressure you into buying or selling in an untimely manner. Related: 5 Reasons why You’re Burning Money Trading Cryptocurrencies

The speculators have many weapons in this unregulated market. If you are not positive you know something ahead of others, you are probably cannon fodder for the latest mania. Charitable donations to future innovations are always welcome, but not profitable. – Mike Maples, Jr.

The game is rigged.

The more you think you can try to time the market, the more you open yourself up to making a terrible financial decision!

My advice to you if you’re new is to stop actively trying to trade Bitcoin. If you’re as convicted as I am about Bitcoin, using dollar-cost-averaging is probably the best strategy for everyone.

Nobody has psychic powers.

I have come across many ‘pundits‘ on twitter, TV talking heads and technical analysis experts who seem to have done quite well for themselves buying low and selling high. Often times, they’ll brag about how much percentage they gained over the last couple of months or even weeks.

But it turns out that these ‘pundits’ were only right about 47% of the time. But they rake in thousands or millions of dollars from the eyeballs they get, newsletters, financial products and services that they sell.

There are plenty of get-rich-quick traders as well with many followers who operate like ‘bots‘, liking and tweeting every post they make.

Funny thing is I always only seem to hear about the biggest catches of all time.

As time went on, even those stories became increasingly exaggerated.

For each quick win, you don’t hear many stories of the losses and the failures.

Have you ever heard of anyone getting rich taking advice from these experts? Personally I haven’t. It could even be in their vested interest to vouch for someone else.

So don’t expect someone else to show you how to make a fortune. They’ll most likely make money off of you rather than make money on what they already know. Remember, they’ll always show you what they want you to see.

Don’t Let Trading Burn Your Bitcoin Portfolio

1. Don’t trade. Seriously, don’t trade. The *vast* majority of people overestimate their trading abilities and underestimate the risks involved. I knew someone who mined 5000 BTC in 2010 and dwindled his holdings down to < 2000 BTC by day trading on Gox. Don’t be that guy.

— Vijay Boyapati (@real_vijay) April 23, 2019

Trading is where 90% of people lose their money, never to come back learning about the bullish case for Bitcoin.

And because of that, they miss out on the greatest asymmetric bet of a lifetime.

It is one of the few asymmetric bets that people all over the world can participate in.

I use “asymmetric” here to describe an opportunity where the outcome may be uncertain but the risk/reward ratio is entirely in your favor.

In other words, “Risk a Little to Make a Lot.”

These situations arise when the market places certain odds on an outcome that are different from the real odds. This can be due to cognitive biases or herd instincts and the fear of being out of the consensus… even when the consensus is wrong.

That’s the situation we see with regard to Bitcoin and its impact on monetary independence.

The biggest problem with most investors today because of their high time preference is they believe you need to take “home-run” risks to make “home-run” returns.

You actually don’t need to.

Mathematically, there’s Not Enough Bitcoin To Go Around.

The path to home-run returns is to make “asymmetric” bets – where your downside risk is much smaller than your upside potential.

That is the way you need to think about your investments. Something you can hold for the long term.

Bitcoin gives us a great reward-to-risk ratio considering that its market cap today is only at a tiny fraction at $200 billion compared to gold’s mammoth $8 trillion.

“Holding bitcoin is the exact opposite of speculation.

A trade can be called speculative when the incentives for buying and selling is merely based on market sentiment. You hope to sell the product for profit despite the fact that it did not accrue any intrinsic value for society over the holding period.

Holding of money does not have this downside, rather the opposite is true. By holding money you invest in the economy as a whole. Every time you choose to retain money you decrease the available amount in circulation…

This leads to the increase of purchasing power per unit of that money. The result is that prices fall and all participants in that economy become wealthier.

By holding Bitcoin the price per unit increases.

The more people hold Bitcoin in the long run, the more volatility drops towards a gradual increase in price.

This convergence towards a stable increase in price makes Bitcoin more attractive to new audiences, creating a feedback loop.” — Willem_VdBergh

Choose Your Battles Wisely

Praet: As a central bank, we can create money to buy assets #AskECB https://t.co/zTQuU4y1ch

— European Central Bank (@ecb) March 12, 2019

₿itcoin is both the anchor and ignition for sound money.

And the only way to turn Bitcoin into an anchor is to first stop treating it like a get rich scheme.

When gold is measured against your national currency; it doesn’t represent a rise in the market value of your gold, but rather a drop in the value of your fiat currency.

Like gold, Bitcoin whose supply cannot be expanded easily, will likely gain in value over time compared to your government fiat money because its supply is fixed. One bitcoin is always equivalent to one bitcoin.

The only way to be one step ahead of others, is to understand this simple fact that free-floating national currencies will increase by several orders of magnitude over time.

When you’re able to understand this ahead of time, you turn the expected disadvantage into power. The power to make an accurate prediction about the nature of hard money.

So, If you believe in the future of bitcoin, it’s best to hold as much as possible instead of selling it for gains in monopoly money. What matters in money is purchasing power.

Had fiat money been a superior unit of account and store of value, it would not require laws to enforce its legality, nor would governments worldwide have had to confiscate large quantities of gold and continue to hold them in their central bank reserves.

The fact that central banks continue to hold onto their gold, and even increasing their reserves, testifies to the confidence they have in their own currencies for the long run. – The Bitcoin Standard; Monetary Inflation

Why You Might Not Have Gained From Buying Bitcoin Early

Why you might not have gained from buying Bitcoin in 2013 https://t.co/swqK1Oc9mA

— Bruce Fenton (@brucefenton) December 7, 2017

This is another common fallacy to think that anyone who bought bitcoin early is rich today. Let me demonstrate why that’s not always the case.

Anyone who got in before 2015 would have sold for highly tempting gains early on.

And anyone who got in after 2015 would have sold for 10 times the gain on his money, or had his bitcoins hacked along the way and have had to start from scratch.

This is another impaired judgement.

Thinking you’re always late to the party.

Thinking you’re the greater fool.

A false notion that destroys the positive probabilities of a thousand lives, based on an erroneous assumption.

I sold 10 $BTC in 2016, at 400$.

— SalsaTekila (JUL) (@SalsaTekila) June 21, 2019

I sold 50 in 2013 to buy a sports car. But I bought them back later….

— jratcliff63367 (@jratcliff) June 21, 2019

That wasn’t the big one. I sold 150 bitcoin at about a $1,000 and paid off my kids student loans. I never got those bitcoin back again. I have no regret. I changed my kids lives in a positive way and marked my ability to stay a long term holder, because I had accomplished that.

— jratcliff63367 (@jratcliff) June 21, 2019

Once you understand the Bitcoin is technology that rewards slow money investors whether they are early or late, you will no longer fall prey to any of your petty emotion.

Investing in Bitcoin favors the emotionless.

Bitcoin efficiently separates high time preference investors from their money. (Take note of how VCs invest above!)

Early traders and investors lack the information to make an informed decision. They would have lost the majority of their coins leaving it on an exchange like Mt. Gox.

Or either they got scammed into new ICOs or crypto get rich-quick schemes.

Phishing attacks, bad trades, over-buying, risking too-much and poor operational security habits all lead to the same inevitability. Losing your precious and scarce bitcoins.

When you’re wealthy, you tend to be reckless with your money! Losses are inherently inevitable.

So at the end of the day, it all comes down to having a system in place and having the discipline to follow through it. That’s why I believe you’re not late.

It’s like the Tortoise and the Hare. Traders get all the positive attention and headlines in the beginning for huge gains, but being patient and right drives the biggest outcomes when it comes to investing.

When the dust settles, my bet is that the people who accumulate bitcoins in a focused way for the longest time will rise above the rest.

How to HODL in a Bull or Bear Bitcoin Market

Investing in Bitcoin is counter intuitive.

You would think that you have to time everything just right in order to make a huge gain in Bitcoin.

Common sense right? Wrong!

Fortunes require leverage.

And the leverage you will get from Bitcoin comes from numbers; capital and people.

Vires in numeris. Strength in Numbers.

Bitcoin is a tool to help people secure what they value.

In order to do that, Satoshi needed to bootstrap the Bitcoin network with an incentive mechanism to keep the protocol decentralized – so everyone could participate in the economy without any restrictions.

Before this, private digital currencies that were invented like Ecash or E-gold, were riddled with problems stemming from centralization. Governments could just shut it down if they didn’t like it.

With Bitcoin, there is no way to shut it down without first turning off the internet.

A centralized system requires one person to shoulder all of its risk.

A decentralized system divides risk among individuals who are also participants in the security of the network.

When you HODL bitcoins, you’re accepting the personal risk of losing your own funds if you do not secure it properly. You’re not passing the buck to an intermediary like Tony here, who promises to keep your money safe and sound.

In order to minimize that risk, you have to first learn how to secure your bitcoins properly. You can do this with a brain wallet where you memorize the 24 word recovery phrase of your Ledger Nano used to secure your bitcoin private keys. (Forgetting and losing your recovery phrase would result in losing your bitcoins forever.)

This is the “Risk Sharing Principle“. Accountability and self-custody of your own valuable bitcoins.

Bitcoin was designed as a new financial system, one that didn’t require trust.

In a world where trust in banking is broken, this is not just a technological breakthrough but a social revolution.

By owning Bitcoin, you are the central bank.

You are the backbone of your own personal financial dependence.

Hodling isn’t about finding that greater fool, it’s about fighting for our own financial sovereignty.

Hodlers are believers of sound money.

Early Hodlers continued believing in Bitcoin in spite of overwhelming negativity and information. That’s why their perseverance paid off tremendously today. Everyone else would have called them insane.

But Hodling Bitcoin is easier said that done.

What happens during a bear market by PercentEvil (Twitter: @dAnconiaMining; Medium: @PercentEvil)

So you think that 5% dip counts as a correction?

Let me give you a helpful hint..

We’re not in a correction until the sweat falling down your neck meets the sweat of your ass crack in a pool on your desk chair while your sitting up at 3am staring at a stamp chart 3 inches from your face trying to convince yourself thats its going to reverse any second now. Your hand shaking like a Parkinson’s patient over an oily mouse when suddenly you feel the dire need to take a shit but you vomit in your mouth a little bit instead and before you have time to question how those two bodily functions could possibly be related we’ve already dropped another 20%. You’ve now got a big red dildo candle showing a 60% loss in a matter of minutes staring back at you as price has dipped far below your buy in spot, all the profits you made over the past several weeks, dreams of that new car, that new house disappear in an instant and you cant imagine what possibly could have caused this.

You default to erroneously blaming the Chinese but that doesn’t quite add up so you take to twitter with panicked breath searching for anyone, anything that might have the answer as to what the F is happening. Of course no one has any more of a clue then you do so you immediately start to internalize the struggle. What starts as a whisper of “why didn’t I just sell” turns into a rampage scream in the back of your mind, after all its so obvious that this was the top, it’s so clear now looking back, of course that was the top how the hell didn’t I see that 15 minutes ago? Meanwhile we’re down another 5% and you just can’t take it anymore. Tears are rushing from your eyes, something that looks like dried blood is all over your arm emanating from the spot you didn’t realize you were subconsciously digging your fingernail into. You close your eyes just for a moment but when they reopen you realize you’ve somehow already logged into your Coinbase account and punched in a sell order. Thats it. You sold. Your devastated, but manage to breathe a small sigh of relief. Well at least i can’t lose anymore you say, at least i walked away with something. Your emotionally and physically exhausted now but you manage to drag yourself across the room, you fall flat on your bed with one final thought passing through your mind before you let the darkness overtake you…”why didn’t i just sell the top?”

In the morning you wake to the realization that you slept fully clothed and at an odd enough angle that your neck is surely going to feel exactly as bad if not worse for the rest of the day. The events of the previous night come back to you in a flurry of blurred emotions and while you almost can’t bring yourself to check the price you just have to know. How much lower did it go? After all, there is still a glimmer of a hope, you think well, perhaps it isn’t all bad, perhaps I can buy back in a bit lower and make the losses back in the long term. You begrudgingly open a chart and whatever small amount of hope that remained escapes your lungs before the sigh hits your lips. Price has fully recovered, it’s actually trading up 10% from yesterdays highs…

Thats a correction.

Edit: For those who didn’t get the joke this is just some bitcoin satire not my life story. It’s the result of reading too much…

Everyone should invest based on their own risk tolerances and in accordance with their own investment goals. Hodling is a viable strategy for those who truly believe Bitcoin is the next big thing, but a word of caution to the new comers who are just here for a quick buck. This space can and will be more volatile then anything you’ve ever seen before.

2/ The bull wants the rider off its back. #bitcoin is in the biggest secular bull of all time. But don’t trade. Most will try but end up with less bitcoin. At $1 million #bitcoin, that’s about $20 Trillion market cap. Vs global assets still only in the 2% range.

— BitcoinTina – “TINA” (There is no Alternative) (@BitcoinTina) June 22, 2019

Though it isn’t a personal account, I think it’s a great description and close enough simulation to prepare you psychologically for huge bear phases in Bitcoin.

I can attest to its authenticity having experienced a substantial unrealized loss in my investment when the price of bitcoin dropped from $19,800 in Dec’17 to a low of $3,200 in Dec’18 and stayed there for 7 months before recovering.

Hodling can be extreme. It brings forth huge psychological and emotional exhaustion.

The unprepared investor or trader will not be able to sit tight if too much of his/her savings is being obliterated by sellers pushing the panic ‘sell‘ button repeatedly. (I found that storing my bitcoins offline in a cold wallet would reduce any temptation to sell during a flash crash.)

On the flip side of it, consider the situation where you see your Bitcoin investment going parabolic, and I mean every hour you see the value of your investments going up by 1X, 2X, 3X, … 10X.

Now you’re thinking whether you should sell now to take some profits and buy it back when it’s cheaper.

Remember the Marshmallow Experiment?

You could take some profits off the table especially if you can’t bear the thought of seeing your fiat value dropping by as much as 85%.

It depends of your time-preference.

It’s just like that guy who sold 50 BTC in 2013 @$800 to buy a sports car.

Was that money well-spent? I bet it did at that moment. But today it would be worth a life-changing sum. You may never get that chance to buy that amount of bitcoins ever again.

It’s important to keep this in mind: When you’re selling your bitcoins, you’re essentially trading something incredibly scarce for something abundant.

Trading the future for the past.

But if you can’t bear the thought of your fictitious fiat money sum of 1’s and 0’s dropping by 85% or more, you should de-risk into other assets. (You should never sell all your bitcoins even if you want to take some profit!)

Who Wants to be a millionaire?

Everybody wants to be a bitcoinaire!

Who doesn’t want to be a millionaire? Fact is you could simply become a fiat millionaire by moving to countries where inflation is so rampant, their nationalized currency is denoted by thousands’ if not millions’.

On a long enough time-frame, all fiat currencies would inevitably be inflated beyond measure.

Inflation is perfectly described in the fable of slowly boiling a frog alive.

Is the measure of wealth really about the arbitrary dollar amount or is it determined by how well-behaved your politicians are?

Think about it. For folks living paycheck to paycheck, money that can be easily inflated and subjected to the whims of political headwinds comes with a high price.

Bitcoin will be a tailwind for a new generation of savers rather than spenders.

An asset that holds its value 1 BTC = 1 BTC now or in the future is highly preferable to an asset that loses it value over time. Savers who want to choose a store of value will naturally gravitate towards assets that holds its purchasing power over time.

Look at how conspicuous consumption is destroying our world. History has shown us that it is not possible to insulate anyone from the consequences of climate change.

Earth is at the brink of irreversible destruction because of our spending habits. The largest banks are seeing losses on credit card debt setting to outpace auto and home loans at a rate not seen in over a decade.

When it does finally fall out, the last thing most people will be thinking is whether or not they qualify as a millionaire.

I’m not a Financial Advisor. Bitcoin can be volatile as it is still a new asset class, but it would become less so as mass adoption kicks in.

I own Bitcoin and have experienced sharp 85% drops before, but because I continue to HODL, I didn’t sell at a loss like the majority of people, in fact I’m at a net positive again.

This is a decade long investing strategy, I do not plan on selling bitcoin for gains in fiat, but I plan on accumulating as much BTC as I can over time. I do not recommend short-term Bitcoin trading.

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Zodiac Collection, that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.

There’s a lot of exciting stuff to read — I’ve selected a few of the stories, to start with, below.

To read a curated list of the most important crypto news stories each morning, subscribe for FREE. It will be everything you need to know, in your inbox, every day. No brainer 🙂

I certainly don’t want to overload your brain with the library of Bitcoin resources we have here.

Here are some special picks:

- How to Buy Cheap Bitcoin

- The 7 Basic Tenets of Investing in Cryptocurrency – A Quick And Dirty Guide

- Top 10 Crazy Bitcoin (BTC) Predictions that Could Come True

- How do I Buy Bitcoin (BTC) on Binance w/ My Credit Card?

- 7 of the Fastest Ways to Buy Bitcoin (BTC) Today!

- Buy Bitcoin With Paypal Instantly on these sites (Explained Step-by-step)

- My 8 Step Process to Identify The Best Cryptocurrency Exchange [2019-2020]

- 6 Top Ways to Instantly Exchange One Cryptocurrency for Another [300+ Altcoins]