- What will be the Best Cryptocurrency Exchange?

- High Trading Volume Cryptocurrency Exchange

- Great for Buying Altcoins

- For Trading BTC Leveraged

- Top 3 Cryptocurrency Exchange in North America

- Quick-Fire way to Buy Cryptocurrency with Credit Card or Debit

- Countdown to the Best Cryptocurrency Exchange

- Why Do Cryptocurrency Exchanges Die?

- 29 Worst Cryptocurrency Exchange Hacks of All Time

Look, everyone has their own reasons for choosing their favorite cryptocurrency exchange.

Certain ‘experts’ are going to tell you one thing, while others will tell you something different.

Now, I may be new in this space, but the one thing I know for sure is that some exchanges cheat to attract more attention.

They use fake exchange volume data to deceive the market into believing that they’ve high liquidity. And they are not being transparent about it.

High volume does not necessarily mean that the exchange has high liquidity. These exchanges commonly engage in wash trading and some of their figures are being overstated by as much as 95%.

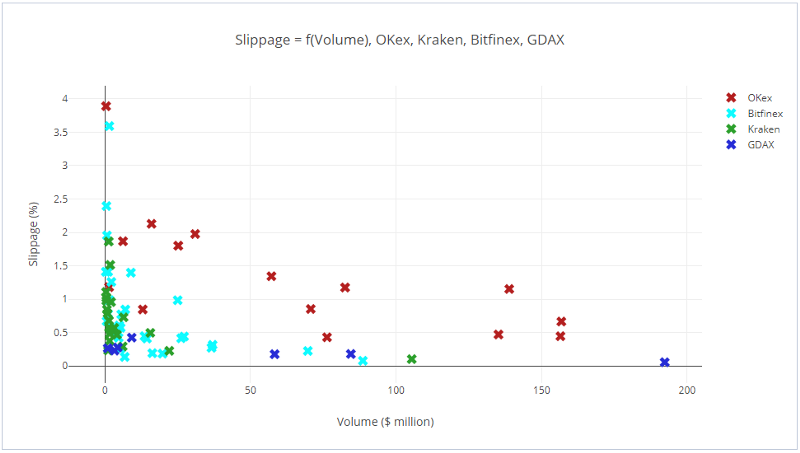

OKex is one of these exchanges at the center of this controversy uncovered by Sylvain Ribes, a trader and crypto-market analyst.

According to the data mined by Ribes, the “slippage” exhibited by OKex in red is striking with regards to its volume. This could only mean that most of OKex’s volume is completely fabricated.

Although wash trading and artificial volume inflation is expected in an unregulated market like cryptocurrency, the scale at which it was identified is staggering.

Which is why many experts have advised against cryptocurrency trading. Read 5 Reasons why You’re Burning Money Trading Cryptocurrencies

Don’t trade, it’s a trap! Just hold on to Bitcoin for the long term. I would love to send you a copy of my book to explain the economics behind it!

— Saifedean Ammous (@saifedean) May 14, 2019

Here are my 8 Step Process to Identify The Best Cryptocurrency Exchange in 2019-2020

- Coverage,

- Ease of use,

- Number of pairs,

- Fiat exchange,

- Fees,

- Regulation,

- Influence

- and Advanced features.

Rankings are subject to change!

Countdown to the Best Cryptocurrency Exchange

-

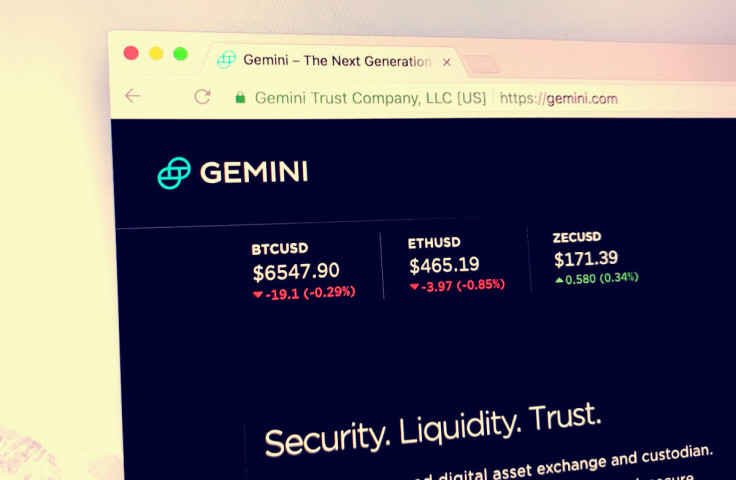

#10. Gemini

| 24-hour trading volume | $25 million – Check Real Time |

| Tradeable coins | BTC, BCH, ETC, ZEC, LTC |

| Accepts fiat | Yes – USD |

| Fees | Maker/taker fees 0%-1%; typical $1000 bitcoin cost: $10 |

| Short selling | No |

| Margin trading | No |

- Coverage: U.S, Canada, U.K, Hong Kong, Singapore, South Korea

- Regulation: High

- Influence: Low

Run by the Winklevoss Twins, Mark Zuckerberg’s arch-rivals, Gemini was launched back in 2014. A safe and licensed exchange with regulatory oversight by the New York State Department of Financial Services (NYSDFS)

They offer services to retail & institutional investors. Your US dollars are deposited into an FDIC insured bank.

Check out GeminiTwitter

-

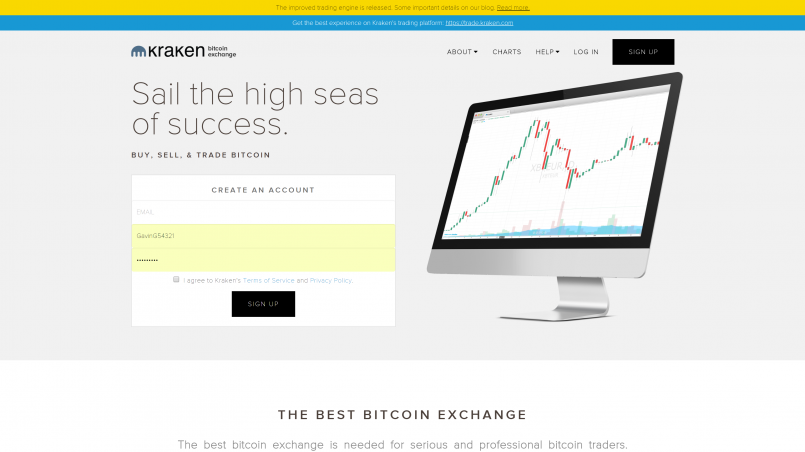

#9. Kraken

| 24-hour trading volume | $250 million – Check Real Time |

| Tradeable coins | 20 |

| Accepts fiat | Yes – USD, CAD, EUR, JPY |

| Fee | Maker/taker 0%-0.36%; Deposit/Withdrawal fees $5-$60 |

| Short selling | Yes |

| Margin trading | Yes, up to 5x on Bitcoin |

- Coverage: Global with exceptions

- Regulation: High

- Influence: Medium

Kraken is highly trusted in Japan and by banks throughout Europe since 2011. While it is based in the US, Kraken allows anyone outside the US to trade and buy cryptocurrencies from its platform.

While it supports countries outside the US, USD deposits via wire transfer is only available if you verify your account to Tier 3. It will cost you a lot of money to trade on Kraken if your fiat currency is not one of the major ones accepted.

Security: Cryptography-verified proof of reserve audits determines the total amount of cryptocurrency held by Kraken and not just what they say they say they have.

Check out KrakenTwitter

-

#8. Coinbase Pro

| 24-hour trading volume (Pro) | $370 million – Check Real Time |

| Tradeable coins | 18 |

| Accepts fiat | USD, EUR, GBP |

| Fee | typical $1000 bitcoin cost: $15-$25 |

| Short selling | No |

| Margin trading | No |

- Coverage: 32 countries

- Regulation: High

- Influence: High

- Features:

- 🔒 Coinbase Custody lets funds and institutions store their tokens inside Coinbase’s secure vault, responsible for protecting over $20 billion in customer deposits every day.

- 🏦 Coinbase Prime is a powerful cryptocurrency trading platform for institutions.

Security: Majority of digital assets are stored offline; covered by insurance and good industry practice.

Check out CoinbaseTwitter

-

#7. HitBTC

| 24-hour trading volume | $300 million – Check Real Time (Volume Highly Inflated) |

| Tradeable coins | 372 |

| Accepts fiat | No (you have to buy btc via Changelly) |

| Fee | 0.01% maker rebate, 0.1% taker fee; typical $1000 bitcoin cost: $1 |

| Short selling | Yes |

| Margin trading | Yes, 3x |

- Coverage: Global

- Regulation: Low

- Influence: Medium

Take advantage of HitBTC’s low fees by first buying btc on Changelly, and then sending it to your HitBTC account. (You do not need to go through the verification process on HitBTC this way)

Then you can start trading over 200+ coins.

If you’re an intermediate to advanced trader, this platform offers you something that you cannot find on most exchange platforms, a rebate system for market makers and an advanced matching algorithm.

Security: Automatic log out, 2-FA, log-in history, cold storage wallets for selected cryptocurrencies

Check out HitBTCTwitter

-

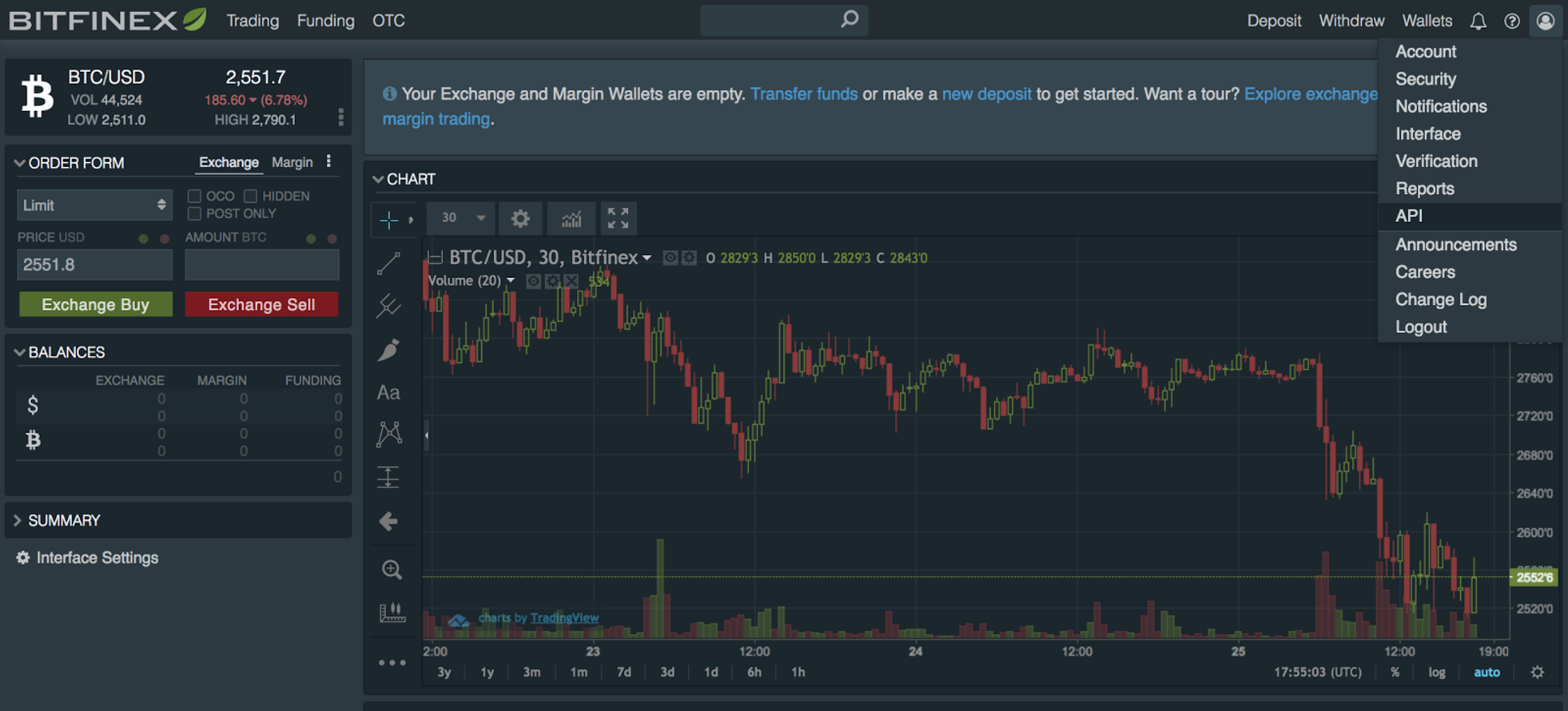

#6. Bitfinex

| 24-hour trade volume | $300 million – Check Real Time |

| Tradeable coins | 36 |

| Accepts fiat | USD |

| Fees | Maker/taker fees 0%-0.2%; typical $1000 bitcoin cost: $2 |

| Short selling | Yes |

| Margin trading | Yes, up to 3.3x |

- Coverage: Global except US residents

- Regulation: Low

- Influence: Medium

Bitfinex and Tether (USDT), the stablecoin shares a close affiliation, where they shared the same CEO in 2016.

Any user including US residents can trade crypto-to-crypto without needing to verify their ID if they first buy btc on Changelly and then deposit into their Bitfinex account, and trade without needing to convert to fiat. (There are of course crypto withdrawal fees)

Take advantage of Bitfinex’s advanced trading features, high liquidity and multitude of Altcoins available on the platform. Professional traders get to delve in margin trading and 10 different types of order so that you can fully gain the upper-hand in a highly competitive market.

Security: Was breached in 2016, with $72 million worth of bitcoin stolen. But Bitfinex successfully compensated its users in less than a year. That shows a lot of commitment on the company’s end.

Check out BitfinexTwitter

-

#5. Bittrex

| 24-hour trade volume | $70 million – Check Real Time |

| Tradeable coins | 251 |

| Accepts fiat | USD |

| Fees | All-Flat 0.25%; Withdrawal fees Vary |

| Short selling | No |

| Margin trading | No, but are working on providing in the future |

- Coverage: Global except certain US states

- Regulation: Low

- Influence: High

Bittrex is related to it Korean cousin UPbit, a $300 million a-day exchange.

A simple to use exchange that allows you to buy 140+ Altcoins at very low fees.

- Unverified account: 1 btc/day or equivalent

- Activating a 2-FA security measure will give you a withdrawal cap of 3 btc

- Enhanced account: 100 btc/day or equivalent (requires your selfie ID)

-

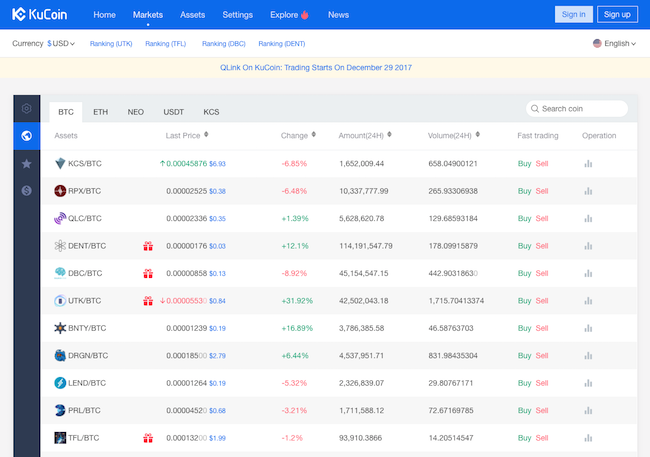

#4. Kucoin

| 24-hour trade volume | $30 million – Check Real Time |

| Tradeable coins | 188 |

| Accepts fiat | No |

| Fees | All-Flat 0.1%; Withdrawal fees Vary |

| Short selling | No |

| Margin trading | No |

- Coverage: Global

- Regulation: Low

- Influence: Medium

Need to find a Rare New Altcoin? Most likely it will be listed right here in this exchange.

First, register an account with Kucoin, no ID verification is needed. Then you must buy BTC or ETH from Changelly and deposit your coins into your Kucoin account in order to trade other cryptos on this cryptocurrency exchange.

A large range of trading pairs with highly competitive fees gives you the unfair advantage.

Loyalty Benefits: By holding its Kucoin Shares (KCS), holders of the coin will receive special discounts on trading and dividends as well. (1% discount on trading fees for every 1000 KCS you hold, up to 30%)

Check out KucoinTwitter

-

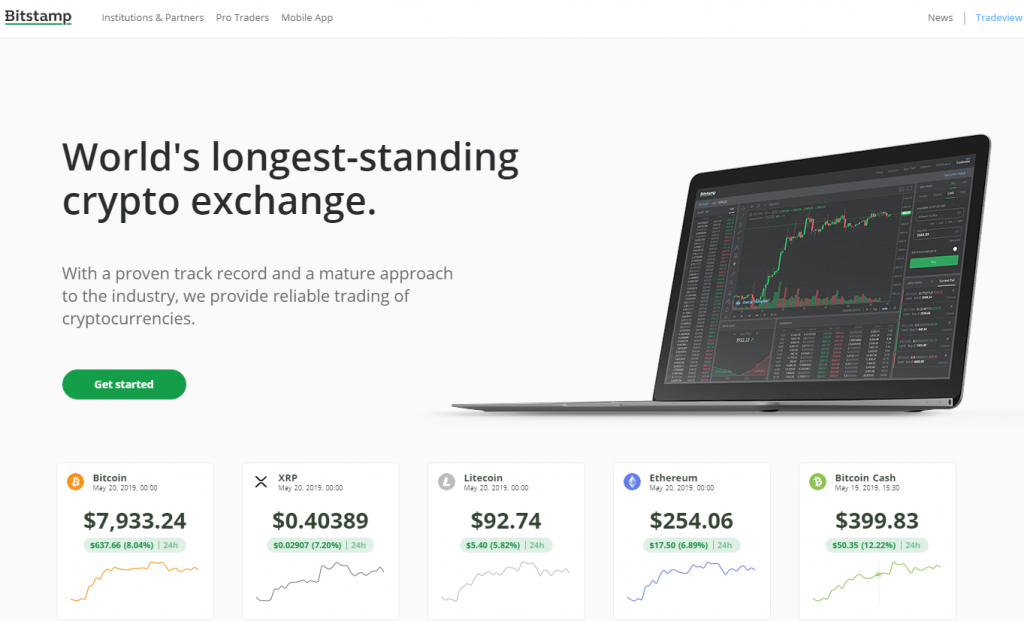

#3. Bitstamp

| 24-hour trade volume | $170 million – Check Real Time |

| Tradeable coins | 5 |

| Accepts fiat | USD, EUR |

| Fees | 0.10% – 0.25%; Deposit and Withdrawal fees apply |

| Short selling | No |

| Margin trading | No |

- Coverage: Global

- Regulation: Medium

- Influence: High

One of the longest standing cryptocurrency exchange based in the U.K. yet available to traders worldwide.

They’re a globally recognized exchange that allows crypto-to-crypto and crypto-to-fiat currencies.

With a trade volume of over 100 million per day, they’re highly liquid and transparent.

There are no signs of fake volumes.

With its low transaction fees, Bitstamp appears to be the go to platform for medium to professional traders.

Check out BitstampTwitter

-

#2. Waves Platform

| 24-hour trade volume | $80 million – Check Real Time |

| Tradeable coins | 26 |

| Accepts fiat | Fiat Gateway |

| Fees | Low |

| Short selling | No |

| Margin trading | No |

- Coverage: Global

- Regulation: Zero

- Influence: Medium

One of the most promising decentralized cryptocurrency exchange (DEX) with respectable liquidity.

What I like about this project is that they offer users a unique level of security unlike any other centralized exchanges.

All you have to do is download the software client. (It’s available on Windows, Mac OS and Linux.)

Since it’s decentralized, you will enjoy incredibly low fees and be in complete control of your funds.

With the Waves Platform, your computer is now your wallet.

Check out WavesDEXTwitter

-

#1. Binance

| 24-hour trade volume | $2 billion – Check Real Time |

| Tradeable coins | 151 |

| Accepts fiat | Use the new Credit card option. |

| Fees | Trading fee 0.1% (discount for BNB holders); Withdrawal fees Vary |

| Short selling | No |

| Margin trading | No |

- Coverage: Global

- Regulation: Low

- Influence: Very High

Cryptocurrency exchange with the highest liquidity. Binance is masterminded by CZ, a brilliant high velocity platform developer who designed Binance in such a way that it is capable of handling over 1.4 million transactions per second.

Before you start trading on Binance, you will need to buy Bitcoin. Read my step-by-step guide on how you can do that on Binance itself without leaving the platform.

- How To Deposit & Withdraw Money (GBP/EUR) on Binance?

- How do I Buy Bitcoin (BTC) on Binance w/ My Credit Card?

Even without personal ID selfie verification, you can transact and transfer 2btc/day. This allows almost everyone in the world to trade on the platform without much restriction.

Benefits:

- BNB Coin – Hodling BNB allows you to deduct 50% of the trading fee to 0.05% in the first year then 25% the second year, etc. For more info, check the Binance website.

- Programs – Users get to participate in countless competitions, voting, contests and bug bounty programs

You can learn more about Binance right here:

- How do I Trade Cryptocurrencies on Binance?

- How to Buy Binance Coin at a Good Price

- Why Binance is Building its Own Decentralized Exchange (DEX) for the Future

If you already have a Bitcoin wallet, and looking to buy bitcoins instantly without confusing User Interfaces, why not try these with your credit card?

- Coinmama (broker)

- CoinSwitch (Instant exchange)

- ChangeNOW (Instant exchange)

Alternatively, you can purchase P2P via LocalBitcoins

For Trading BTC Leveraged (including altcoins & futures contracts)

- Bybit – $90 Bonus After depositing

- Phemex – $80 Bonus After depositing

- bitMEX: A derivatives market dedicated for professional traders rather than retail investors. If you wish to trade btc leveraged (Shorts, futures contracts, Margins up to 100x.)

Top 3 Cryptocurrency Exchange in North America

- Gemini: Owned by the Winklevoss Twins – Recently released their own Stablecoin called Gemini Coin

- Coinbase: Largest in the North America, boasting over 13 million users and over $20 billion in trading volume. Only available in 32 countries. Extremely easy on the eye interface and has high fees.

- Kraken

Other Quick-Fire ways to Buy Bitcoin with a Credit Card or Debit Card

Do Cryptocurrency Exchanges Die? Yes

Here are the striking statistics:

- Failure in banking relationships 1%

- Financial difficulties 1%

- Hacked 97%

- Criminal convictions 1%

With disruptive technology, mass adoption usually comes with all sorts of growing pains — which is why cryptocurrency exchanges are the temporary bridges that can be burned to the ground once the entire world conducts trade in only cryptocurrency itself, or when Bitcoin becomes a Unit of Account.

Cryptocurrency exchanges are getting hacked because it is so easy.

Decentralize exchanges doesn’t come with all the security risks but suffers from scalability issues. Which is why there are plenty of developers working on solving this problem right now.

35 Worst Cryptocurrency Exchange Hacks of All Time

Bitcoin is the most secure financial network on the planet. But its centralized peripheral companies are among the most insecure. pic.twitter.com/0rxLtXscNJ

— Nick Szabo⚡️ (@NickSzabo4) June 18, 2017

- June 2011: Mt. Gox ~$8.75 million stolen

- October 2011: Bitcoin7 ~ $50,000 stolen

- March 2012: Bitcoinica ~ $228,000 stolen

- May 2012: Bitcoinica ~ $87,000 stolen

- July 2012: Bitcoinica ~ $300,000 stolen

- September 2012: Bitfloow ~ $250,000 stolen

- May 2013: Vicurex: $160,000 stolen

- June 2013: PicoStocks: $130,000 stolen

- November 2013: PicoStocks: $3,000,000 stolen

- February 2014: Mt. Gox: $460,000,000 stolen

- March 2014: Cryptorush: $570,000 stolen

- March 2014: Poloniex: $64,000 stolen

- July 2014: Cryptsy: $9.5 million stolen

- August 2014: BTER: $1.65 million stolen

- October 2014: MintPal: $1.3 million stolen

- October 2014: KipCoin: $690,000 stolen

- December 2014: BitPay: $1.8 million stolen

- January 2015: 796exchange: $230,000 stolen

- January 2015: Bitstamp: $5.2 million stolen

- February 2015: BTER: $1.75 million stolen

- April 2016: Shapeshift: $230,000 stolen

- May 2016: Gatecoin: $2.14 million stolen

- August 2016: Bitfinex: $77 million stolen

- October 2016: Bitcurex: $1.5 million stolen

- February 2017: Bitthumb: $1 million stolen

- April 2017: YouBit: $5.3 million stolen

- December 2017: EtherDelta (DEX): $270,000 stolen

- January 2018: Coincheck: $500 million stolen

- February 2018: Bitgrail: $187 million stolen

- June 2018: Coinrail: $40 million stolen

- July 2018: Bancor (DEX): $23.5 million stolen

- Sept 2018 Zaif: $60 million stolen

- Jan 2019 Cryptopia: $17 million stolen

- Feb 2019 Quadriga CEO Death: $150 million lost

- May 2019 Binance: $50 million stolen

Get a Ledger Nano S and transfer your precious bitcoins there.

“I found ridiculously massive discrepancies between exchanges. Not the kind that can be easily hand-waved away (“oh well, their users must behave differently”), but the kind that can only be explained by some figures being overstated as much as 95%,” explains Ribes’ study. So unless you understand how trading cryptocurrencies works under the hood, it’s best to just buy and hodl in your hardware wallet. So which one of these exchanges do you like the best? Also, what cryptocurrency exchange would you like me to list here? Let’s hear your thoughts in the comments below! Here’s something related that you can read next: Like to read it later? Save it to Pinterest! So you may find that your favorite cryptocurency exchange isn’t listed here. That’s because they were strike-out: study by Sylvain Ribes finds that over $3 billion dollars worth of faked Cryptocurrency volumes & wash trades were concocted across all major exchanges.

So you may find that your favorite cryptocurency exchange isn’t listed here. That’s because they were strike-out: study by Sylvain Ribes finds that over $3 billion dollars worth of faked Cryptocurrency volumes & wash trades were concocted across all major exchanges.