Bitcoin isn’t an investment scheme.

Bitcoin isn’t an investment scheme.

Its deflationary money. The ultimate savings account.

I started buying Bitcoin thinking it would make me rich overnight.

Towards the end of 2017, everyone thought like this. People loved the insane returns.

Early investors were buying Lamborghini’s for god sake!

Then I got disappointed. CRUSHED even.

So did everyone else who jumped onto the bandwagon thinking like this.

I didn’t want to disappoint my family so I had to dig deeper.

I’ve spent months researching Bitcoin and its issues.

And this is a short summary….

I loved how Bitcoin keeps out the guys who aren’t supposed to be in it.

Almost like magic somehow.

People love to examine Bitcoin for its potential return as an investment. None for its implications.

They look to its price for a shallow indication. But that’s far from the point.

Bitcoin is an idea of insurance of survival; it’s a necessity, not an option.

A lifeboat can weather the worst of storms out in sea.

It’s pointless in harbor. Bitcoin is a lifeboat.

The price reflects that. It’s highly volatile. Yet indestructible.

How then can it be used as a store of value or money for that matter?

When Satoshi Nakamoto disappeared, he left us with a clue, an Easter egg.

And in that 10-year-old Easter egg, he cites the Times headline – “Chancellor on brink of second bailout for banks”

During the 2008 – 2009 financial crisis, hundreds of billions of dollars were artificially injected into the system to keep fragile banks from going under.

By repeatedly bailing out the weak, the entire financial system becomes extremely fragile.

Nature loves the occasional purge. Volatility is a part of nature. Humans detest them.

In markets, ‘cleanups‘ are vital for getting the ‘weak hands‘ or the fragile out of the way.

Purges are vital to ensure hidden vulnerabilities doesn’t accumulate silently under the surface.

Small forest fires periodically cleanse the system of the most flammable material, so this does not have the opportunity to accumulate.

Systematically preventing forest fires from taking place “to be safe” makes the big one much worse.

For similar reasons, the economy becomes very weak during long periods of steady prosperity devoid of setbacks.

Stability is an illusion. And it is not good for the economy in the long run.

Light control works, but close control tends to lead to overreaction, sometimes causing the system to completely break down.

This is called a “Black Swan” event. The last a Black Swan event happened was 11 years ago.

And central banks didn’t solve the crisis. What they did was unintentionally create a bigger distortion by suppressing the symptoms.

Now the risks are even greater than before as they have now taken us all further out on to the same ledge.

Don’t take my word for it:

Complex systems that have artificially suppressed volatility tend to become extremely fragile,while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks accumulate beneath the surface. Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite. These artificially constrained systems become prone to “Black Swans”—that is, they become extremely vulnerable to large-scale events that lie far from the statistical norm and were largely unpredictable to a given set of observers. Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability or, in some cases, ending up far worse than they were in their initial volatile state. Indeed, the longer it takes for the blowup to occur, the worse the resulting harm in both economic and political systems.[…]

Variation is information. When there is no variation, there is no information […] As Jean-Jacques Rousseau put it, “A little bit of agitation gives motivation to the soul, and what really makes the species prosper is not peace so much as freedom.” With freedom comes some unpredictable fluctuation. This is one of life’s packages: there is no freedom without noise—and no stability without volatility. (Foreign Affairs, May/June 2011 Issue)

The longer it takes for the blowup to occur the worse the resulting harm to both economic and political systems.

Bitcoin is an insurance policy against that.

Imagine a world where your money doesn’t rely on bankers. Money without masters.

What a wonderful world it would be.

Could a Financial Crisis Really Happen?

When your friends tell you that you’re dumb / crazy for putting any money on bitcoin, tell them to give this man 2 minutes and 11 seconds of their time. pic.twitter.com/Yv7APSasoN

— Dennis Parker⚡️[Jan/3🔑] (@Xentagz) September 30, 2019

According to billionaire financier Ray Dalio who manages one of the world’s largest hedge funds with $160 billion in assets.[Bloomberg ranked him as the world’s 58th-wealthiest person.]

“The world has gone mad and the system is broken”

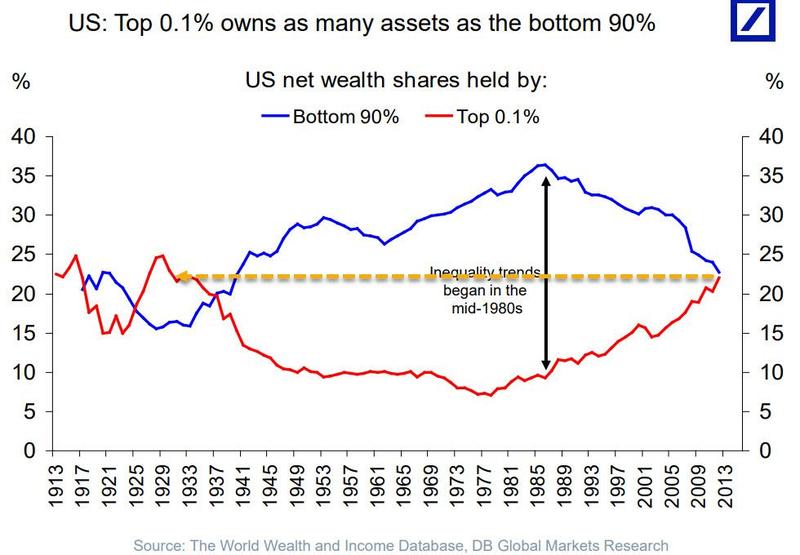

So says Dalio attributing it to several problems, including an overzealous lending market, a growing mountain of government debt and a widening divide between the rich and poor that’s becoming more tense.

“This set of circumstances is unsustainable and certainly can no longer be pushed as it has been pushed since 2008. That is why I believe that the world is approaching a big paradigm shift,” Dalio wrote in a LinkedIn post published Tuesday.

His advice is so respected he’s appeared on Time 100 of the 100 most influential people in the world and was featured by Forbes, Bloomberg and even CNBC…

It’s simply too late for small steps anymore.

The situation we’re in now…

With its deeply rooted financial risks, security risks and privacy threats…

Is now so dangerous that it will require nothing less than a “GLOBAL REBOOT” that could rewire as much $16.8 trillion of our world economy.

Dalio believes that the new decade might offer some clues to the coming paradigm shift.

Here’s the good news — this reboot won’t just change everything you know about earning, saving and investing your money. It will also give you a chance to get very, very rich.

What do you think increases your chances of wealth?

A study of some of the wealthiest people in the world found that the most important thing they started doing, which contributed to their wealth later on, was living below their means.

Best investments over the past decade:

Bitcoin: +8,990,000%

Netflix: +4,177%

Amazon: +1,787%

Mastercard: +1,126%

Apple: +966%

Visa: +824%

Starbucks: +800%

Salesforce: +792%

Adobe: +790%

Nike: +587%

Microsoft: +556%

Costco: +542%

Disney: +423%

Google: +335%

McDonald’s: +325%— Lolli 🍭 (@trylolli) December 23, 2019

With gains of more than 9,000,000% since July 2010, Bitcoin was the best performing asset of the decade.

9,000,000%

Let

That

Sink

In.— ℳ (@MichellePhan) January 2, 2020

Contrary to what Hollywood movies would have you believe, the rich do not frivolously piss away all their money to look wealthy.

Only the middle class do. They buy up all the hype in order to look fashionably rich.

They buy up branded and luxury items.

Buy cars and homes they cannot afford by borrowing more money than they can repay.

The rich did not start becoming rich by taking on unnecessary expenses, they started by saving a portion of what they earned.

Over a long period of time (10 – 20 years), this savings, or “nest-egg,” is re-invested.

Now the problem with saving money in your local fiat currency is inflation.

Policy makers and economist will have you believe that you should be spending money. Not saving money.

And that is a blatant lie.

Put more simply, the rich can borrow money to buy real assets while the poor cannot.

This monetary policy to spur job growth at the expense of savers is highly regressive.

And it is the cause of major uproars in countries like: Chile, Ecuador, Lebanon, Barcelona, France, London, Puerto Rico, Hong Kong, Iraq, Guinea, Bolivia, Algeria, Haiti, Egypt, Pakistan, Brazil, Sudan, and today, Azerbaijan.

Why are everyday goods getting more expensive?

Why is the $50,000 saved for your college education now $100,000 in only a few years?

Why can’t millennial’s afford a home anymore?

Is the “dollar” still a useful gauge to preserve and protect ones hard-earned wealth?

In Hong Kong, you can hear screams in the streets yelling, “7K for a house like a cell and you really think we’re afraid of jail?”

HK$7,000 is the monthly rent an individual can expect to pay for a flat the size of a prison cell. That’s more than half the monthly salary for most university graduates.

Why? Monetary debasement transfers wealth from the poor & middle class to the rich.

Returns this decade:

Bitcoin: $1 -> $90,000

Gold: $1 -> $1.34#DropGoldhttps://t.co/XE7BkWVapC— Barry Silbert (@barrysilbert) December 18, 2019

% of world using the Internet in 1995 = 0.4%

% of world using the Internet in 2019 = 58.8%

Bitcoin is to money what the Internet is to information.

% of world using Bitcoin in 2019 = 0.4%

If you thought you are late to Bitcoin, think again.

— Misir Mahmudov (@misir_mahmudov) September 23, 2019

And this is happening all over the world. Particularly in wealthier and developed countries.

Even in South Korea, which appears to be a prosperous democracy with many world-beating corporate brands and futuristic infrastructure.

According to a survey of 5,000 people, 75% of 19 – 34 year old natives of the world’s 11th richest nation want out.

They describe their situation as “Hell“.

In order for this condition to change in favor of the poor and the middle class, we have to change our spending habits and support a new kind of financial system that’s open, decentralized, peer-to-peer, borderless and permissionless.

And that was the gift given to us by Satoshi Nakamoto on the 3rd of January 2009, some 11 years ago.

When the dust settles, my bet is that the people who accumulate bitcoins in a focused way for the longest time will rise above the rest.

It’s like the Tortoise and the Hare. The wealthy get all the positive attention and headlines for now, but being patient and right drives the biggest outcomes when you accumulate & HODL your bitcoins (Satoshis).

Take notice of how early it is if you buy and HODL bitcoin today. 👉

Just make sure you set aside money for bitcoin for at least 4 years.

“If you bought very top of Bitcoin market in Nov 2013 (~$1150) & sold very bottom ~5yrs later during the next cycle (Dec 2018 ~$3150), you would’ve still made ~22% annual return, which beats most investors in all assets.”

You can’t lose w >4yr time preference…@HODL

IGNORE the price fluctuations for at least 4 years and you’ll be leveraging one of the greatest paradigm shifts in history.

A shift in our monetary standard.

It’s not too late to be early.

Once you understand the Bitcoin is technology that rewards slow money investors whether they are early or late, you will no longer fall prey to any of your petty emotion.

Investing in Bitcoin favors the emotionless.

Bitcoin efficiently separates high time preference investors from their money.

Of course, there are many other steps – but this is the most important, foundational principle that generational wealth is built upon. This is the FIRST and most important step in the process. So, spend a few years learning how to discipline yourself to save and accumulate bitcoins.

The concept of SACRIFICE plays very large here: you must give up some of the present luxuries and desires in your life, and put them off for a later reward.

This is called lowering your time preference.

I know— it’s boring and not all that exciting to hear this— but, it is a simple truth. And, those who learn and follow this will reap larger rewards after a long period of time. And, the earlier in life you start forming these habits, the greater your wealth will ultimately become in the current decade.

Only a Poor Man Sells His Prized Assets

The filthy rich seek wealth, not fiat money.

The common man trade-in their time in exchange for fiat money.

Wealth are assets that appreciates over time even while you’re asleep.

You’re not going to get rich one day working for your boss. You must own an equity, a piece of business or an asset in order to gain your financial freedom.

In the 18th century, Yeoman farmers who own acres of land experienced unsettled conditions like clustered crop failures, cold winters, famines and plagues.

When crop yields failed to recover, the landowners faced a desperate situation. Continue to hold on to their land for dear life (HODL) or give it away to the Church in preparation for the telling disaster.

Many landowners, large and small gave them away.

For centuries, markets have always placed the greatest pressures on the weakest holders.

Our new report “Bitcoin in Heavy Accumulation” is out. Read here: https://t.co/DkjedcF3RG pic.twitter.com/UpQotZUTdW

— Tuur Demeester (@TuurDemeester) April 18, 2019

Dire situations and an impending collapses create conditions that centralizes wealth.

It has happened to land.

It has happened to gold.

It has happened to bitcoin.

During the last Bitcoin bull run in 2017, many retail investors bought bitcoin at higher than average prices during the fear of missing out (FOMO) run. The new highs triggered a feeding frenzy.

With all the media attention, new entrants got attracted by the allure of quick profits, driving prices higher at an accelerated pace.

Eventually, all the hysteria reached a crescendo at around $19,500 per BTC.

Traders who got in early wanted to cash out some profits and started selling. A little push was all it took to trigger a sell-off. The ones who got in much later got their hopes pitilessly crushed.

The price of Bitcoin crashed to a low of $3,200 in 2018 because new entrant mom-and-pop investors didn’t fully comprehend the long term value of Bitcoin.

Bitcoin vs Top Performing Stocks. pic.twitter.com/ee0MgJNAPo

— Wayne Vaughan (@WayneVaughan) June 21, 2019

Bitcoin’s yearly lows:

2012 – $4

2013 – $65

2014 – $200

2015 – $185

2016 – $365

2017 – $780

2018 – $3200

Bitcoin is a long-term investors’ dream.

You cannot find another store of wealth such as Bitcoin that combines both exceptional rate of returns with a highly secure decentralized payment network that’s free from government control.

It is technology that enables individuals to accumulate wealth in a realm that cannot be bent easily to the demands of systematic compulsion. It renders every government’s capacity to monopolize money obsolete.

That is why, when retail investors drove the price up, institutional investors used their capacity to drive the prices back down. After that, they gradually began accumulating Bitcoin at very low prices.

If you invested $1,000 in Amazon 10 years ago, you’d make about $20,000 today.

Even Warren Buffett himself admitted he was too dumb to realize Amazon would succeed at this scale. He opted not to invest in Amazon when he had plenty of opportunities. He did not understand or appreciate the value of technology.

$1,000 in Microsoft 10 years ago = ~$8,000

$1,000 in Netflix 10 years ago = ~$100,000

$1,000 in Apple 10 years ago = ~$9,000

$1,000 in Bitcoin 10 years ago = >1,000,000,000 ( 185,185 bitcoins at $7,000 per BTC)

Based on an account of a Norwegian man buying 5,000 bitcoins for $27 in 2009. I had to recheck my calculations 3 times to make sure I had the right figures which amounted close to $2 billion. Note: Of course in those days, it’s extremely difficult to find and buy bitcoins.

If only the majority of investors were patient enough… Food for Thought!

In Bitcoin’s 10 year-long history, no single asset, startup, stock, precious metal or commodity has even come close to providing better returns than investing and HODLing bitcoin (BTC) itself.

It has been the best performing asset over the last decade.

The only exception: if you bought during the high of Dec’17 and sold it on Feb’18 (if those investors did some homework and held on to their BTC, they would’ve been in the net positive again.)

Who is Someone Famous who Owns bitcoin?

1. Tim draper

Made over $1 Billion by getting in early on Twitter, Skype, Tesla and many more companies.

Draper is an American venture capital investor, and founder of Draper Fisher Jurvetson, Draper University, Draper Venture Network, Draper Associates, and Draper Goren Holm.

During a Major Tech Conference in Lisbon, he told Forbes of the potential Bitcoin is bringing to the world.

2. Peter Thiel

Peter Andreas Thiel is an American entrepreneur and venture capitalist.

He is a co-founder of PayPal, Palantir Technologies and Founders Fund. He was ranked No. 4 on the Forbes Midas List of 2014, with a net worth of $2.2 billion, and No. 328 on the Forbes 400 in 2018, with a net worth of $2.5 billion.

Peter Thiel is betting on bitcoin because one cryptocurrency will become the ‘online equivalent to gold‘.

Been riding it for 6 years. Haven’t bailed yet

— Tony Hawk (@tonyhawk) May 29, 2019

Wanna buy some Bitcoin? 😉😉 pic.twitter.com/9ZbBJ5fuVq

— Elon Musk (@elonmusk) October 22, 2018

Recently he doubles down on Bitcoin by backing a Bitcoin mining farm in Texas for $50 million.

3. Tony Hawk

The godfather of skateboarding has been “riding [bitcoin] for 6 years,” he revealed in a 2019 reply tweet asking if it’d be fun to ride the most recent price rise.

“Haven’t bailed yet,” the king of vert wrote in the tweet.

4. Elon Musk

When he’s not building the future, Elon Musk might be getting sued by the U.S. Securities and Exchange Commission (SEC) or talking about anime girls — or talking about bitcoin (OR, as in an especially unique cases, combining bitcoin with anime girls … seriously).

The futurist has publicly stated that he doesn’t own more than 0.25 bitcoin. But maybe that’s just good op-sec. He certainly buys into the concept of cryptocurrency, having called Bitcoin’s design “brilliant” in an ARK Invest podcast with the firm’s CEO, Cathie Wood.

“Paper money is going away. And crypto is a far better way to transfer values than a piece of paper, that’s for sure,” he said during the podcast.

5. Marc Andreessen

Marc Andreessen share Draper’s vision. He restructured his entire VC firm so that they can invest directly into Bitcoin and cryptocurrency without any restrictions.

Marc Andreessen share Draper’s vision. He restructured his entire VC firm so that they can invest directly into Bitcoin and cryptocurrency without any restrictions.

Like the internet, he’s betting that in 20 years, we’ll talk about Bitcoin like we talk about the Internet today.

Andreessen made headways by the age of 24, when Netscape, a company he backed, made the first breakthrough on the internet. Now he’s betting on Bitcoin.

Marc Andreessen’s a16z crypto fund:

a16z crypto is a $350M venture fund that will invest in crypto companies and protocols. Our fund is designed to include the best features of traditional venture capital, updated to the modern crypto world:

- We are long-term, patient investors. We’ve been investing in crypto assets for 5+ years. We’ve never sold any of those investments, and don’t plan to any time soon. We structured the a16z crypto fund to be able to hold investments for 10+ years.

- We have an “all weather” fund. We plan to invest consistently over time, regardless of market conditions. If there is another “crypto winter,” we’ll keep investing aggressively.

- We are flexible with respect to stage, asset type, and geography. One reason we created a new fund is to have maximum flexibility. We invest at all stages, from early stage projects to fully developed later-stage networks like Bitcoin and Ethereum. We’ll invest in traditional financial instruments like equity or convertible notes, and new instruments including the direct purchase of coins/tokens. Crypto is a global phenomenon, with great projects all around the world, and we’ll invest accordingly.

6. Michelle Phan

Surprisingly, most of the celebrities on this list became interested in bitcoin during the first big hype cycle in 2013 to 2014. Michelle Phan, though, is a new initiate — or, at the very least, she’s recently come out as a bitcoin supporter.

Surprisingly, most of the celebrities on this list became interested in bitcoin during the first big hype cycle in 2013 to 2014. Michelle Phan, though, is a new initiate — or, at the very least, she’s recently come out as a bitcoin supporter.

“This is why bitcoin and crypto and decentralization is the next wave. It’s the most important evolution of the internet,” the YouTube Influencer and makeup entrepreneur said recently on the “Off the Pill” podcast.

When she’s not building her multimillion dollar makeup empire, she’ll drop the occasional tidbit about bitcoin on Twitter or other social media platforms.

7. Jack Dorsey

The CEO of Twitter is a big advocate for Bitcoin. In fact his company Square developed the Bitcoin CashApp to allow anyone to purchase bitcoins in 3-simple steps without needing to know any technical skills.

The CEO of Twitter is a big advocate for Bitcoin. In fact his company Square developed the Bitcoin CashApp to allow anyone to purchase bitcoins in 3-simple steps without needing to know any technical skills.

In a strong endorsement of a cryptocurrency that’s had a rough 12 months, Dorsey said he holds bitcoin and he thinks it’s the future of money.

“I don’t see it as an investment,” he wrote in a flurry of tweets. It’s a “currency,” he added.

In messages and responses to crypto fans, Dorsey outlined his reasoning: “Bitcoin is resilient. Bitcoin is principled. Bitcoin is native to internet ideals. And it’s a great brand.”

He added: Bitcoin will “probably be the native currency.”

Overtime people will choose a currency that isn’t controlled by any Government.

So what does it mean to actually HODL bitcoins? Are you buying it in hopes that one day it will appreciate in value? Are you just looking to day trade to profit from its extreme volatility, or are you simply looking to invest in the technology behind Bitcoin which is Blockchain?

PayPal CEO owns Bitcoin.

That’s it.

No other crypto. Only Bitcoin. 🔥https://t.co/HHXhaHjcMO

— Pomp 🌪 (@APompliano) November 20, 2019

Here’s what I think:

Buying and holding Bitcoin (HODL)

This is one of the oldest Bitcoin investing concepts that spread like wild fire. It all started when a forum member on Bitcointalk.org misspelled the word HOLD for HODL.

Unlike trading in Bitcoin whereby it is held for a short duration of time and then sold at a higher price, HODLing as it is more popularly known involves buying and then keeping it for an extended period of time regardless of the UPS and DOWNS.

Later on, people started to define it as Holding On for Dear Life (HODL)

You see, when bitcoin first started appearing on every news outlet and media back in 2013, “the so called experts” were skeptical and labelled it as a hype bubble or simply the greatest pyramid scheme the world has ever created.

Mt. Gox, the biggest Bitcoin exchange site was hacked and hundreds of millions of dollars’ worth of Bitcoin was subsequently stolen from the general public.

It was also used prominently as a currency to purchase illegal drugs and pornographic material on Silk Road and Utopia.

Then to add salt to the wound, Flexcoin a Bitcoin bank announced that its entire user database vanished into thin air.

Bitcoin was practically dead in the water. No one thought it could survive all those pitfalls, after all the technology was still in its infancy.

However, something good did arise from the ashes of defeat; a group of people remained loyal and more convinced than ever that Bitcoin would still be the future of a one global Decentralized financial currency.

The price of a single Bitcoin was around $700 in 2014.

These true believers weren’t just into Bitcoin for the speculation and profit of the currency value; they somehow believed that holding a Bitcoin would make them an active participant of a bold new future.

They stayed on despite all the bad publicity in the mass media. And today, those early HODLers of Bitcoin became multi-millionaires, even if they just put $30 into Bitcoin in 2010, or $1000 in early 2012.

So if you were thinking that the latest major crash is harsh, think what happened a few years back and why each obstacle made these group of people even more fervent and loyal for Bitcoin.

In fact, by this site’s count, Bitcoin has already been pronounced dead 350 times since 2010.

As the decade ends, the biggest unicorn of the 2010s wasn’t Uber, Airbnb, or Snap. It was Bitcoin.

— Balaji S. Srinivasan (@balajis) December 4, 2019

There’s a deeper underlying philosophy that HODLers believe that will keep pushing Bitcoin’s price higher and higher, perhaps indefinitely until it supersedes the U.S. Dollar.

This comes from some of the worst inflation in history like the Zimbabwean dollars or the German Mark.

Both currencies were not backed by any gold or silver and they were printed until they literally lost all of its original value. The German Mark for example lost 99.99% of its value in 6 years, whereas the US Dollar has been gradually losing its value, and has lost over 96% of its value since 1913.

Why 1913? Well it was the year that marked the formation of the Federal Reserve Central Bank of the United States of America. And ever since that pivotal point in our monetary history, banks all over the world have followed this exact same model of the Fractional Reserve Banking system.

Why do you think there are so many powerful people against the idea of Bitcoin? They instead choose to support the technology behind Bitcoin which is Blockchain.

Bitcoin on the other hand does not require any central authority to govern it. No one central authority can print out as many Bitcoins as they like, or to electronically duplicate and add more zeros behind.

It has a fixed supply of ~21 million Bitcoins, a limit written into the code that governs the entire system. It does not need a central figure like a bank to verify whether a transaction is valid or invalid because it has cryptography built-in to secure the code. No one can ever hack into the Bitcoin code.

Now if you’ve read that Bitcoin was hacked, it was the exchanges that hold the currency that were being hacked.

Now just imagine a central place like a bank holding all the money in the world, would they become a target for crooks?

Yes they certainly would. Heck, banks get robbed all the time.

The whole idea of decentralization is to be your own bank, store your Bitcoins in your own Hardware wallet like a Ledger Nano S or a Trezor.

So at the end of the day, limited supply and limitless demand accelerates the price of Bitcoin. HODLing and the cap limit of 21million continue to keep the supply low and that in turn drives up the value of Bitcoins in the long run.

So what are the other incentives of holding on to Bitcoin?

In the U.S., if you hold your Bitcoins for at least a year, you can pocket your profits as long term capital gains, which is taxed lower than that of short-term trading gains.

However, there are certain countries like Switzerland, Hong Kong and Singapore which offers zero tax on long term capital gains. Short and long term holding of Bitcoins is determined by the length of time which you keep and the frequency of your trades.

The Bigger Picture

The U.S Dollar will eventually spiral out of control and suffer high rates of inflation. It is not a matter of “if” but “when”. This is guaranteed because of the current spending habits and debt.

The U.S debt alone is at $20.24 trillion. This is the real bubble waiting to explode. Not Bitcoin.

And when it happens, the dollar you hold will practically be worthless paper. We can see this time and time again throughout history.

…And this would ultimately lead to a Demonetization of the dollar.

Hyperbitcoinization could lead to a mass adoption of Bitcoin and become the de facto world currency of the future. Countries like Japan have completely embraced Bitcoin as a legal payment method.That is a pretty smart move.

So those who have HODLed their Bitcoins would ultimately owe no capital gains taxes. Why?

If your U.S. Dollar rises in value today, do you pay taxes on it? No, there’s no capital gains tax for a currency.

Even if they tried to tax the profits you made out of Bitcoin, hyperinflation would have made the dollars worthless.

That means you have to take the opportunities presented in front of you to make life-changing gains.

So get out there. At the very least, buy some Bitcoin.

Remember, you don’t have to own a whole Bitcoin. You can own just a fraction of a coin.

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Zodiac Collection, that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.

There’s a lot of exciting stuff to read — I’ve selected a few of the stories, to start with, below.

To read a curated list of the most important news stories, subscribe for FREE. It will be everything you need to know, in your inbox. No brainer 🙂

Want to Find out More about Bitcoin?

- Follow my Tweets to learn my latest insights.

- Access the largest Free Bitcoin learning Library here.

Here are some special picks:

How to Invest in Bitcoin if You Missed the Bull Runs. – An honest look into investing in Bitcoin; if you decided to get into cryptocurrency after reading about it in the mainstream…

- How to Buy Bitcoin At Discount

- Saving Money, Literally, in the Age of The Internet (Why Bitcoin?)

- 3 Bitcoin Wallets That Are Iron-Clad, Ultra-secure and Affordable

- Buy Bitcoin With Paypal Instantly on these sites (Explained Step-by-step)

- What Will Bitcoin Be Worth In 2020?

- 7 of the Fastest Ways to Buy Bitcoin (BTC) Today!

- Don’t Let “Blockchain” Burn Your Portfolio

The markets are down for a multitude of reasons. In a nutshell: don’t panic during this dip. Just hold. The recent dip in the crypto market ties directly to what we’ve been repeating since the beginning: patience and discipline. How deep will the dip go? No one can accurately know.

You can earn as much as 0.02 BTC daily and when you invest big get up to 65- 100% of your investment weekly when you invest with (omitted)