…but if you’re prepared, you could stand to make a fortune.

…but if you’re prepared, you could stand to make a fortune.

The best time to profit is when the market plunges.

Sure, you can make money in a stable market. But you could make a fortune in a bad market.

Read on to learn how to protect yourself from a global recession and make yourself a fortune in the process…

The months leading up to 2020 have been anything but ordinary. Forest fires in South America, Brexit in the United Kingdom, protests in Hong Kong, and an escalating global trade war.

While the trade war is dragging on, the yield curve is also inverting. Investors are fleeing to safety. Global growth is slowing. The stock market is dipping.

For now, the man in the street is unconcerned.

But the “big shots” are shaking under their pants.

Politicians are upset. Investors too.

This is widespread, very close to universal.

That’s why central bankers have responded by cutting interest rates.

Fed: easing

ECB: easing

BOE: easing

BOJ: easing

Australia: easing

New Zealand: easing

Brazil: easing

Russia: easing

India: easing

China: easing

Hong Kong: easing

Korea: easing

Indonesia: easing

SouthAfrica: easing

Turkey: easing

Mexico: easing

Philippines: easing

Thailand: easing pic.twitter.com/1jzS8HYDPo— Charlie Bilello (@charliebilello) September 12, 2019

This is called an “insurance cut“, and it’s the first thing central banks do to keep the economy from keeling over.

Economic chickens are coming home to roost.

No one wins in this scenario because every economy is tied to the U.S. dollar.

The rising dollar is tell-tale sign that global trade is suffering.

It leaves no winners in its wake. None.

That’s why the Fed have no choice but to resume Quantitative-easing (QE).

Essentially, we’re repeating the 2008 Financial crisis.

Back then, not a single person was held responsible for the theft of trillions of dollars.

Why is it theft at a global scale?

Instead of being punished for their economic crimes, Wall Street executives and bank CEOs were rewarded with billions of dollars.

Rewarded for sowing the global seeds of economic destruction.

They made it out of the 2008 crisis like bandits.

Joseph Cassano of AIG for example made $300 million while taxpayers had to bailout his company for $200 billion.

Vikram Pandit of Citigroup ordered a $50 million private jet and announced layoffs after getting bailed out.

Citigroup was bailed out for more than $350 billion.

Ken Lewis of Bank of America made over $150 million while his company was bailed out for more than $50 billion.

Jamie Dimon of JP Morgan Chase made over $100 million. His company was bailed out by taxpayers for over $100 billion. He said to a U.S Senator, “hit me with a fine, we can afford it.”

This is what happens when a ring of criminal enterprises are given the license to control the nations wealth.

Banks are essentially putting a choke hold on the people’s wealth. Our money.

Gold friends PLEASE read this piece. This is why you should never hold your physical gold at a bank. This is why I co-founded GBI in 2008 so that I could own and store outside the banking system. Finally, the thieving by the banks is being uncovered.https://t.co/3STgpA1Zfe

— Dan Tapiero (@DTAPCAP) September 17, 2019

Recent fines for 𝗷𝘂𝘀𝘁 the laundering of money:

Wachovia – $160m

Deutsche Bank – $670m

Bank of Australia – $700m

ING – $900m

Citigroup – $237m

Standard Chartered – $967m

Commerzbank – $1.45b

HSBC – $1.9b

JPMorgan – $2.05bAnd they all used the US dollar, not bitcoin. 🤔

— Rhythm (@Rhythmtrader) September 15, 2019

This is called a mega-crime. Mega is the prefix for millions.

Millions got destroyed financially & emotionally by criminals in suits.

The hard fact of life is we can’t win against them.

They’re protected by the very people we voted into office.

Nothing has been able to stop the cancer from metastasizing.

Price fixing in precious metals spanning decades. Including currency markets.

Bankers illegally moving prices of gold, silver, platinum and palladium.

Markets shift in a huge way whenever it becomes unsustainable. Malinvestments.

These nefarious practices began before 2008 and grew larger.

Make billions, fined millions. Banks: “Let’s do it again!”

That’s unsustainable.

The markets are showing signs of exhaustion.

Emerging market currencies are getting hammered…

China’s yuan fell to fresh 11-year lows.

The Argentine peso crashed 30.3%—in one day.

And last year, the Turkish lira lost 30% against the U.S. dollar. (It continued to fall this year, too—plunging over 4% back in March.)

In the currency markets, a 5% annual move is huge. And all these moves are more than three times greater than that.

Keep in mind, if your local currency drops 40% against the dollar, it means anything you buy from America costs 67% more than before.

This surge in import costs can devastate emerging market economies relying on key U.S. imports (food, heavy equipment, technology, etc.).

And today, the world’s market is unsustainable because all our economies are in one way or another tied to the U.S economy.

Mountain of Debt

The ongoing Argentine devaluation is heartbreaking:

100 Pesos

= 20.2 USD (Jan 2013)

= 14.2 USD (Jan 2014)

= 11.6 USD (Jan 2015)

= 7.5 USD (Jan 2016)

= 6.3 USD (Jan 2017)

= 5.2 USD (Jan 2018)

= 2.6 USD (Jan 2019)

= 1.7 USD (Now, Aug 2019)

— Matt Huang (@matthuang) August 14, 2019

The main problem emerging market currencies are facing is debt. Emerging market debt has tripled since 2007—and now stands at $69 trillion.

To make matters worse, many of these loans must be paid back in U.S. dollars. And as the dollar rises, their currencies get weaker. This means their loans are more expensive to service.

Now, emerging markets need to pay back (or refinance) $1.5 trillion in debt over the next 18 months. But guess what? They don’t have the money.

So countries are issuing debt they can’t service—and printing too much money to try to cover it. Nothing kills a currency faster than that.

Take Russia, for example…

During its currency crisis, people simply stopped saving because of the falling ruble. What do ordinary people do in such a situation?

They simply stopped saving!

Saving was pointless—so they spent all their money as soon as they earned it.

Money is not wealth

Money is a measure of wealth.

That might seem obvious. But everywhere you go you will find people clueless about the nature of wealth because of how deceptive our money is.

Say you’re in your mid 50’s in 2008 and you’ve worked hard your whole life.

You’ve done all the right things by saving enough money, $300,000 dollars.

With some luck you’ve probably accumulated half a million, maybe more.

You have a home, a comfortable middle-class income lifestyle.

You plan on retiring with that money.

Little by little you dip into that money and you slice away at it like a cheese cake that’s sitting in your refrigerator.

You don’t plan on eating so soon, but you had to go back to opening the refrigerator door time after time. Each time filled with guilt.

It started off as a healthy piece of cheese cake and you take sliver after sliver and pretty soon you know that it’s no longer going to be enough to live a comfortable life.

That’s what’s happening to people saving money. The story of my dad.

Soon there will be no more cheese cake left and that’s a problem.

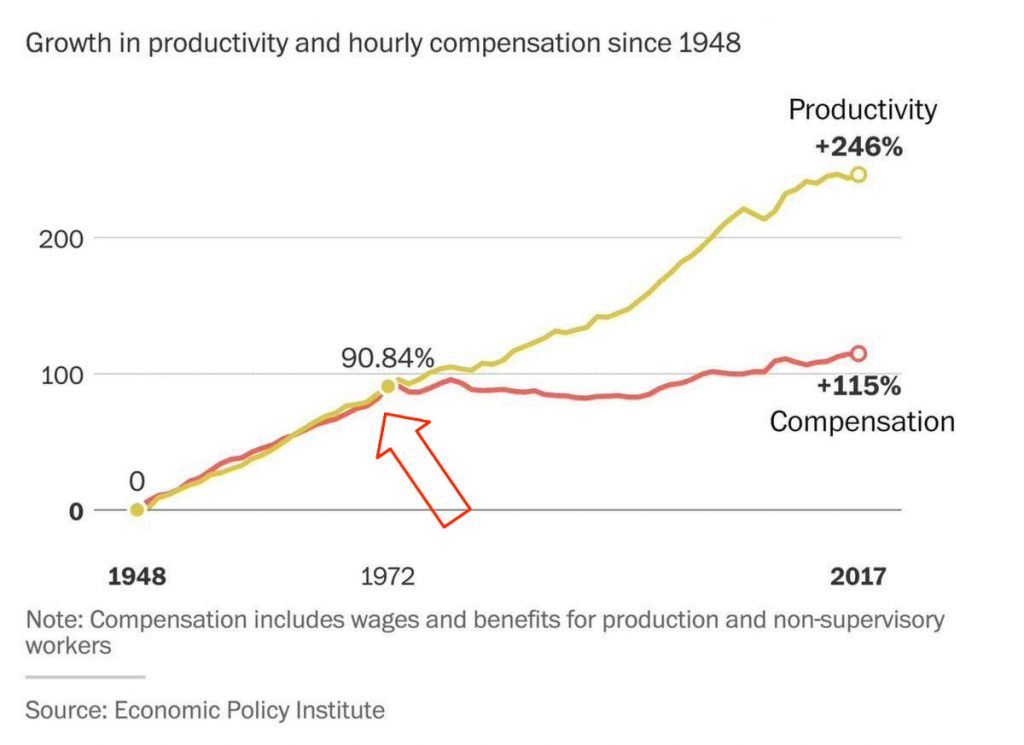

A really big problem. It is the root of a lot of social anger that we see everywhere, expressed through all kinds of social movements today.

People are all riled up.

They feel that there’s something really unfair about the world, but they don’t quite know what it is.

You’ve seen the riots and protests in Hong Kong, Paris, Venezuela, Jakarta, Russia, Brexit and the U.S.

We’ve hit a serious tipping point in the world today. What’s driving so much anger, radical politics and growing racism in society is really about money and hopelessness.

Growing wealth and income inequality is fueling the rise of populism around the globe.

That’s why you need to take the opposite approach to what the market is doing.

The most important thing to understand is that the next downturn is just right around the corner.

No one knows when. It could be next month. It could be two years from now. But I would bet that it happens within that time frame.

Big downturns occur about once a decade on average. And we’re almost 12 years since the financial crisis of 2007–2008 that knocked the market down more than 50%.

It goes without saying… it’s important to have a plan in place and be prepared.

So, here are some key indicators to look for…

Let’s find out if you’re prepared.

7 Steps to Prepare for the Next Market Crash

1. To Diversify or Concentrate?

We may well be at the most dangerous financial moment since the 2009 Financial Crisis with current developments between the US and China.

— Lawrence H. Summers (@LHSummers) August 5, 2019

Mark Carney from the Bank of England: “A new #cryptocurrency could ease reliance on USD” pic.twitter.com/7Vud1Z0W5I

— Eljaboom💥 (@Eljaboom) August 26, 2019

Nobody became wealthy quickly due to diversifying their investments. You know why the wealthiest people tend to be entrepreneurs & their heirs? They focused and risked all their resources on one specific opportunity. Diversification preserves wealth; concentration builds it.

— Jameson Lopp (@lopp) July 25, 2019

The old paradigm is dying.

The old paradigm — growth from government power over money — is dying.

How do you know when a paradigm dies?

The financial establishment ‘experts’ sounding alarms.

Lawrence Summers, the former Secretary of the Treasury under President Bill Clinton, tweeted.

Mark Carney, governor of the Bank of England proposing a Crypto-like currency to replace the dollar hegemony.

World Bank Chief, David Malpass recently warned that he sees a steeper global growth slowdown than previously estimated.

While it’s important to diversify your investments as much as possible, this advice is for people who already have significant wealth. And they’re doing so to preserve and not lose their wealth overnight.

If you’re in that position, you should diversify across different asset classes and regions as well.

How you allocate your investment portfolio will depend on your risk tolerance, time horizon, and goals. But careful diversification gives you a good chance of weathering the storm relatively unscathed.

There is a global hedge against the stupidity of politicians readily available that is becoming increasingly obvious — Bitcoin.

For those who are living paycheck to paycheck and cannot see themselves escaping the clutches of debt, Bitcoin is your best asymmetric bet to help dig you out of trouble when the ship sinks.

We are now at a critical juncture where it would be irresponsible for any investor to have 0% exposure to bitcoin in their portfolio. Why? It has been the best performing asset class for over a decade!

2. Invest for the long term

Billionaire Warren Buffett’s “buy and hold” strategy is renowned.

Put simply, he understands how wealth resides more in thoughts rather than in things. In the current economic climate, value can change as fast as minds can change. Being right and patient is what matters.

The short term is more about investor sentiment and confidence (or lack thereof), while the long term is about real wealth creation and problem-solving.

“Nobody buys a farm based on whether they think it’s going to rain next year.” Buffett said on CNBC. “They buy it because they think it’s a good investment over 10 to 20 years.”

Similarly, he wrote to his shareholders in 1996: “If you aren’t wiling to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Where do we see ourselves 10 to 20 years from now?

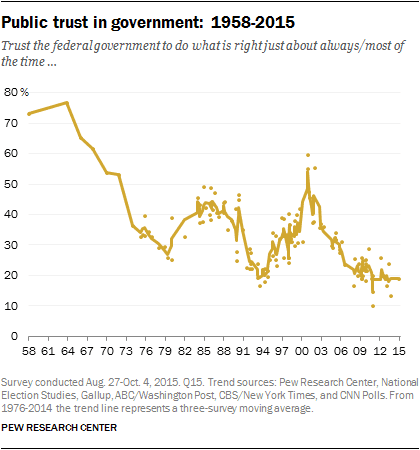

Investor and Web browser pioneer Marc Andreessen thinks he sees a future that’s distributed, messy and fraught with tension.

He sees that the level of trust in governments, banks, institutions and tech companies is failing.

As a consequence, something really disruptive is set to flip the status quo.

He believes Bitcoin is a classic instance of that kind of technology.

So the more your portfolio is focused on the long term, the better off you’ll be.

Bitcoin is the kind of investment that you’ll need to look 10 or 20 years into the future.

Don’t invest more in Bitcoin than you will want to pull out in the next 5 to 10 years.

3. Take emotion out of the game

It may seem crazy to some that @APompliano has >50% of his Net worth in Bitcoin …

… however anyone that HODL’d since ~2015 (e.g. since $200) has nearly 60x’d. It would only have taken a ~1% allocation to get >50%

— Alistair Milne (@alistairmilne) August 7, 2019

#bitcoin: the logical next step in money technology!

1) Scarce as gold: 21M supply cap, high hash rate, high stock to flow -> no more Weimar, Zimbabwe, Venezula, QE

2) P2P: nodes -> no server, no CEO, no Corp, no Govt -> no power abuse (black lists), no privacy hacks (Equifax) pic.twitter.com/nn9Qg1eC3h

— PlanB (@100trillionUSD) September 4, 2019

Develop a game plan to stick to when things go south.

Investing favors the emotionless.

Even the smartest investors do stupid things when they get scared.

You will need it when you invest in Bitcoin.

Investors who entered Bitcoin at $200 saw it rise to over $1,000 in 2013 thought it would reach $10,000 in no time at all.

That however took 4 years to materialize.

Not only that, but it started with a 2 year downtrend, during which Bitcoin lost nearly 90% of its value.

And just when you thought all is well seeing Bitcoin rise from $10,000 to $19,800 within a space of a month; it suddenly free falls in the next 6 months to a low of $3,200.

Imagine trying to hold on to your beliefs when the price moves so dramatically. It’s not easy.

That’s why it’s important to not try to out-predict Bitcoin’s price movements in the short term.

When you hold on to your bitcoins (HODL) over a very long time horizon, you’re taking advantage of market inefficiencies and the lack of understanding.

For example, if you sold all your bitcoins during the major price correction in 2018, you would have missed out on the huge bull run in 2019 that saw bitcoin rise from $3,200 to $14,000.

You would have sold at a lost due to irrational fears instead of just holding on because you understand the nature of Bitcoin.

Bitcoin is highly volatile compared to established asset classes such as gold ($8.5 trillion) because it’s a nascent market class with a capitalization of only $0.2 trillion.

Not only that, you’re taking an unlimited amount of global investor demand / unlimited supply of fiat currency to chase a FIXED amount in bitcoin supply (21M)

If the entire world is racing to see who can devalue their currency the fastest, what are they all devaluing against?

Assets with limited supply. Proven Scarcity.

Bitcoin has no top, precisely because fiat has no bottom.

That also means you’re going to see extreme highs and lows which leaves a lot of upside to investors who understands Bitcoin intimately even today.

You don’t have to own one full bitcoin immediately.

You can always own fractions of bitcoins (Satoshis) up to 8 decimal places, with 1 Satoshi being 0.00000001 BTC.

Gradually dollar-cost averaging your purchases of Satoshis (Sats) gives you the edge. Don’t trade.

It’s important to keep this in mind: When you’re selling your bitcoins, you’re essentially trading something incredibly scarce for something abundant.

Trading the future for the past.

But if you can’t bear the thought of your fictitious fiat money sum of 1’s and 0’s dropping by 85% or more, you should de-risk into other assets. Re-balancing (You should never sell all your bitcoins even if you want to take some profit!)

This would help mitigate risk and take emotion out of the equation.

4. Keep Debt Burden Low

If you’re in debt now, things don’t get any easier during a recession.

Make sure that you aren’t too stretched out. But if you are, stop creating more debt!

This won’t get you out of debt, but at least it won’t get worse.

If you want to know why the rich get richer and the poor get poorer, remember that most of the U.S. Dollar is just debt.

The lower the interest rate, the easier it is to accumulate wealth.

Poor people have high interest rates. Rich people have insanely low interest rates. Its the epitome of modern slavery.

You won’t get ahead financially by creating more debt unless you put it to good use. Debt alone is not bad but shouldn’t be used to get a much more expensive house, car or university education than you can realistically afford.

More debt equals more uncertainty. Look for ways to put more money towards your debt. Don’t gamble.

5. Have Extra Cash on Hand

Warren Buffett hasn’t stockpiled this much cash since right before the last global financial crisis.

Berkshire Hathaway is sitting on a pile of $122 billion, possibly preparing to buy up all of the cheap assets on the dip.

Don’t listen to what they say, watch what they do.

— Rhythm (@Rhythmtrader) September 14, 2019

Warren Buffett shies away from buying stocks; Berkshire is sitting on a monster cash pile of $122 billion https://t.co/cDyrTopEDp

— Bloomberg (@business) August 3, 2019

Warren Buffett is now waiting to find well-priced opportunities to park his money.

He is sitting on a lot of cash. $122 billion to be precise.

It’s important to have cash on hand for two reasons.

For emergency. You’ll need cash on hand to pay your bills and buy food. Give yourself a year’s worth of cash for some breathing space. The more the better.

Buying assets at a discount. Having extra cash positions you strategically for a market crash. The Chinese symbol for “crisis” is a combination of the symbols for “danger” and “opportunity.”

The danger is what everybody sees; the opportunity is never quite so obvious as the danger, but it’s always there.

Unfortunately, accreditation rules prevent the majority of people to learn how to invest and improve their financial standing.

Instead, It pushed people into a small set of “safe” assets, high-priced managers, and into lotteries / gambling. Thus creating rising inequality.

Fortunately for us, we have something similar to the “digital gold” narrative in bitcoin.

It continues to gain relevance amid extreme monetary policies and rising geopolitical tensions.

At the same time, the relative size of bitcoin’s market value compared to the capitalization of the gold market, makes it a tempting opportunity for anyone starving for assets with above-average growth potential.

Buying and HODLing Bitcoin is the ultimate way to be a contrarian. You don’t need any special privileges to buy, hold and sell bitcoins.

Everyone can have access to this “digital gold”.

It is the most secure decentralized financial network in the world.

The opportunity cost of not holding at least a small allocation in bitcoin grows by the day, especially as the long-term outlook for conventional asset classes looks more and more bleak.

The strategy during a market correction is simple for Bitcoin: The coin transfers from weak to stronger hands. So if you have cash on hand, you can stack up on more Satoshis.

As Warren Buffett says, “Be greedy when others are fearful.”

6. Look for Assets that Thrives during Downturns

“Something is going on, and that’s causing I think a total rethink of central banking and all our cherished notions about what we think we’re doing” – James Bullard

— zerohedge (@zerohedge) August 26, 2019

Bitcoin can protect my money from gov’t theft, says Snowden https://t.co/K3zCTq4yvq

— Cointelegraph (@Cointelegraph) September 18, 2019

What are the kind of assets that tend to do better in a downturn?

Consider this: The Federal Reserve manipulates the economy.

They are cutting interest rates, printing money & doing whatever they can to prop up the market.

Its an illusion of prosperity. Don’t be fooled.

The European Central Bank (ECB) has cut interest rates & restarted Quantitative-Easing (QE) at €20bn/month with many more to come.

They’re buying more bonds every month than the 30-day circulating supply of Bitcoin (BTC)

The Fed will be cutting more interest rates pretty soon.

Cutting interest rates is tantamount to printing an insane amount of money within a short time frame.

Whatever wealth you’ve saved from decades of hard work can easily be erased because central bankers are in a race to devalue their currencies.

If you had $1 million worth of Venezuelan bolívars in 2013, it would now be worth less than 37 cents.

Bitcoin has no top, precisely because fiat currencies has no bottom.

Who wants to be a millionaire? I don’t.

If the entire world is racing to see who can devalue their currency the fastest. What are they all actually devaluing against?

ASSETS WITH PROVABLE SCARCITY.

It will be bullish for a non-sovereign, hard-capped supply, global, immutable, decentralized, digital store of value.

7. Only a Poor Man Sells His Prized Assets

In 2015 I sold 800 BTC to buy a house for my family.

In 2018 I sold my house and bought back 50 BTC.

People who thinks I’m crazy for selling my house please know that my only regret is to have sold my bitcoins.

Investment in Real Estate is now garbage comparing to #Bitcoin. https://t.co/fK2ynLELFp

— That’s my name (@bitcoinization) August 13, 2019

The filthy rich seek wealth, not fiat money.

The common man trade-in their time in exchange for fiat money.

Wealth are assets that appreciates over time even while you’re asleep.

You’re not going to get rich one day working for your boss. You must own an equity, a piece of business or an asset in order to gain your financial freedom.

In the 18th century, Yeoman farmers who own acres of land experienced unsettled conditions like clustered crop failures, cold winters, famines and plagues.

When crop yields failed to recover, the landowners faced a desperate situation. Continue to hold on to their land for dear life (HODL) or give it away to the Church in preparation for the telling disaster.

Many landowners, large and small gave them away.

For centuries, markets have always placed the greatest pressures on the weakest holders.

Our new report “Bitcoin in Heavy Accumulation” is out. Read here: https://t.co/DkjedcF3RG pic.twitter.com/UpQotZUTdW

— Tuur Demeester (@TuurDemeester) April 18, 2019

Dire situations and an impending collapses create conditions that centralizes wealth.

It has happened to land.

It has happened to gold.

It has happened to bitcoin.

During the last Bitcoin bull run in 2017, many retail investors bought bitcoin at higher than average prices during the fear of missing out (FOMO) run. The new highs triggered a feeding frenzy.

With all the media attention, new entrants got attracted by the allure of quick profits, driving prices higher at an accelerated pace.

Eventually, all the hysteria reached a crescendo at around $19,500 per BTC.

Traders who got in early wanted to cash out some profits and started selling. A little push was all it took to trigger a sell-off. The ones who got in much later got their hopes pitilessly crushed.

The price of Bitcoin crashed to a low of $3,200 in 2018 because new entrant mom-and-pop investors didn’t fully comprehend the long term value of Bitcoin.

Bitcoin vs Top Performing Stocks. pic.twitter.com/ee0MgJNAPo

— Wayne Vaughan (@WayneVaughan) June 21, 2019

Bitcoin’s yearly lows:

2012 – $4

2013 – $65

2014 – $200

2015 – $185

2016 – $365

2017 – $780

2018 – $3200

Bitcoin is a long-term investors’ dream.

You cannot find another store of wealth such as Bitcoin that combines both exceptional rate of returns with a highly secure decentralized payment network that’s free from government control.

It is technology that enables individuals to accumulate wealth in a realm that cannot be bent easily to the demands of systematic compulsion. It renders every government’s capacity to monopolize money obsolete.

That is why, when retail investors drove the price up, institutional investors used their capacity to drive the prices back down. After that, they gradually began accumulating Bitcoin at very low prices.

If you invested $1,000 in Amazon 10 years ago, you’d make about $20,000 today.

Even Warren Buffett himself admitted he was too dumb to realize Amazon would succeed at this scale. He opted not to invest in Amazon when he had plenty of opportunities. He did not understand or appreciate the value of technology.

$1,000 in Microsoft 10 years ago = ~$8,000

$1,000 in Netflix 10 years ago = ~$100,000

$1,000 in Apple 10 years ago = ~$9,000

$1,000 in Bitcoin 10 years ago = >1,000,000,000 ( 185,185 bitcoins at $9,800 per BTC)

Based on an account of a Norwegian man buying 5,000 bitcoins for $27 in 2009. I had to recheck my calculations 3 times to make sure I had the right figures which amounted close to $2 billion. Note: Of course in those days, it’s extremely difficult to find and buy bitcoins.

If only the majority of investors were patient enough… Food for Thought!

In Bitcoin’s 10 year-long history, no single asset, startup, stock, precious metal or commodity has even come close to providing better returns than investing and HODLing bitcoin (BTC) itself.

It has been the best performing asset over the last decade.

The only exception: if you bought during the high of Dec’17 and sold it on Feb’18 (if those investors did some homework and held on to their BTC, they would’ve been in the net positive again.)

Following these seven steps will help you survive (and thrive) during the next market crash.

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Zodiac Collection, that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.

There’s a lot of exciting stuff to read — I’ve selected a few of the stories, to start with, below.

To read a curated list of the most important crypto news stories each morning, subscribe for FREE. It will be everything you need to know, in your inbox, every day. No brainer 🙂

I certainly don’t want to overload your brain with the library of Bitcoin resources we have here.

Here are some special picks:

- How to Get Rich Without Trading Bitcoin (or renting out your time)

- How to Buy Cheap Bitcoin

- How Satoshi Nakamoto Used the 1950’s Game Theory to Design a $100 Trillion System

- The 7 Basic Tenets of Investing in Cryptocurrency – A Quick And Dirty Guide

- Top 10 Crazy Bitcoin (BTC) Predictions that Could Come True

- How do I Buy Bitcoin (BTC) on Binance w/ My Credit Card?

- 7 of the Fastest Ways to Buy Bitcoin (BTC) Today!

- Buy Bitcoin With Paypal Instantly on these sites (Explained Step-by-step)