Are you a first time investor venturing out into the worldwide west of Cryptocurrencies?

Are you a first time investor venturing out into the worldwide west of Cryptocurrencies?

Have you been losing money instead of making big profits like everyone who hear in the news or social media. Ever wonder why?

Here’s the blatant truth about Cryptos. Trading is a game of patience. But , and its a big but. For you to outperform the market, tons of other people like yourself have to first underperform. And that is just the simple mathematical fact.

And most of the time traders would try to study the market, feed off the news, read and follow “prophets”of the market to try to time themselves to either go in or get out.

The problem is, It isn’t that simple.

In a free market environment, coupled with some fair regulation and rules; some investors look for inside information to get that bit of an unfair advantage. But that is called insider trading, and its illegal. You could get punished in a court of law.

The winners and losers in this market are determined by whose prediction is more accurate. You could study the fundamentals or technicals all you want, some people a very complex model, but in the end, its always difficult to outsmart the market.

In Cryptocurrency, the markets are not regulated. And there are no rules. No one to monitor fair play. It’s kind of like the wild west of the internet. The person with the bigger gun wins most of the time. People don’t play fair, and profit is all that matters. even at the expense of others. Especially a small fry like you and me.

So what’s happening in the cryptocurrency markets that you cannot see?

It is not my intention to spread FUD, but that’s how the public get cheated.

Insider Trading

The SEC deems this illegal. The reason? Insiders will always beat the stock market. Every single time. When someone is aware of a nonpublic information, (MNPI) they could easily make a killing. That is why they (insiders) have to make a 10b5-1 plan , a predetermined written plan that discloses their buy or sell trades at scheduled intervals to the SEC.

In Cryptocurrency however, its a different ball game altogether.

Over the past 9 years alone, we’ve seen plenty of high profile cases which frankly is pretty sickening.

Most people are still unaware of these large scale misappropriations. In fact, there are still thousands of unreported insider trades across the world. Some small exchanges are still not put under the scrutiny to protect the public from these unethical traders.

The 21st-century boiler room: @shaneshifflett and @paulvigna identify and illustrate (awesome graphics!) 175 crypto pump-and-dumps. https://t.co/TMWS8TbJTJ

— Charles Forelle (@charlesforelle) August 5, 2018

One of the biggest stories of 2017, the year that brought Bitcoin mainstream was not just the news that Bitcoin touches $20,000. It was also the year that ICOs and pyramid schemes were rife and spreading like a virus within the veins of the Crypto economy.

What followed was the short-lived boom in token sales to newbie investors who frankly don’t understand shit about cryptocurrencies. All they care about is the promises made by some charismatic CEO that promises them large profits and gains.

The Coinbase Bitcoin Cash was one such incident.

Before Coinbase even made it official that the coin would be listed officially on its exchange, prices and trades bizarrely surged thousands of fold higher than normal.

As BCH pumped before the announcement. Even trading on insider tips are considered a violation in traditional markets

Coinbase’s Bitcoin Cash Class Action Lawsuit is just the tip of the iceberg.

Consider the thousands of other new token and coins that surfaced the market. Compounded by hundreds of new exchanges popping up like mushrooms handling millions of dollars in transactions.

South Korea, the hotbed of the cryptocurrency market had regulators that were themselves violating this code of conduct. The Korean regulators called the FSS knew before hand that new trading restrictions would be enacted, so they bought and sold just before they themselves made the announcement.

In fact, even after being caught red-handed, they argued that there were virtually no laws that could persecute them. Therefore, no arrests or punishments were made because they were the law.

That is just a scratch of the surface. Insider trading till this day is still running rampant and there is just no solution at the moment.

In an unregulated market, can we continue to accept that there is nothing that can be done to rectify the situation without a central authority? Sadly, this doesn’t come as a surprise anymore to seasoned investors. So if you’re new to this market, consider yourself warned.

Meanwhile, apart from every effort to regulate the Token economy from insider trading fraud, there is one kind of investor that regulation are unable to touch.

And they’re called Whales.

Investors who can move mountains of capital to drive markets to where they want it to be. Definitely not your everyday mom and pop investor.

Most people are aware of the existence of whales by monitoring trading activity. Some say its a conspiracy that they exist. Others just accept that the unregulated market is easily manipulated by big capital investors and so they stay away from it.

According to ScienceDirect Journal, a single entity was identified to be responsible for the Bitcoin price to be jacked up from just $150 to $1000 in a matter of two months. But If you can’t imagine why would anyone do such a thing, and how it’s possible, read on.

Whales want to suppress the price in order to buy a huge portion of a coin at a discount. How do they do that?

The goal is to drive the price below $100, which may be a psychological breaking point for some people and therefore a likely place for stop-losses. One can do this by:

So the original intention is, to drive the prices down by first selling a huge portion of your coins, then as the pressure to sell intensifies, the whale would then snap up all the cheap coins and hold it until the market grows or recovers.

Or, rather, that is just one way to do it. This strategy only works for new coins that have just been issued and listed on an exchange. They have small trading volumes so it’s kinda’easy to pull it off. That’s why you should stay away from the new coins and ICOs unless you really believe in it and plan to HODL.

Even so, it is still possible to manipulate the price of Bitcoin if you have huge capital and influence. What do you say to people like Jamie Dimon, the CEO of JPMorgan who has so much influence and media coverage who called Bitcoin a fraud publicly, and then threatened to fire any of his employees who bought Bitcoin; and then after the price gets knocked down, his traders in London went on to purchase 3 Million Euros worth of Bitcoin XBTs.

Think about that for a moment. Why are these Whales doing it differently from what they publicly declare to loathe?

The hypocrisy is astounding. Observe and understand what these high profile people say from doing are two absolutely different things.

That’s the Biggest reason why I choose to ignore mainstream media news. Aside from being controlled and owned by some of the richest of most influential people on earth, they could simply sway public opinion to line up their own pockets.

Aside from the whales, many Bitcoin exchanges know how to engineer certain price movements to their own benefit. It’s simple work when you have the financial incentive to do so. While you think you can learn all these techniques to try to predict the market, they can easily outsmart you with massive buy or sell orders within a short period of time.

To be honest, there isn’t any evidence that implicates many of these smaller exchanges, you just have to trust them. That is why when you actively trade and try to time the market, it leaves you open to all these kinds of variables.

It is still much easier for you to just buy a coin you believe in and hodl for the long term.

Its always dubious whenever you see sideways movements followed by a sudden burst of volume and directional price movement.

Of course, there’s nothing wrong or illegal with that. But whenever you see a spike like that, it’s better not to make a decision. Just stay put and see how it goes.

Whales could also easily spoof bids or offers with the intention to send you the wrong signals. You may think its a bullish or a bearish market, but actually they just created large buy or sell orders as a disguise, then immediately after the smaller order gets filled, they cancel it.

Doing so could easily lure the average investor to sell their coins at a massive discount, or simply just buy above the market value. Bitfinex investigated one of its users for spoofing.

While spoofing could be easily spotted, something like Wash Trading is difficult.

Wash Trading is simply a strategy to artificially inflate trading volumes but its hard to prove it as such because they seem like normal trades in a bullish market.

This happened during the highly anticipated fork on July 27 where Bitcoin (BTC) and Bcash (BCH) separated. Bitfinex traders would then receive an equal proportion in BCH based on how many BTCs they held.

But the rules in Bitfinex could be manipulated because a trader could simply buy X BTC and then short X BTC. You can read their official statement on this matter here.

Pump and Dump Groups

This form of fraud is the most extensive with new tokens that are cheap and relatively well-known. Executives would recruit massive amounts of members to join groups in Telegram or WeChat.

After that a simple coordination with the members in a group could easily and artificially inflate the price. After that, its all about timing the dump.

Groups like “Big Pump Signal‘ has over 80,000 members. And that is just one in a mania of frenzy groups that keep on spreading like wildfire.

It’s so trendy right now. People get fed to the brim with all this quick profits that they don’t care if it is at the expense of others. Its a cycle of greed. It never ends well for most people.

Most of these groups are led by a leader who identifies the right coin to get in and out easily. Of course, they first would need to have some strong influence or an engaging community with big numbers.

A low trading volume is ideal.

Before they start announcing to their cohorts on Telegram, they will first accumulate large amounts of the coin. Greed and deception starts at the top. They would first try buying it without giving out too much of a bullish signal.

The profit and greed starts at the top and trickles down to their premium paying members who subscribe to get ahead of the crowd.

Want to get in early and know when to buy or sell before the crowd gets in? Pay for that privilege.

Then after that is all about how much profit they want to take off the table. Of course they’d ensure their members get a taste of the real deal as well so they would stay engaged and attentive.

Other investors who hasn’t got a clue about this and is the slowest to sell would lose all their investments in a flash. There is no remorse from the winners. Its all about the money.

If you have no access to this group, and you were just trading based on the technical or fundamental, you’ll get Rekt.

The ones at the top of this pyramid scheme stands to profit the most. The people at the bottom are just their chess pieces.

Conclusion

The Entire Cryptoverse is rigged. And you’re just a small fish in a tank of sharks that will eat you up alive if you don’t know what you’re doing.

The more you try to think your can outsmart the market, the more likely you’d lose money.

I know you’ve read about how easy it is to trade cryptocurrencies and make tons of moolah overnight. I know, I know you get jealous of your friend who bought a coin a few months back and now drives a lambo. Sure you want it too; You’ve heard how easy it is. You want to quit your lousy job.

But I’m here to tell you its all bullshit. You have to be an expert and be a very patient person to sustain this long term. And even those who said they’ve made thousands are going to get rekt if they keep trying to find the next bitcoin.

Not all Cryptocurrencies are going to survive for years on end.

In 2013 these were The top 10 coins that stayed at the top with Bitcoin. Are they still here today?

Think about it.

If you genuinely believe in the technology and you’re in it for the long run, why even bother trying to speculate and make more fiat money?

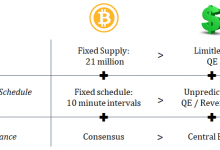

Bitcoin is the internet of money. And it isn’t going to go away or get duplicated out of value. A fixed supply of 21 million BTC means that its a better store of value than even gold (something people can dig more out of the earth)

The sooner you get it, the better, because make no mistake, Bitcoin will be forced upon you in the future whether you like it or not. It is only a matter of time. Bitcoin will become a payment system or currency at a point when it captures about a third of the gold market.

This is why I started CoinZodiaC. It’s easy to keep thinking that Bitcoin is the MySpace of Social Media and that it will easily be innovated out of existence. Bitcoin is not created or designed to be this fancy new technology that has a ton of new features with flashy gifs or kittens, it’s digital gold.

There has to be a trade-off. You want your money to safe and secure? Don’t you?

I don’t mean to spread all this FUD on cryptocurrencies. I’m merely pointing out the beast within us that sets out to destruct anything or everything that is good.

This Token economy is a brave new world filled with possibilities and brand new innovation and it is quickly breathing down the necks of its incumbents, but this unbridled freedom comes with all kinds of nasty stuff.

If you plan to just make quick profits, then you’re not truly seeing the bigger picture. If you’re a smart investor, you’d be adding to your positions and Hodling to see the day that the future has arrived in place of the present.

Quite well-stated. Wise words.

Appreciate your kind words. Thank you. 🙂