The 7 Best Bitcoin Hardware Wallets (for the Extra Paranoid) in 2021

Someone with serious tools is trying to steal your bitcoins. Don't let them.

Bitcoin is the new land.

Bitcoin is the new land.

Hodlers are the new landowners.

To get yourself prepared for this massive digital land-grab, you need the safest way to secure your Bitcoin private keys offline.

And to do that, you want the best hardware wallet money can buy.

If you’re worried about getting hacked, or constantly second-guessing your current wallet setup, here I’ll be highlighting some pretty extreme security measures.

When I first got into the world of digital assets, I could literally count the number of companies working on hardware security solutions and simply pick one without much deliberation.

But of course that was ages ago.

Now with an industry maturing, more intelligent and consumer friendly options are springing up like mushrooms.

How do you keep up with the technology? Most importantly, how do you know which hardware wallet is best for your needs?

Let my inner geekiness help you weed out the weak from the strong wallets.

Very smart people have very specific methods and strategies to keep their bitcoins safe. I will show what you need to know, the best safety practices and the hardest wallets to hack.

*Storing your bitcoins on an exchange like Coinbase or any other trading platforms like Binance is never a good practice (Always online). You don’t own the private keys offline.

If they’re Not Your Keys, they’re not your Coins. That’s a mantra you should keep in mind if you’re new.

Now, let’s dive right in.

If you don’t have the luxury of time, that’s the 3-leading models in a glance. For a more detailed review of each hardware wallet continue down below:

Here's what I'll cover: Table of Contents (TOC)

-

- The Basics of a Bitcoin Wallet

- The Best Way to Keep Digital Gold Safe

- 35 of the Worst Bitcoin hacks

- My 7 Hardware wallet Reviews:

- Ledger Hardware Wallets

- Keystone Hardware Wallets

- Trezor Hardware Wallets

- ColdCard Hardware Wallet

- CoolWallet S

- KeepKey Hardware Wallet

- Ellipal Titan

- Are Hardware Wallets Secure enough?

- Q&A: Frequently Asked Questions

- My Quest for Extreme Security Measures Led Me to this Conclusion…

Don’t second guess, Bitcoin is very new and different from what you already know and use every day. It’s still very early in this space.

To give you a perspective of how early it is, imagine 1994 just before the internet boom.

Yeah, that’s right.

This is going to get big … and you know bitcoins are extremely scarce, only less than 21 million in the world.

That’s why it pays to stake your claim on bitcoins properly and HODL.

We’re so used to custodians (banks) keeping our money safe that we’ve come to accept the economic uncertainties and the monstrous cost that comes with storing our wealth with a third party.

Fiat money is highly subjected to the whims of political forces. The government can cut off any Individual and their access to money with a switch of a button.

Not happy? Want freedom? Too bad, banks have co-opted with the government. That’s what happened in the Hong Kong resistance movement.

Here’s another example:

In 2016, citizens of India were given just 4 hours to turn in their wads of cash as their Prime Minister Narendra Modi gave an abrupt order that would render 1,000 and 500 rupee notes worthless.

With a broad-stroke, his shocking declaration rendered 86% of the cash in India unusable. Hundreds of people died trying to turn in their worthless fiat money.

China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA. We should MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games – as they have for many years!

— Donald J. Trump (@realDonaldTrump) July 3, 2019

Translation: i want to print money to inflate away the massive hole I’ve made in the public finances with my tax giveaway to people like me. I do not care that this will lead to inflation as my wealth is based on property so inflation helps me.

— James Willby 🇺🇸🇬🇧 (@JamesWillby) July 3, 2019

The feeble, disabled, elderly were forced to wait in line for hours just to withdraw some money. A baby dies being denied treatment because the hospital refused to accept the outlawed currency notes.

There is no greater terrorism than going to war against your own people.

Citizens living in Greece, Cyprus, Iran, Syria, India, Spain, Venezuela, Argentina, Turkey, Pakistan, Zimbabwe, Brazil and Ukraine are all embroiled in some form of domestic or international currency war. And the people living in these countries are the hostages.

If you ask “Why should I care? I’m not experiencing any of that.” Well, that’s because your economy isn’t being looted from the inside out yet.

The problem with centralized governance of money, is that you can never quite predict when the next politician is going to take it upon themselves to rob and loot in order to obtain cash to redistribute to their followers among the poor.

Money is the lifeblood of the people and yet it is a plaything for politicians.

Which is why, the historical average life expectancy of any fiat currency is 27 years.

But people are smart.

Over time they learn to hold on to good money by getting rid of the bad. In any economy, the good or hard money tends to be the one that has the strongest purchasing power or the lowest monetary supply growth rate.

This is called Gresham’s law. And we’re constantly seeing this play out all the time. In countries like India, Venezuela or Zimbabwe; the moment people get their hands on harder money, they will find innovative ways to hide, bury or save it.

That’s because the harder money will preserve their wealth far into the future while the bad money tends to be dispensed away as quickly as possible because inflation eats away its value every week.

Over time, you will notice that the bad money drives away the good money.

The people who are left stuck with piles of worthless toilet paper will see themselves losing most of their wealth.

So it is important for you to understand the concepts of hard money early!

Today we’re seeing large swaths of Bitcoin adoption in these countries purely because people are suffering from the effects of bad money.

I CAN’T use Apple pay/PayPal/Visa/Master or anything like them

I’m from Iran

I CAN use Bitcoin

What do you have to say?!

— Ziya Sadr (@Ziya_Sadr) July 5, 2019

We’re essentially witnessing Gresham’s Law in action.

When people get their hands on bitcoin, they’re going to HODL!

They’re going to bury that so deep, to ensure they have the good money saved for their children, for their future. And they’re going to trade the bad money for bitcoins.

Nowadays, all money is bad money compared to Bitcoin.

For the first time, Bitcoin is helping individuals solve a huge problem by allowing them to store value in a realm that cannot be bent easily to the demands of systematic compulsion.

It renders every government’s autocratic capacity to monopolize money obsolete.

There is a ruthless need for a new currency that does not rely on any one government. That currency should be decentralized, open, public, neutral, borderless and censorship-resistant.

Should you believe that Bitcoin is that currency, your first investment should not be in buying them, but in spending time understanding how to store and own bitcoins securely.

Now that you understand the HODL philosophy, let’s dive straight into securing your bitcoins.

Over time, HODL has become synonymous Holding for Dear life and not selling in times of market despair.

Remember, this is a new era of regaining your independence from banks and the government. Its now your responsibility to adopt good practices and choosing your wallets carefully in order to protect your wealth.

No one else should do that for you.

It should be treated with the same care as you would with your banking details and passwords.

The Basics of Bitcoin Wallets

Some Things You Should Know Beforehand

2/ Easiest way to reduce coin theft risk is by storing your seed offline.

Do not store them in a Google doc.

Do not store them in your notes app on your iPhone.

Do not store them in a text file on your computer.

Do not take a picture or screenshot of them.

— Matt Odell (@matt_odell) January 7, 2018

3/ K.I.S.S – Keep it Simple Stupid

Writing your seed down with pen & paper is more secure than any of the above methods.

Want redundancy? Keep multiple copies in different physical locations.

Want additional protection? Be creative. Split your words up or create a code/system.

— Matt Odell (@matt_odell) January 7, 2018

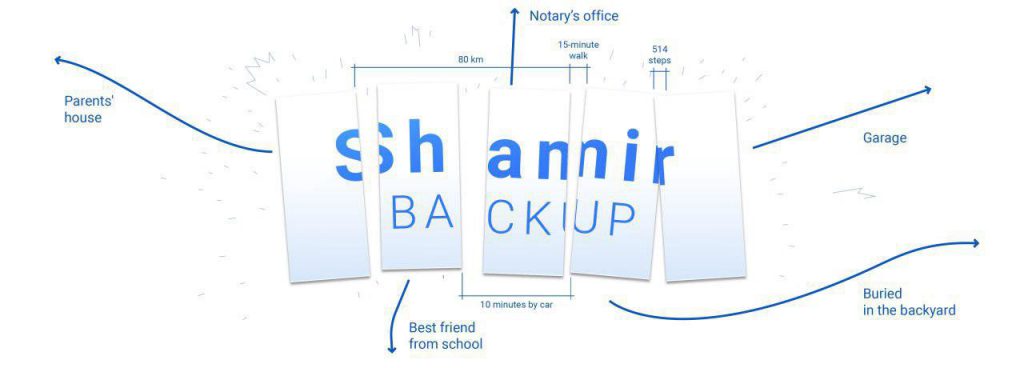

Most bitcoin wallets use seed words as a backup.

Usually 12 or 24 random words are given to you when you first setup your wallet.

Your #1 priority should be in keeping those words safe. If anyone has access to them, they can steal your bitcoins!

There are literally hundreds of wallets in the market that allows you to store and keep your bitcoins.

They’re generally divided into Cold Wallets and Hot Wallets.

Not all of them are ideal bitcoin wallets. There’s always a trade-off.

The easiest way to describe them is this: hot wallets are connected to the internet while cold wallets are not.

Generally, I hold my Bitcoin on both cold and hot wallets because I intend to use them differently.

Hot wallets are like checking accounts, its easy access, you can use it to instantly send and receive bitcoins on the go; while cold wallets are bank vaults, it doesn’t offer you the convenience and flexibility, but it does offer you iron-clad security.

People who have bitcoin keep a small portion in their hot wallets for everyday purchases like buying coffee or sending money to their friends. They keep the vast majority in their cold wallets.

Bitcoin allows you to transfer money anywhere in the world, even to remote places directly via peer-to-peer. Without any intermediary involved, it doesn’t cost you an arm and a leg just to send money across the internet.

For the very first time, the banks are being disrupted by a decentralized network that cannot be bribed, controlled or manipulated in any way.

With such empowering features, users and owners are now fully responsible for the security of their own bitcoins. That’s why it’s important for you to understand the best and the worst elements of custodial or non-custodial wallets.

Bitcoin was designed as a non-custodial solution for the people.

- A custodial wallet is where you entrust a service or an entity to hold your money for you.

- Non-custodial wallets give you full control and sovereignty over your money.

Bitcoin itself is highly secure, but the on and off-ramps that create bridges to and from the bitcoin network is highly insecure. Unfortunately, these exchanges are the places where 99% of the people are getting their initial exposure to Bitcoin.

And that’s where most of them are leaving it.

Related: 5 Things to Watch If You Leave Bitcoin on an Exchange

Unlike your national currency where the central bank can print it out of thin air, there will only be 21 million bitcoins (BTC) in the world.

Like it or not Satoshi Nakamoto can never print more of it, even though he’s the head honcho.

When you consider a store of value which is much scarcer than gold, that cannot be duplicated or inflated over time in any way, you have to treat it very differently from how you would treat your paper money.

In fact, you have to treat it closer to what you would have if you had gold tucked under your bed.

The Best Way to Keep Digital Gold Safe

During the last #gold rally 2011, many tungsten filled gold bars were found.https://t.co/3qt9mFFFg8

Don’t have to worry about that with #Bitcoin, no way to fake it.

— bitcoiner (@AnselLindner) May 2, 2020

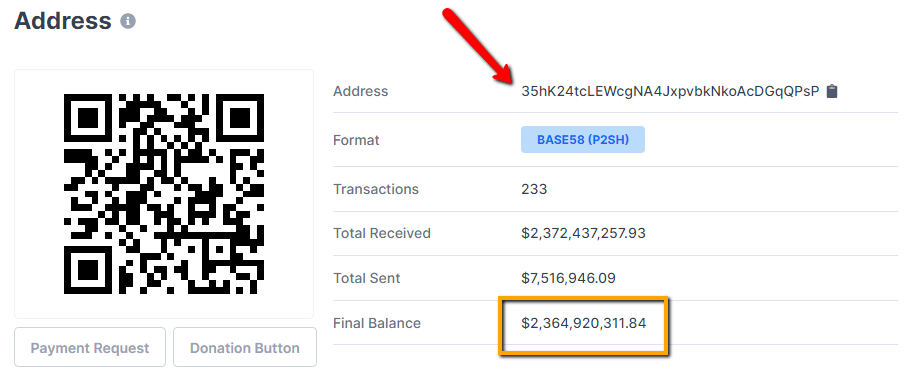

Imagine the scenario of storing $2 billion worth of gold.

First you’ll need to verify every single bullion for authenticity. Many tungsten filled gold bars exists in the market. Huge headache! But you don’t have to worry about that with Bitcoin.

Second, how do you store your precious gold without putting yourself in harms way? Owning gold is one thing, storing it is quite another.

Now compare that with securing the equivalent amount in bitcoins within this 34 alphanumeric characters.

35hK24tcLEWcgNA4JxpvbkNkoAcDGqQPsP

This string of alphanumeric characters is what you call a Bitcoin address, and it contains over $2 billion dollars worth of bitcoin.

Whoever controls the private keys to this address is the lawful owner of the funds.

Would you give away your private keys that enables you to sign away your $2 billion to another party?

No. Of course not.

So the best way to keep your digital gold safe is for you to own the private keys to your estate.

A private key is a secret number that allows bitcoins to be spent. Every Bitcoin wallet contains one or more private keys, which are saved in the wallet file.

The private keys are mathematically related to all Bitcoin addresses generated for the wallet. Your 12 or 24 seed phrase contains all the private keys to your hardware wallet.

One of the benefits of saving in bitcoin – is that it allows you to safeguard your own money without needing to delegate security & cost to a third party.

Yet, most people start off by getting involved with Bitcoin on cryptocurrency exchanges like Coinbase or Binance.

Again, on such platforms, you don’t own your private keys.

Generally speaking, many would just buy and then leave their bitcoins on the exchange itself.

This is very bad practice and defeats the purpose of decentralized technology.

If you watch closely, people living in countries like Lebanon, India, Venezuela, Greece, Cyprus, Argentina, Hong Kong or Zimbabwe can teach us a thing or two about misplaced trust.

Experience taught them a very harsh life lesson about trusting governments and banks with their money!

The Lebanese for example are hostages to a full blown currency crisis. They watched the financial meltdown diminish 25 years of hard earned savings despite being pegged to the dollar.

Hong Kong protesters on the other hand had their bank accounts frozen for being involved in the freedom movement. Individuals identified as dissenters were instantly being locked out of the financial system and labeled a domestic terrorist.

In Greece and Cyprus, citizens were losing their pensions and savings in bank bail-outs to as much as 30% of their salaries.

Many of these catastrophic events happen very abruptly and catches millions of people off-guard.

Today, if they get their hands on cold hard cash, they’ll immediately keep it tucked away instead of leaving it with a bank.

Why would they trust someone else when they can secure that wealth on their own. Today with Bitcoin, it’s even easier.

You can defend your livelihood with a set of passphrases without the need to employ costly security or crack your head at hiding wads of cash.

Besides, the value of the dollar can still be confiscated without any violence involved. You just need to switch on the money printer and it’ll go Brrrrrrrrr……

Many unsuspecting traders and investors buying bitcoin assume that exchanges are safe, and hence they routinely get caught off-guard too.

Major security breaches like the infamous Mt. Gox, saw individuals lost hundreds, if not tens of thousands of dollars overnight.

Some of the worst hacks happen on cryptocurrency exchanges. And there’s no denying that the peripheral infrastructure for on and off-ramps to bitcoin are extremely vulnerable.

Here are 35 of the Worst Cryptocurrency Exchange Hacks of All Time.

- June 2011: Mt. Gox ~$8.75 million stolen

- October 2011: Bitcoin7 ~ $50,000 stolen

- March 2012: Bitcoinica ~ $228,000 stolen

- May 2012: Bitcoinica ~ $87,000 stolen

- July 2012: Bitcoinica ~ $300,000 stolen

- September 2012: Bitfloow ~ $250,000 stolen

- May 2013: Vicurex: $160,000 stolen

- June 2013: PicoStocks: $130,000 stolen

- November 2013: PicoStocks: $3,000,000 stolen

- February 2014: Mt. Gox: $460,000,000 stolen

- March 2014: Cryptorush: $570,000 stolen

- March 2014: Poloniex: $64,000 stolen

- July 2014: Cryptsy: $9.5 million stolen

- August 2014: BTER: $1.65 million stolen

- October 2014: MintPal: $1.3 million stolen

- October 2014: KipCoin: $690,000 stolen

- December 2014: BitPay: $1.8 million stolen

- January 2015: 796exchange: $230,000 stolen

- January 2015: Bitstamp: $5.2 million stolen

- February 2015: BTER: $1.75 million stolen

- April 2016: Shapeshift: $230,000 stolen

- May 2016: Gatecoin: $2.14 million stolen

- August 2016: Bitfinex: $77 million stolen

- October 2016: Bitcurex: $1.5 million stolen

- February 2017: Bitthumb: $1 million stolen

- April 2017: YouBit: $5.3 million stolen

- December 2017: EtherDelta (DEX): $270,000 stolen

- January 2018: Coincheck: $500 million stolen

- February 2018: Bitgrail: $187 million stolen

- June 2018: Coinrail: $40 million stolen

- July 2018: Bancor (DEX): $23.5 million stolen

- Sept 2018 Zaif: $60 million stolen

- Jan 2019 Cryptopia: $17 million stolen

- Feb 2019 Quadriga CEO Death: $150 million lost

- May 2019 Binance: $50 million stolen

Incidents such as this prove the dangers of trusting any third party custodians.

Its fine if you are planning to use bitcoin on a daily basis by storing small amounts on your mobile phone or while trading on an exchange.

If you’re treating it like cash, its fine.

However, If you plan to store a substantial amount of your wealth in bitcoins, you should ONLY use Hardware Wallets. You could use paper wallets, but it isn’t recommended for most people simply because it has too many technical steps.

The greatest enemy to security, on the front-ends where users are operating, is complexity.

We all have the Dunning-Kruger effect. In security this could be fatal. We all have domains in which we think we know, but don’t. Our ignorance of what we don’t know makes us cocky, we take risks we don’t even understand, because… we don’t have enough knowledge to evaluate the risks.

We all suffer from Dunning-Kruger. In security, however, it [can be] fatal. In security, it [will] cost you your funds. You don’t know the risks that you can’t evaluate.

If you want an in depth yet beginner’s explanation on how hardware wallets work, watch this great explainer video from Andreas Antonopoulos:

Hardware Wallet Review

Hardware wallets are tough to crack because the private keys are stored offline within the device, and never revealed out in the open, even to you.

It’s ultra-secure because only you and you alone can ever approve a transaction because you have to confirm each one by pressing a button on the device.

**Unlike most articles highlighting the pros of having a device that supports thousands of altcoins. I don’t really see it as an advantageous feature. If any it poses a risk to the security of your unforgeably scarce bitcoins.

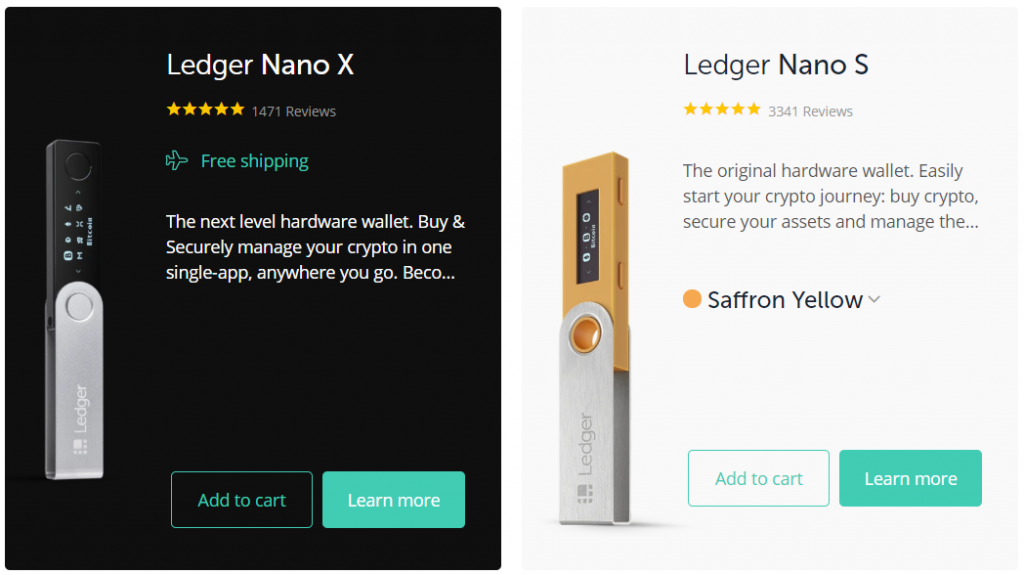

Hardware wallets like the Ledger is famous for its USB-styled device.

This French based company has even received funding from prominent VCs like Tim Draper.

I started my journey learning about the intricacies of hardware wallets through The Ledger Nano S. Eventually this device became an industry standard for all cryptocurrency enthusiast.

And it still is till this day (It sold 1 million devices in 2017).

Pros

- The Most Popular 1,326,201 Sold Worldwide as off August 2018

- The Most Affordable Hardware Wallet $ 69

- Supports 30 major different Cryptos, can install up to 16 apps at any one time.

- Ledger Live, a new desktop application that shows all your crypto accounts in one place.

- World Class Support and Team – quickly replies to feedback and complaints. Constantly improving.

Cons

- Need to delete apps to make room for other apps if the device run out of space. (can be fixed with latest firmware upgrade)

- Requires certain degree of know-how to use

The Ledger Nano X is the new Bluetooth version of the Nano S. It now offers Ledger users great mobility and convenience with its mobile app.

| Ledger Type | Nano S (Best-seller) | Nano X (New) |

| Price | $69 | $139 |

| App Capacity | Up to 16 | Up to 100 |

| Bluetooth | No | Yes |

| Screen | 128 x 32 Pixels | 128 x 64 Pixels |

| Connector | USB Type Micro-B | USB Type-C |

| Battery | – | 8 hours in Standby mode |

| Size | 57 x 17.4 x 9.1 mm | 72 x 18.6 x 11.75 mm |

| Weight | 16.2 g | 34 g |

| Learn More | Learn More |

Important to Know:

- There are many tampered products on Amazon & eBay. Only Buy from The Ledger Shop and Not from third party vendors. Cases like these has happened.

- There is no anti-tampering sticker! Its no use having one to protect your device because it can easily be faked.

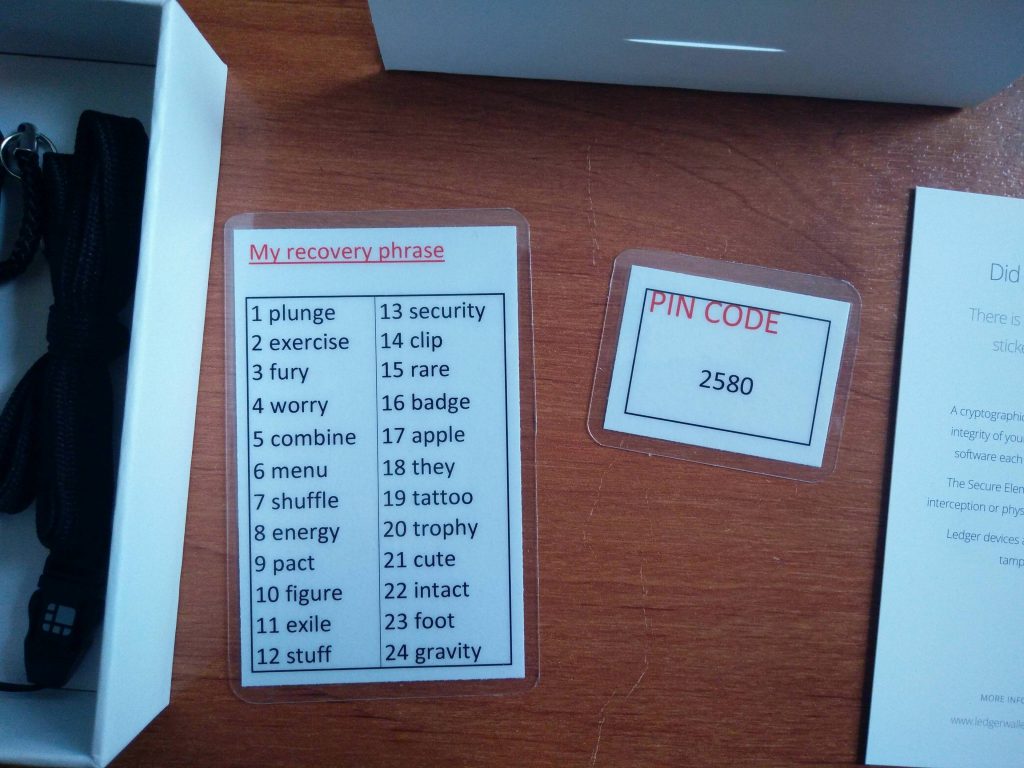

- You have set your pin and write down your own 24-word recovery phrase. Don’t accept one that already comes with the 24 recovery phrase.

- Even if you lose this device, you won’t lose your cryptocurrencies. You can buy a new device and restore using your own 24-word seed phrase.

- The mobile app is only fully-compatible with the Ledger Nano X.

This hardware wallet was designed by miners for miners. (It has to undergo the scrutiny of Miners)

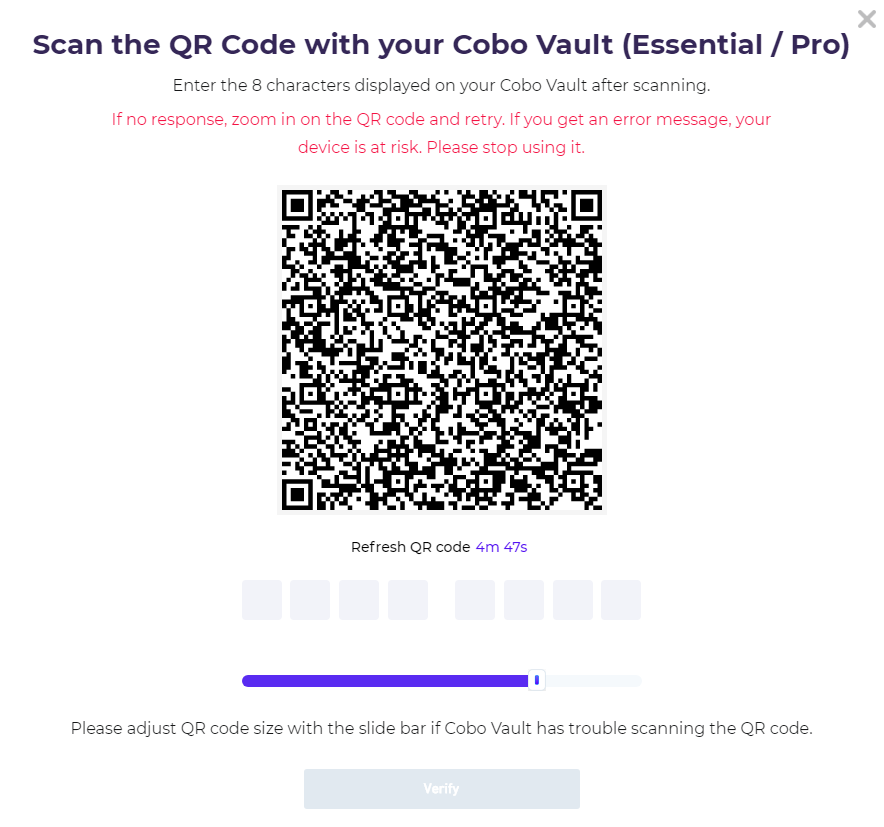

The Keystone uses rechargeable batteries to maintain an air-gapped security unlike most hardware wallets in the market.

An air gap is a network security measure employed to ensure that the hardware wallet is physically isolated from the internet or malware-ridden laptop.

It bypasses the need to connect directly via the USB port of your computer by including a small camera on the device.

The camera allows you to do a QR code scan to get handshakes between your private keys and the companion app.

Thus removing the need to connect physically via a USB cable or wirelessly using WIFI, Bluetooth or mobile data.

While the price of the Cobo Vault starts at $99, this entry model comes without special features like the fingerprint sensor and self-destruct mechanism or any of the enhanced durability material.

| Keystone Type | Essential | Pro | Ultimate |

| Price | $119 | $169 | $479 |

| Air-gapped | ✔ | ✔ | ✔ |

| Detachable battery | AAA battery support | AAA battery support + rechargeable battery | Rechargeable battery |

| Fingerprint sensor | ✔ | ||

| Self-destruct | ✔ | ✔ | |

| IP68 Waterproof | ✔ | ||

| IK09 Impact Resistant | ✔ | ||

| US Military Standard | ✔ | ||

| Aerospace Aluminum | ✔ | ||

| Learn More | Learn More | Learn More |

To enhance the security and durability of the device, the makers chose to use an aerospace aluminum alloy that’s IP68 waterproof as well as IK9 drop resistant.

It also passed the American military-standard durability test, MIL-STD-810G.

But this model is priced at a whopping $479.

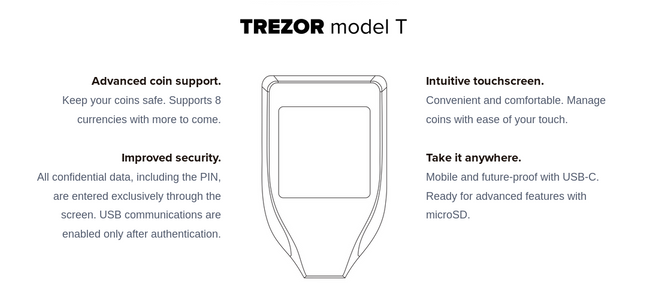

There are two types: Trezor One and Trezor Model T

Slush is the co-founder of Trezor, a pioneer in the Bitcoin scene since 2010. His company developed the very first hardware wallet prototype in 2012 and launched within a year to give the masses groundbreaking Swiss bank vaults in our pockets.

Trezor is literally the product that kick-started this whole hardware wallet industry. Their open source standard ensures progress in hardware wallet security ensues and that potentially critical bugs get discovered way before they cause irreparable damage.

What’s so reassuring with this company is the fact that Slush is a huge Bitcoin advocate. And his focus lies entirely on delivering greater security within his hardware wallets.

Thus, Trezor hardware wallet users benefit from the strong encryption software innovation like:

| Trezor One | Trezor Model T | |

| Price | $55 | $169 |

| Display | Monochrome + 2 buttons | Full color touchscreen |

| Pin entry | On computer or mobile | On your Trezor |

| Passphrase entry | On computer or mobile | On your Trezor |

| Device Recovery | On computer or mobile | On your Trezor |

| Shamir Backup | – | ✔ |

| Password Manager | On cloud | On cloud + microSD card |

| FIDO2 authentication | – | ✔ |

| Learn more | Learn more |

Even Jack Dorsey the CEO of Twitter buys a Trezor!

Just bought a @Trezor hardware wallet with bitcoin through @CashApp pic.twitter.com/TBYn1q5XzI

— jack (@jack) March 7, 2019

Important to Know:

- Only Buy from the Official Website and Not from third party vendors like eBay or Amazon. Threats like these can happen.

- Trezor One cost €49 for one (Save € 22 with a 3-pack for Trezor One on Trezor’s Website)

- Model T Hardware Wallet comes with a Full-color touchscreen which is more intuitive the the Trezor One.

- There is an add on backup called Cryptosteel which stores your 24-word recovery seed in Stainless-steel to protect from Water, Fire and other weathering elements.

- Open Source, devices have no serial numbers, offers more privacy because you can buy on Trezor’s website with BTC.

- Even if you lose this device, you won’t lose your cryptocurrencies. You can buy a new device and restore using your own 24-word seed phrase.

The Coldcard Mk3 hardware wallet is a Bitcoin-only hardware wallet for advanced users. It comes highly recommended from more technically savvy Bitcoiners.

The Coldcard Mk3 hardware wallet is a Bitcoin-only hardware wallet for advanced users. It comes highly recommended from more technically savvy Bitcoiners.

It includes advanced features such as a random number seed generator and a self-destruct feature.

You can generate a 24 word seed completely offline which is a great feature for paranoid users. Creating your own seed with the roll of a dice is also a very cool feature for Cypherpunks.

Pros

- NO specialized software required.

- True air-gap operation

- Under duress features

- Open source.

- Physical numbered-buttons.

Cons

- Not user friendly

- Requires advanced technical know-how

- NO companion ‘app’ on your computer, only works with Electrum or Wasabi wallet.

CoolWallet S is a credit card-sized bluetooth hardware wallet.

It connects to your smartphone (iOS/Android) via the CoolBitX app allowing for quick and secure transactions.

This hardware wallet manufacturer is based in Taiwan and has sold over 150,000 units to date.

This hardware wallet manufacturer is based in Taiwan and has sold over 150,000 units to date.

For additional security, CoolWallet S has the option to enable 2 + 1 Factor Authentication through the CoolBitX Crypto app.

One of the biggest arguments against Bluetooth connection safety is that it might get intercepted given the wireless range.

That is why the device requires you to scan your fingerprint or face ID and physically press the button on the card, rather than just the wireless Bluetooth connection between the devices.

While the CoolWallet S seem like a pretty nifty device for hiding your cryptocurrencies, there isn’t enough market consensus yet on its security, durability and reliability.

Having said that, it has a Wallet Connect feature with the Binance DEX. You can instantly connect your CoolWallet S to the decentralized exchange and trade at a moment’s notice.

You can get two cards for just $159. Please get it on the official website.

The KeepKey hardware wallet is a fork of the Trezor open source codes. The company was acquired by ShapeShift in 2017. As a result of this acquisition, customers can now purchase the KeepKey Hardware wallet at a significant discount. (Used to be $79)

With a larger display, the KeepKey gives clarity to every digital asset sent and received on your device. Each transaction must be manually approved using the confirmation button, giving you control and visibility over your transactions.

But a bigger screen also means it’s too big to carry in your pocket.

Thanks to the ShapeShift integration, you can send and receive dozens of the leading tokens and coins available on the market directly from your KeepKey Hardware wallet.

Since ShapeShift is a popular non-custodial exchange platform, incorporating the In-wallet exchange feature gives their customers a better sense of security and convenience.

Effortless Exchanges: Trade crypto commission free with the ShapeShift platform, directly from your wallet.

The Ellipal Titan hardware wallet is a cold wallet companion to the Ellipal App (hot wallet). Pairing both wallets in tandem gives you offline private key security plus the freedom of managing multiple coins on the go.

The first thing you’ll notice about the new Ellipal Golden Titan is the size. A mid-size tablet that’s a little bigger than your iPhone. Definitely bulkier than most hardware wallets.

Similar in many ways with the Cobo Vault, It too has an in-built internal rechargeable battery.

From an offline standpoint, it uses a camera to communicate with the app via QR codes. A similar strategy employed by other wireless hardware wallets.

You can check out their ON SALE offers only on the official website.

Are Hardware Wallets Secure Enough?

Watch this 12″ video to understand why:

Q: What are the unique advantages that I should look in a hardware wallet?

- Offline, anytime backup and recovery with a microSD card.

- Native software client avoids security risks of browser-based clients.

- Plausible deniability with hidden wallets and backups.

- Portable case filled with epoxy and packed with security.

- Subtle design avoids unwanted attention.

- Fully open source.

- On device display for secure transaction verification.

- On device touch buttons for secure password and seed entry.

- Quality and privacy without backdoors.

Q: Do my private keys ever touch my computer or the internet?

No. It’s NOT connected in any way. Not even during the initial setup or backup. The onboard microcontroller generates a wallet using a high-quality hardware random number generator to create entropy.

Some have an onboard slot for a micro SD card that allows offline backup and recovery.

There is no need to expose your wallet while typing on a keyboard or displaying recovery information on a screen, leaving it susceptible to theft by key logging, screen captures, and cameras

Q: Why are Hot wallets unsafe?

You have to trust third parties. The whole idea of Bitcoin is so that you can regain your independence from intermediaries or bankers and not just replace the status quo with new faces that acts like banks.

The hot wallet on your laptop or your mobile phone is constantly accessing the internet, sending and receiving data packets sometimes even without your knowledge. For the average user, it is highly unlikely that you can be 100% certain that your phone/laptop is clean from malware.

Q: Should I buy a Second hand or cheaper knockoff from Amazon or eBay?

In the world of security you probably DO NOT want to save 10 bucks on a knock-off hardware, like a clone of the original hardware wallet, when you are going to put thousands of dollars worth of bitcoin into the device.

Q: Should I use a hardware wallet that come with a PIN and Recovery Phrase?

No. Like your bank account, you have to create your own PIN code.

No. You should always Initialize your wallet as a new device. Do not use any recovery phrases that comes with your purchase:

Q: Why is having Two Hardware Wallets Better than One?

This strategy can vastly improve your security! Some of the reasons depending on your personal environment:

1) Keep as a back up

2) Keep as a clone wallet

3) Help spread risks

Q: Who is the Winner in each Category – Ledger vs. Trezor vs. Cobo vs. ColdCard?

| Security | Trezor Model T |

| Price | KeepKey |

| Ease of Use | Trezor Model T |

| Screen | Trezor Model T |

| Durability | Cobo Vault |

| Size | Ledger Nano S |

| Compatibility | Ledger or Trezor |

| Advanced Features | ColdCard |

| Concept | Coolwallet S |

| Value for money | Ledger Nano S |

Q: What if a Bully forces me to open my wallet?

1) Use plausible deniability. If you enable the optional passphrase feature, you will be prompted to enter a passphrase after entering your PIN.

This option can be used to derive different wallets. Put some change in one to add plausibility.

Warning! Funds deposited to a wallet derived from a passphrase can only be recovered from the backup when enabling the passphrase option and entering the same passphrase text. This is an advanced feature.

The primary purpose of a hardware wallet has always been to protect users and funds against online malware attacks, computer viruses, and various other remote dangers.

Theoretically, you can even use it on a laptop laden with malware, but there’s always a relatively small probability of “$5 wrench attacks”

2) Use Strong Passwords with Diceware.

3) Use Multisig wallets to eliminate single points of failure in both your hardware and software. If you’re technical oriented (follow guide here) or outsource it to companies like Casa for a monthly fee.

Security tip to Mitigate $5 Wrench Attacks

For anyone looking to get a hardware wallet for the first time, do not ever buy it on Amazon, eBay or from any 3rd party re-seller. Just don’t.

The 24 word recovery phrase and extra passphrase functionalities enable a range of security setups. You may use them to design the security strategy that meets your personal situation.

But please do not over-complicate things, the best security setup is one that you master and can execute with confidence!

My Quest for Extreme Security Measures Led Me to this Conclusion…

You’ve checked off the basics. But you still can’t fight a nagging feeling it’s not quite enough.

At some point, the value of your bitcoins are going to grow, and you want the convenience of a Swiss vault in your pocket that you can access at a moment’s notice.

For me, the best for securing your bitcoins as a beginner starts with The Ledger Nano S…

They make it really easy, very secure for anyone to store their keys. Don’t listen to anyone bragging about this and that level of security, “you should do this… etc” or else…..

Different people will have different risk models and tolerance for technical complexity.

If you’re trying to follow someone else and their security procedure that far exceeds your technical skill, you may introduce a more serious risk of losing your bitcoins. Your level of ambition may exceed your current skill level.

And you could mess it all up.

So keep it simple. Get an affordable hardware wallet first and then gradually brush up your knowledge about them before upgrading.

While most people are thinking about theft or break-ins, that is actually not the biggest risk.

The biggest risk is that you lose your 24-word recovery phrase, forgetting where you keep it, no-back ups, damaged by moisture, fire, termites, natural disaster, etc…

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Zodiac Collection, that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.

There’s a lot of exciting stuff to read — I’ve selected a few of the stories, to start with, below.

To read a curated list of the most important crypto news stories each morning, subscribe for FREE. It will be everything you need to know, in your inbox, every day. No brainer

I certainly don’t want to overload your brain with the library of Bitcoin resources we have here.

Here are some special picks: