No one knows the exact day, but I can promise you this:

No one knows the exact day, but I can promise you this:

Another highly reputable Cryptocurrency Exchange will get Hacked. Maybe not tomorrow, maybe not next month, but we’re definitely going to see another ‘large scale‘ attack on the horizon.

And a lot of uninformed people are going to lose their precious bitcoins again.

When you leave your bitcoins on an exchange, here are the 5 things to watch out for:

1. Crypto Exchanges Have Aspirations to become Banks

I genuinely believe that cryptocurrency exchanges are huge security holes like the banks we use today or the PayPal account we have on the fringes of our financial world.

They are the ‘new’ banks in the age of cryptocurrency.

Cryptocurrency Exchanges thrive upon your business. Listing countless “Shitcoins” gives them more ways upon which you can lose your money.

It’s a gambling addiction that cryptocurrency exchanges encourage you to partake.

For every trader who made money from Altcoins (vs BTC) there are probably 2-3 that lost money (vs BTC)

This is very much like stock picking vs. indexing, most people think they know better… they don’t.

These “New” banks are also not much different from their fiat banking predecessors. They still lose billions to theft every single year.

No matter how well these “security experts” paint a picture of their secure digital walls, they’re still highly susceptible to external and internal hacks.

Arguably, nobody can secure your bitcoins as well as your own. (for example using a brain wallet) Unless you suffer from the Dunning-Kruger effect.

‘Self-custody‘ is still the only way to go forward if you’re planning to hold bitcoins long term.

Evidently, people are still more concerned about how much fiat money they can make trading cryptocurrencies rather than learning how to secure their wealth with bitcoins. That’s why exchanges are springing up like mushrooms on a wet summer’s day.

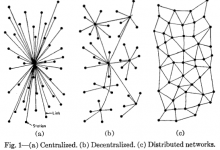

Bitcoin is the most secure financial network on the planet. But its centralized peripheral companies are among the most insecure. pic.twitter.com/0rxLtXscNJ

— Nick Szabo⚡️ (@NickSzabo4) June 18, 2017

The Price is highly attractive, but remember that you still mostly suck at trading. So, don’t.

If bitcoin is so safe, why does it keep getting hacked?

By owning Bitcoin, you become the central bank. And it is inherent that such empowering aspects of money isn’t delegated to anyone else even in trusted hands like bitcoin exchanges.

Not Your Keys, Not Your Coins

Bitcoin’s security isn’t a marketing gimmick you may make it out to be.

Problem is, learning how to secure it intelligibly even for information security experts, is a highly inter-subjective matter.

Some may say a paper wallet is the safest way you can secure you bitcoins. Others like Andreas Antonopoulos swears by hardware wallets. “Use a hardware wallet. Ignore all the people … who tell you to use a paper wallet.”

Whether you use a paper or hardware wallet, as long as you own your own bitcoin “keys”, you have nothing to worry about.

The concern arises when you store bitcoins on an exchange, now they basically own your “keys”. And the thing with bitcoin is that once it’s gone, it’s really gone for good.

Losing your funds on exchanges is unfortunately part of the growing pains in understanding Bitcoin as an individual’s sovereign money. And I can bet my bottom Satoshi that people will never learn until they lose their rare bitcoins.

Bitcoin is going to be digital gold, a place where you have sovereign money.

It’s not US money. It’s not Chinese money. It’s sovereign. Sovereignty cost a lot. It should”. – Mike Novogratz

If you want to learn how I store my bitcoins, read my essay on How I Chose My Bitcoin Wallet.

2. Trust in Centralized Cryptocurrency Exchanges Will Collapse

May 7th, 2019, the world’s largest cryptocurrency exchange, Binance discovered a security breach where hackers stole API keys, 2FA codes to access and withdraw 7,074 BTC (~$50 million) in one transaction.

Fortunately, that amount only comprises 2% of their total BTC holdings.

As it turns out that Binance CEO, CZ has known all along that even his incredible exchange isn’t completely immune to attacks.

In order to protect his customers money from attacks such as this, he had set aside a Secure Asset Fund for Users known as #SAFU in July 2018. The fund sets aside 10% of all the profit his company has made from trading to cover up losses.

Today, that fund which had barely crossed the 1 year mark is already set to be used to recoup the loss of some 7,074 btc (~$50,273,162 at the time of writing) on Binance.

Why did I make the comment in the first place?

2018 Binance revenue: $446mil

SAFU fund: 10% of all Binance trading fees

Age of SAFU fund: 10 months

Losses in Hack: $40milBinance claims the SAFU fund is mostly in BNB.

— DonAlt (@CryptoDonAlt) May 8, 2019

This is not an isolated incident.

Here are 35 of the Worst Cryptocurrency Exchange Hacks of All Time.

- June 2011: Mt. Gox ~$8.75 million stolen

- October 2011: Bitcoin7 ~ $50,000 stolen

- March 2012: Bitcoinica ~ $228,000 stolen

- May 2012: Bitcoinica ~ $87,000 stolen

- July 2012: Bitcoinica ~ $300,000 stolen

- September 2012: Bitfloow ~ $250,000 stolen

- May 2013: Vicurex: $160,000 stolen

- June 2013: PicoStocks: $130,000 stolen

- November 2013: PicoStocks: $3,000,000 stolen

- February 2014: Mt. Gox: $460,000,000 stolen

- March 2014: Cryptorush: $570,000 stolen

- March 2014: Poloniex: $64,000 stolen

- July 2014: Cryptsy: $9.5 million stolen

- August 2014: BTER: $1.65 million stolen

- October 2014: MintPal: $1.3 million stolen

- October 2014: KipCoin: $690,000 stolen

- December 2014: BitPay: $1.8 million stolen

- January 2015: 796exchange: $230,000 stolen

- January 2015: Bitstamp: $5.2 million stolen

- February 2015: BTER: $1.75 million stolen

- April 2016: Shapeshift: $230,000 stolen

- May 2016: Gatecoin: $2.14 million stolen

- August 2016: Bitfinex: $77 million stolen

- October 2016: Bitcurex: $1.5 million stolen

- February 2017: Bitthumb: $1 million stolen

- April 2017: YouBit: $5.3 million stolen

- December 2017: EtherDelta (DEX): $270,000 stolen

- January 2018: Coincheck: $500 million stolen

- February 2018: Bitgrail: $187 million stolen

- June 2018: Coinrail: $40 million stolen

- July 2018: Bancor (DEX): $23.5 million stolen

- Sept 2018 Zaif: $60 million stolen

- Jan 2019 Cryptopia: $17 million stolen

- Feb 2019 Quadriga CEO Death: $150 million lost

- May 2019 Binance: $50 million stolen

When you leave your valuable bitcoins (as you can see DEXs aren’t completely immune to attacks) on an exchange, you’re also leaving it to the inevitable.

Nevertheless, incidents such as this prove the dangers of trusting any exchange, decentralized or otherwise.

For many, the proliferation of Decentralized exchanges (DEX) is an essential ingredient that will provide the necessary resiliency to the cryptocurrency exchange space.

That being said, even DEXs has elements of centralization that can lead to single points of failure. Still since it delivers funds directly to users wallets, their funds were never at risk except the private funds of the exchange, so at least it didn’t have any elements of failure that some of the more prominent centralized exchanges do.

EtherDelta’s hack was due to DNS hijacking which meant that their domain was maliciously taken over to look like the real EtherDelta webpage. So any new orders on the site went to the attackers wallet instead.

On the other hand, Bancor’s weakness was in its Smart Contract that was apparently editable. And that the private key was somehow leaked to allow the hacker to move funds.

Be careful out there, not all DEXs are made equal. Here are our Top 20 Decentralized Exchanges on the Planet (Latest DEXs in 2019)

3. People Will Be Forced to Get Smarter About Where They Put Their Money

- 70% of Americans live paycheck to paycheck, with the vast majority of them having a negative net-worth.

- 72% cannot even get their hands on $500 in an event of an emergency

- Student debt is at $1.5 trillion

- Wealth inequality is at all time highs, 95% of America’s wealth is owned by just 15% of the population.

- 96% of financial advisers says that financial literacy is a significant issue, yet only 40% of them are doing anything about it.

- Finance industry spent less than $1 billion on financial literacy but spent $22 billion on marketing and sales campaigns to sell products to an uneducated consumer base. ~ Shirl Penny @DynastyFP

Not everyone is as fortunate as you are.

Wealth isn’t a game of cat and mouse.

People work their entire lives and deposit their hard-earned savings in banks.

If you were one of them who earned well before 2008, and you chose to deposit all your money in an Icelandic bank account, you would have lost all your wealth in a blink of an eye.

Weren’t banks meant to function as our trusted custodians of our hard-earned money?

How do banks all over the world get pulled under by such reckless lending practices by their American counterparts?

Then comes the decision to inject more monopoly money into the faltering economic system.

With so much money being pumped into the system via Quantitative-Easing (QE), federal governments today can still get away with substantial malinvestments in the hundreds of billions of dollars.

A detailed report written in 2015 called ”Prime Cuts” suggested that the government could actually eliminate $648 billion in spending from agriculture to defense, energy to health and human services, justice, labor, transportation and more.

Meanwhile, student debt is at a new all-time-high at over $1.5 trillion. As college costs rise, we’re seeing parents borrowing to make up for the difference.

And when that happens… there’s little incentive to save and plan for the future. Without any future plans, it’s difficult for families to ever recover from financial difficulty & debt.

For many people, myself included, the experience of the financial crisis primed us to embrace a new form of money. Money that is free from the hands of greed, tyranny and stupidity.

Money that upholds the principles of free markets, neutrality, censorship-resistance and above all, immutability.

That money is Bitcoin.

Satoshi was well aware of the frailty of our modern financial system. He published the Bitcoin white paper on 10/31/2008, one month after the collapse of Lehman Brothers.

Bitcoin was introduced at a time of absolute necessity. Trust that had already been lost to the hands of political greed.

And so it is vital for you to understand that bitcoin currency isn’t something that should be used as an instrument to make you more fiat money by adding 1s and 0s to your bank account.

Your first investment should not be in buying bitcoins, but in time understanding how to buy, store and own bitcoins securely in your own hardware wallet.

When you leave bitcoins on a custodial centralized exchange, you are repeating the same mistakes, entrusting your wealth in the hands of someone you can never trust.

4. Benefits of Trading Bitcoin Vs. Hodling

1. Don’t trade. Seriously, don’t trade. The *vast* majority of people overestimate their trading abilities and underestimate the risks involved. I knew someone who mined 5000 BTC in 2010 and dwindled his holdings down to < 2000 BTC by day trading on Gox. Don’t be that guy.

— Vijay Boyapati (@real_vijay) April 23, 2019

Do you have a long time preference or a short time preference? If you have a short term mentality, you must read this and rectify your ways before investing in bitcoin.

Trading is not for you! You will most likely be suckered into buying a trading course, or worse, buying into some shitcoin scam.

Unless of course you have a crystal ball that can tell you exactly when the prices will rise and when it will fall.

Absolutely no one on Earth can tell you this. Even those with complex stargazing charts that sounds phenomenal.

If they tell you they made lots of gains during the Bull Run in late 2017… consider this:

Bitcoin is not a Get Rich Quick Scheme,

It is a Get Rich Slow Scheme.

Don’t trust anyone who tells you they’re an expert and have made $X amount of dollars. These people are normally looking to get rich out of you, not their trades.

If you truly believe in Bitcoin, You should be Dollar-cost averaging your purchases. You should be demanding to get paid in Bitcoin or Earning them through places like Earn.

Because Bitcoin is the Ultimate game of accumulation.

Short term thinking is everywhere.

Noisy Speculative trades over little Gains.

The long term thinker will be king.

Win the decade, not the day.

Read my recipe for Bitcoin investing: The 3 Best Stock Trading Website for Beginners Offering Bitcoin

5. Your Bitcoin Will be the Scarcest Asset the World has Ever Seen

If you invested $1,000 in Amazon 10 years ago, you’d make about $20,000 today.

Even Warren Buffett admitted he was too dumb to realize Amazon’s Jeff Bezos would succeed on the scale that he has. He opted not to invest in Amazon when he had plenty of opportunities. He did not understand or appreciate the value of tech.

$1,000 in Microsoft = ~$8,000

$1,000 in Netflix = ~$100,000

$1,000 in Apple = ~$9,000

$1,000 in Bitcoin = ~10,000,000 (Even after an 85% crash in 2018)

If only the majority of investors were patient enough… Food for Thought!

Consider storing bitcoin for decades inside your own personal Swiss vault (brain wallet) and access it one day to find that it’s worth millions in fiat money.

You know how many people buy stocks in the recession? Less people.

You know how many people buy companies in a crash? Less people.

You know how many people are buying homes? A lot less people.

It’s just the Ugly Truth! In the last recession, stock markets plummeted, companies went bankrupt from being over-leveraged and millions were unemployed.

A collapse in demand for fiat money forces the economy to enter into a deflationary period.

What do governments do next?

They print more money. Inject more monopoly money and hope for the best. And that picture is what happens when the economy is filled with worthless paper money.

In a free market where money is subjected to great competition, the hardest money will win.

Money is a game where winner takes-all, driven by social network effects.

Since Bitcoin has a fixed supply of 21 million btc, the free market will only value it as something incredibly rare. Hence, the existing holders of bitcoin would tend to save rather than spend recklessly for their future.

This predetermined supply ensures that bitcoins cannot be diluted and this trait tends to drive demand way up over the long run.

For most types of assets, a price increase entices producers to make more of it, pushing the price back down. Giving a unit of money a false sense of illusive stability. But inflation happens ever so slightly, that it creeps up on us without getting our attention. And that folks is really dangerous!

You can typically see this happen will almost every kind of asset or fiat money in the world.

When the world melts, people will become more pragmatic about how they live their lives and how they manage their finances.

Bitcoin will be recognized as something hard, scarce, neutral and unchanging. Not something that governments and banks of the world can achieve and control.

I’m super passionate about this message, if you found it insightful please share this article on Twitter! Else, you can also keep updated on my research here:

As always, I’m not a financial adviser. I do own some bitcoins and I believe it will be recognized as the first truly sound money. Never invest more that you can afford to lose.

Understanding bitcoin will help you stomach the “dark times” and be more resilient in holding on and not selling at a loss. Bitcoin will experience periodic Gardner Hype cycles.

Our Quick Resources: