Decentralized Exchanges or DEXs will be a huge thing in 2019.

Why? Because it gives users like you and me Real freedom, security and control. The Exchange that you’re currently using now is most likely a centralized one.

On a centralized exchange, you have to deal with setting up accounts, satisfying AML/KYC laws, filing for withdrawal requests and trusting that your money is safe (#SAFU) with them.

Bitcoin is the most secure financial network on the planet. But its centralized peripheral companies are among the most insecure. pic.twitter.com/0rxLtXscNJ

— Nick Szabo⚡️ (@NickSzabo4) June 18, 2017

That’s how all the early bitcoin enthusiasts traded bitcoin — a Decentralized currency, one that allowed consumers to buy things while sidestepping both the banking system and national governments. But what the centralized exchanges like Mt. Gox shows, however, is that we’re replacing Central Banks with Centralized Exchanges. But I’m getting ahead of myself.

Cryptocurrency is meant to give power back to the people, reduce control & minimize the influence of tech companies, banks and billion dollar corporations.

However, the very first experience that you’ll likely have with this new form of decentralized currency is with a centralized one.

You would have to take a selfie with you holding up your passport or driving license; like a criminal.

And then, you’ll have to submit your personal information, with your home address and proof altogether with that just to have your first taste of what a decentralized cryptocurrency really is and does.

Not only do every new participant in this brand new decentralized experiment require setting up an account in that order, they likely have to deal with security vulnerabilities and lost of funds…

Here are 29 of the Worst Cryptocurrency Exchange Hacks of All Time.

- June 2011: Mt. Gox ~$8.75 million stolen

- October 2011: Bitcoin7 ~ $50,000 stolen

- March 2012: Bitcoinica ~ $228,000 stolen

- May 2012: Bitcoinica ~ $87,000 stolen

- July 2012: Bitcoinica ~ $300,000 stolen

- September 2012: Bitfloow ~ $250,000 stolen

- May 2013: Vicurex: $160,000 stolen

- June 2013: PicoStocks: $130,000 stolen

- November 2013: PicoStocks: $3,000,000 stolen

- February 2014: Mt. Gox: $460,000,000 stolen

- March 2014: Cryptorush: $570,000 stolen

- March 2014: Poloniex: $64,000 stolen

- July 2014: Cryptsy: $9.5 million stolen

- August 2014: BTER: $1.65 million stolen

- October 2014: MintPal: $1.3 million stolen

- October 2014: KipCoin: $690,000 stolen

- December 2014: BitPay: $1.8 million stolen

- ….WHEW……

- January 2015: 796exchange: $230,000 stolen

- January 2015: Bitstamp: $5.2 million stolen

- February 2015: BTER: $1.75 million stolen

- April 2016: Shapeshift: $230,000 stolen

- May 2016: Gatecoin: $2.14 million stolen

- August 2016: Bitfinex: $77 million stolen

- October 2016: Bitcurex: $1.5 million stolen

- February 2017: Bitthumb: $1 million stolen

- April 2017: YouBit: $5.3 million stolen

- January 2018: Coincheck: $500 million stolen

- February 2018: Bitgrail: $187 million stolen

- June 2018: Coinrail: $40 million stolen

- Just happened Zaif: $60 million stolen

~Source: CoinIQ ( Psst! Guess what, they’re all centralized )

So you mean to tell me that this decentralized cryptocurrency is so insecure?

No. I’m telling you that securing or storing your cryptocurrency in a centralized exchange like the ones above, is highly insecure.

Centralized exchanges are no different from banks. They’re the third party we’re trying to sidestep in the first place.

If a thousand people trusts a single person with all their money, that single person will turn into a Honeypot. And Honeypots lure the brightest and smartest cyber-attackers to detect and study ways to gain access to those funds because its worth all the time and energy to do so.

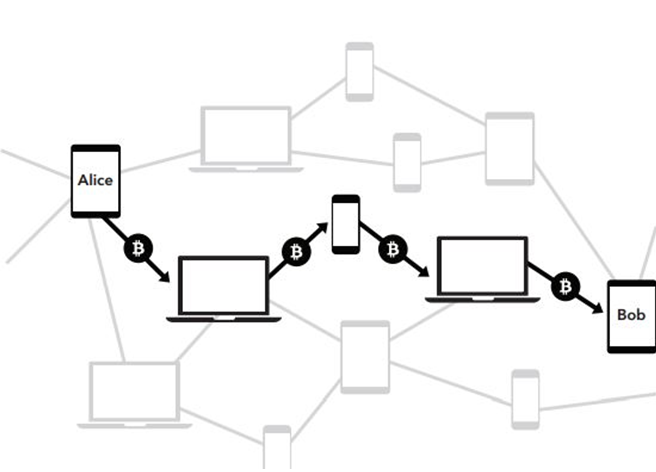

Since the majority of exchanges operate in a centralized fashion as custodians of your crypto, the only way to mitigate this single point of failure is to turn centralized exchanges into decentralized exchanges (DEX).

Decentralized exchanges when fully functional, will render bad actors powerless against the cryptocurrency market. And we still need cryptocurrency markets to attract more users into the network.

Eventually, as the adoption of cryptocurrencies reaches the tipping point, fiat currency or the dollar bill in your pocket will become less and less relevant as traders will have no choice but to revert their positions in crypto instead of fiat on decentralized exchanges.

Security expert and founder of McAfee Corporation, John McAfee believes that centralized exchanges will go extinct one day and that decentralized exchanges (DEX) will mark the beginning of the largest economic boom in human history.

As of now, all the top exchanges are all centralized. A study by Mistertango suggests that 88% of cryptocurrency exchanges are in favor of regulation for operational certainty and price stability.

It is the inherent nature of Bitcoin that such a knowledge given to us by Satoshi Nakamoto, should never be delegated or outsourced.

The plight of the world we live in today comes down to the lack of personal & financial responsibility that each of us carry. And this is the real investment that everyone needs to make to carry the world forward.

20 Top Decentralized Exchanges – Not All DEXs Are Created Equal

Currently, decentralized exchanges are being developed along these three avenues:

- On-chain orderbooks and settlements

- Off-chain orderbooks with on-chain settlement

- Smart contract-managed reserves

*24-hour trading volume is represented in BTC as a Unit of Account, does not mean that the DEX trades BTC pairs.

1. IDEX

IDEX is an example of a partial decentralized form of exchange. It allows you to trade ERC20 tokens with the speed and intuitiveness of a centralized exchange but you will still need to rely on them as an arbiter/third-party to complete each trade.

It offers a smoother and faster trading experience than EtherDelta or ForkDelta because of this “arbiter”.

The arbiter needs to frequently send completed smart contracts to the blockchain to maintain its books. This keeps the balances in synchronicity at all times.

For traders who aren’t comfortable with them handling your private keys, this would be the only major drawback.

PROS:

- High Volume compared to other DEXs (24-hour volume – 125 BTC)

- Uses a native token AURA offer similar benefits to hodlers like the Binance Coin.

- Use in conjunction with MetaMask or Hardware Wallets to improve security.

CONS:

- Still need to register on this exchange

- You have to trust your Private keys with IDEX

2. StellarTerm

Stellar (XLM) is currently the 4th largest cryptocurrency by market cap at the time of writing. It is also behind this DEX.

StellarTerm is relatively easy to use but lack substantial liquidity for high velocity traders. They do offer a variety of markets to trade. (24-hour volume – 115 BTC)

This DEX identifies you via your wallet, but requires your private keys. As an added precaution, you can password protect.

You will need to deposit 20 XLM to activate and start trading.

There is an open-source desktop client for installation.

3. Waves DEX

Waves DEX is another example of a partial decentralized exchange which still requires users to register an account. But no personal information is required from your part.

Waves uses its own blockchain and so you will need to have your own Waves wallet because the Waves DEX uses your wallet to secure your funds via their blockchain without storing it in a centralized server.

Similar to IDEX, centralization improves the trading velocity on the platform and ensures blockchain synchronicity.

All the fees you pay to transact on its blockchain are based in WAVES. (24-hour volume – 100 BTC)

You can trade some of the biggest cryptocurrencies in the open market right here including fiat to crypto as well.

There is a desktop client for installation.

4. OpenLedger DEX

OpenLedger is built using the Bitshares blockchain, an industrial-grade decentralized platform conceived by Dan Larimer; a serial cryptocurrency entrepreneur.

This DEX has full-blown Bitcoin trading pairs, altcoin pairs and fiat to crypto exchange.

You have to own the tokens called BITs to trade and pay transaction fees.

There are two simple options to start with, creating a wallet which the DEX identifies you directly via your unique computer wallet address (more secure) or register an account like any normal centralized exchange (more accessible from any devices)

OpenLedger DEX is 24-hour trading volume at (24-hour volume – 65 BTC)

5. Kyber Network

CEO Loi Luu from Singapore calls the Kyber Network the hybrid of NASDAQ and Visa combined.

What makes it so special? Well, for starters they have Vitalik Buterin as their advisor.

Want to be a Liquidity Provider and not a trader? The KyberNetwork will give you exactly this.

It works by users sending and receiving ERC-20 tokens at predetermined rates. Meaning its like a second hand bookstore, where anyone can list their tokens and wait for someone who agrees on the price and make the swap.

The process is instant, and immediate completed with just a few clicks.

To start, access the website here, connect to your wallet, options include: Metamask, JSON, Trezor, Ledger, Private key or Promo Code.

This is unlike any ordinary exchange where you have to register an account. The swaps here happen without needing you to deposit your tokens.

Kyber has its own token called KNC, trading at $0.13 with a (24-hour volume – 290 BTC)

6. EtherDelta

-

- PROS; Etherdelta only allows you to trade Ethereum and Ethereum based tokens (ERC20)

I think the https://t.co/X1GnJmkC5U model for developers getting paid is underrated. https://t.co/Nt3duMYOVX

— Vitalik Non-giver of Ether (@VitalikButerin) October 8, 2017

- It uses smart contracts to manage the trades between users.

- You don’t need to setup an account or verify your ID.

- It uses your ETH wallet to identify each participant in the market.

- Brand new tokens typically appear right here long before they get traded elsewhere.

- CONS; DNS attacked, Ugly interface, Frequent lags and quite un-user friendly.

- Beware of Phishing sites that pretend to be the official site.

- Low liquidity (24-hour volume – 38 BTC)

Ethereum founder Vitalik Buterin once praised the model being used on EtherDelta as a decentralized exchange.

Developers are normally reluctant to work on decentralized exchanges because of the lack of monetary incentives. With EtherDelta however, developers continue to maintain and upgrade the site.

Once there was somebody who recommended Binance to Buterin, but he responded:

“That requires setting up an account. I like EtherDelta precisely because it doesn’t. Just visit the site with MetaMask on and start using it. Not slow at all. I don’t give a damn about split-second trading. To me, speed includes login, deposit, withdrawal, logout time,”

7. ForkDelta (EtherDelta Fork)

This DEX is a fork of EtherDelta. Their developers parted ways due to disagreements between the developers.

According to the ForkDelta team, ‘they introduced questionable development decisions…”

ForkDelta is a clone of EtherDelta in every way but strives to progress in the direction of community consensus. They want to be open and fair to their members.

They are paying royalty fees to EtherDelta for using their smart contracts.

Look out for the Green Padlock and check the Alexa ranking. (this extra steps does not guarantee you’re safe but it’ll give you some peace of mind.

8. Bancor

(Hacked in July 2018 due to editable Smart Contract) Some may consider Bancor to not qualify as a DEX: Read this Redditor’s answer on why…

This gives KyberNetwork some form of competition in the arena.

Bancor allows swaps for ERC-20 tokens via your mobile messaging apps. Options include – SMS, Telegram, WeChat and Messenger.

As such when accessing the site, you need to use your mobile device.

After verification, you will then have you wallet ready on your mobile phone where you can start importing or swapping tokens.

Similarly to KyberNetwork, the prices, volume and graph shown do not reflect the depth and liquidity of an exchange site. The swap rates you see here are final, you can only choose to agree or move on to the next offer to swap. It’s a barter trade. Two chickens for a Tyre? Well, the choice is yours…

9. CryptoBridge DEX

Similar to OpenLedger DEX, CryptoBridge utilizes Bitshares amazing Graphene to process up to one hundred thousand transactions per second (100,000 Tx/s)

Trade BTC, ETH, LTC, RVN and many more Cryptocurrencies. Using Bridgecoin (BCO), its native token, you’ll gain 50% revenue share with BCO Hodlers.

When you click on “Create Account”, you’ll be assigned a locally generated password which you’ll need to confirm that you’ve written it down. Losing or theft of this password would ultimately mean that your funds are as good as gone.

CryptoBridge has a respectable 24-hour volume – 246 BTC.

10. OasisDEX

Created by MakerDao and backed by Andreessen Horowitz’s fund; OasisDex is a compelling DEX that has a respectable 24-hour trading volume of 157 BTC.

Despite only listing 3 trading pairs of ETH, DAI (stablecoin) and MKR; OasisDex is popular because it relies heavily on its first decentralized asset-backed stable coin (1 DAI = 1 USD) which is being integrated into many other platforms and exchanges.

Trading on this DEX requires you to integrate an Ethereum client (Metamask, MIST or a Coinbase wallet)

11. Radar Relay

A cool sleek, trustless trading platform that utilizes the 0x protocol to run (trade/fees are in ZRX).

You would first need to buy a Trezor or a Ledger, or if you have a MetaMask account, connect the wallet to access your funds.

As such, there is no middleman involved, because its direct from your wallet to the RadarRelay app. The app is programmed to settle and apply fees onto each trade making is feel seamless, smooth and intuitive like a centralized exchange.

RadarRelay has a respectable 24-hour trading volume of 155 BTC.

12. 0x protocol

0x protocol is an example of a DEX with an off-chain orderbook with on-chain settlements being used by DEXs like RadarRelay which I have just featured above.

Built on Ethereum, trades happen on the Ethereum blockchain, giving you control over your funds when you connect your Ledger or Metamask wallet while waiting for the exchange to take place, meanwhile the order books are hosted by third-parties called Relayers like the ones in the boxes above.

13. Bisq (BitSquare)

- 24-hour trading volume of 90 BTC

You can simply download the open-sourced client software like any other computer application on your WINDOWS, Mac, Ubuntu or Linux and start trading without needing to give away any of your personal information.

All your trading data is stored locally on your computer. Therefore protecting your privacy.

Also, your funds are fully under your control. The software acts like a desktop cryptocurrency wallet where you have to set your own password and secure your own seed words.

- Payment Methods — Explore 20+ supported fiat currency payment methods, from Alipay to Zelle

- Altcoins — Explore 100+ supported cryptocurrencies, tokens and assets

14. TRX Market

TRON’s founder, Justin Sun, behind the 10th largest cryptocurrency TRX by market cap recently launched the DEX called TRXMarket for TRC20 tokens. Previously, their Tronscan.org platform only caters TRC10 tokens.

The exchange is currently running only 3 trading pairs:

- GOC/TRX

- BET/TRX

- FUN/TRX

As of now, they have have a 24-hour trading volume of around 10 BTC. To begin trading, you will need download the tronlink wallet to start your trade.

15. AIRSWAP

Another ERC20 token Decentralized exchange with a wide variety to choose from. You’re actually trading on the Ethereum blockchain where you can connect your MetaMask, Ledger or Trezor to immediately swap tokens simply, securely and with ZERO Fees.

This is not a conventional exchange with order books or front-running traders.

You offer the bid price for your asset, and somebody will accept your bid. As takers, they pay nothing to discover your bid. This is done via Smart contracts, Airswap indexers and Oracle.

Want to be a liquidity provider? Signal the support by staking 100 AST (Airswap Tokens), once the amount is locked, you will be given 10 trades.

Its special feature, Airswap Spaces allows you to build eCommerce stores, marketplaces and allow auctions. Meaning you can start a business right here, right now and accept tokens as payments for your goods.

A notable Cryptocurrency hedge fund manager, Michael Novogratz is also backing this project to succeed.

Check it out!

16. BarterDEX (Komodo)

This is Komodo’s Decentralized exchange (DEX)

To use BarterDEX, download the software client on your computer via the link. Above is a simple video walkthrough to help you install it on your computer.

For you to start trading, you’ll need to download its Agama wallet as well and fund your address with tokens.

BarterDEX is a Komodo Atomic Swap Powered DEX and the world’s leading with over 110,000 completed swaps.

September 2017, saw the first Atomic swap ever completed by Charlie Lee, Litecoin founder:

Did a cross-chain atomic swap with LTC/BTC! 😁

10 LTC for 0.1137 BTC with @JStefanop1. ⛓️⚛️💱https://t.co/vXwTNirk0Jhttps://t.co/3NTplBOoW9 pic.twitter.com/DRKaHg4Wc7— Charlie Lee [LTC⚡] (@SatoshiLite) September 22, 2017

With BarterDEX, you are dealing directly with the other party’s wallet, there’s no intermediary at all. You are also not giving up your private keys at any point in time.

Atomic swaps do not happen unless both parties receive the funds they wanted. There is however a small transaction fee for the order taker should the swap fail.

One great thing about this is that you can swap Bitcoin protocol based coins and Ethereum based ERC20 tokens, giving BarterDEX a complete coverage of up to 95% of all coins and tokens in the current market.

To Learn more about Atomic Swap, check out Komodo’s writeup.

17. RexEx (Republic Protocol – Beta)

RenEx is a Decentralized dark pool exchange protocol for trading large volumes of digital assets.

It seems they found a way to carve out a niche within the decentralized exchange space.

What dark pool means is that orders are matched on the DEX without exposing the price or volume of the orders. This gives privacy to token asset owners who wants to trade large amounts of token.

The Republic Protocol ensures that the rules of the dark pool cannot be infringed.

Interested to learn more about RenEx? Read their documentation.

18. EthFinex Trustless

Ethfinex Trustless is a high performance platform for decentralized trading. Built by the creators of Bitfinex as a new community focused on ERC20 tokens and Ethereum based projects.

With Ethfinex Trustless there are no signups, no deposit or withdrawal delays and no sacrificing custody of your tokens.

You and only you will retain full control of your funds throughout the whole process whilst executing trades against a highly liquid off-chain order books.

In fact, the whole process feels seamless…like a full-blown centralized exchange.

The Bitfinex order book makes the Ethfinex trading experience unique in the DEX space.

While most DEXs lack liquidity, Ethfinex Trustless allows you to trade directly against the Bitfinex and Ethfinex order books.

With one of the most liquid order books in the crypto space, you can now take advantage of a high-liquidity, low-spread trading experience without sacrificing the control that the decentralized movement is founded upon.

19. Altcoin.io

Powered by Ethereum’s Plasma technology, Altcoin.io is a next gen DEX.

Plasma gives Altcoin.io the underlying architecture to build a faster, safer and more scalable decentralized exchange.

20. OMG DEX (Under Development)

OMG DEX design uses the OmiseGo Network with provable on-chain settlement.

Order matching is performed off-chain.

21. Binance DEX (Almost Completed – Sneak Preview)

Binance DEX is built on top of Binance Chain, using the Binance Coin (BNB) as a native asset.

What can you do on Binance DEX?

- Send and receive BNB to anyone on the DEX

- Issue new tokens

- Send tokens to others on the DEX, and receive some in return

- Burn tokens as needed

- Freeze some tokens, and unfreeze them later

- Propose new trading pairs, with the whole community having a say on the merits of the pairing

- Send buy and sell orders through trading pairs the community created

Binance DEX takes the current Binance initiative to make your funds even more secure.

Your DEX funds is secured via the Trust Wallet, which will store your private keys only on your device.

Details on when Binance Coin will transition from ERC20 token to native Binance Chain asset will also be revealed soon.

Conclusion – Which is the Best?

The decentralized exchange model is at a nascent stage, but there are dozens of players growing and expanding in the space as we speak.

Notable names include Bisq, 0x, KyberNetwork, Binance, Ethfinex, WavesDEX and BarterDEX.

The best DEX depends on what you’re looking for:

- EtherDelta offers the largest number of ERC-20 tokens.

- 0x is a protocol that uses relays to decentralize trust and;

- Waves DEX is sleek and intuitive.

- Kyber and Komodo’s BarterDEX uses swaps to solve the matching problems.

Overall, the decentralized exchange model that’s most efficient and liquid will win over the crowd.

This remains DEXs’ greatest challenge.

Competing with the established centralized exchanges (which typically trade hundreds of times more volume every day) is simply impossible.

But also take note that with centralized exchanges, you are taking risky bets storing your cryptocurrencies on their platforms.

For regular traders, DEXs is the obvious choice: you find one that has satisfies your need.

Soon, you’ll not have to deal with clunky, slow and ugly DEXs; Ethfinex, Kyber & RadarRelay are paving the way for highly intuitive and beautiful interfaces.

Did I miss out anything? Let me know in the comments section below or pin this article.

10 hours of writing and research went into this piece on CoinZodiac. Please share, thank you.

You can keep updated on my research here:

Below, If you like to read it later, Pin it!