Ever wondered where all those fees you pay go when you send bitcoin from one address to another?

Well, a large amount of it is going to miners, the people who validate the transactions on the network and complete the blocks.

For years, mining bitcoin and other cryptocurrencies was a popular way for tech-savvy enthusiasts to earn extra money on the side. But as the network has grown, the processing power demands have increased dramatically, as well as the amount of electricity required to run computers or specialized mining equipment.

Demand for the semiconductor division increased due to sales of system LSIs [ASICs] for flagship smartphones and demand for virtual currency mining chips. ~ Samsung

Are you intrigued by the idea of getting into bitcoin mining, but aren’t sure if it still profitable? Don’t worry— we’ve got you covered. We’ve put together this quick A-Z guide to explain what mining is, how it works, what you’ll need to get started, and help you decide whether it is worth your time and money.

A Quick Mining Recap

A brief refresher on what defines “mining” is in order. Simply put, without nodes operated by miners, the bitcoin network would not function. Miners are not actually “digging” for anything. Rather, they are using computer processing power to verify transactions between bitcoin users, and add the record of those tractions to the public ledger. This is also done to prevent problems like would-be scammers attempting to spend the same coins more than once.

When a block is created, the miners apply a complex mathematical formula to it, and the numbers of the block are reduced to a much smaller, seemingly incomprehensible number called a hash. This process is called “Proof of Work” or “PoW”.

From a computational standpoint, mining is very hard work. It demands a lot of processing power, as well as electricity (which we’ll talk about more in a moment). Given the level of difficulty involved with mining, there needs to be an incentive for people to do it in the first place. As a reward for their efforts, miners earn payment in the form of bitcoin transaction fees. This is how the bitcoin network sustains itself (as well as other POW coins).

In addition to this, they get a chance to earn bitcoins every ten minutes, when a new block is added to the chain. The more processing power you are contributing, the greater your chances of winning the reward (6.25 BTC at the time of this writing).

Bitcoin mining is entering commoditization phase with a variety of competitive manufacturers:

– TSMC 16nm: Bitmain Antminer S9 (~10GH/J), Bitfury BF8162C16 (~10GH/J), Canaan AvalonMiner 841 (~10GH/J).

– Samsung 10nm: DragonMiner T1 (~11GH/J), Ebit E10 (~11GH/J). pic.twitter.com/FN5n3bhecL— Fernando Nieto (@fnietom) May 16, 2018

Miners can work solo, or team up with other miners to form what is called a “mining pool”. If the pool wins bitcoins, the reward is distributed among members of the pool.

Different Types of Mining

There was time when all you needed to mine bitcoin was a laptop to run the special mining software, and a steady internet connection. But those days are long gone.

You see, as time has gone on, the bitcoin network has gained more and more users, and there are more and more transactions that need to be verified. In addition to this, the mathematical complexity of mining grows over time. As this process has continued over the years, it reached the point where laptops or basic desktop computers were simply not up to the task any more.

People began to switch to souped-up desktop systems with very powerful graphics processing units (GPUs) which handle the burden of mining much better, despite not being designed for such a task. Eventually though, even faster solutions were needed.

This led to the development of Application Specific Integrated Circuit (ASIC) hardware. These are expensive, specialized machines which are designed for mining cryptocurrency— and nothing else.

There are pros and cons to each, which we’ll break down below.

ASIC Mining

If you have a lot of money to invest and are serious about making money from mining, ASICs are the way to go.

Pros:

- ASIC machines generally use less power than GPUs.

- Much higher hash rates. ASIC machines are predominantly used for mining with the SCRYPT and SHA-256 algorithms, which apply to Litecoin (LTC) and Bitcoin (BTC), respectively. For this reason, if you are interested in mining these two currencies and sticking with it in the long run, ASICs are the best choice.

- Potentially much more profitable. The combination of greater processing power and higher energy efficiency means a higher profit margin.

Cons:

- (Very) Expensive. ASICs tend to cost at least $500 USD, with the higher-end models costing $1000-$1500 USD. And don’t think about buying a used one because…

- ASICs have very low resale value. It is unlikely you will make any money selling a used ASIC because newer versions of the hardware come out so quickly, and once a model is released, the old one becomes obsolete. ASIC hardware also cannot be upgraded; once it is released, that’s it. You stick with it, or you buy a new one.

- Factors outside your control can ruin your investment. A change in the hashing algorithm can make running a particular ASIC model unprofitable. While this isn’t something that should keep you awake at night, it is a minor risk you need to be aware of.

- Fewer mining choices. As the name implies, they are very specific to the algorithm it is designed to work with. This means fewer choices in terms of which cryptocurrencies you can mine with that hardware.

Graphics Processing Unit (GPU) Mining

Pros:

- Lower prices create a much lower barrier to entry for miners with smaller budgets.

- Higher resell value. GPUs can be used for more than one thing, and retain more value over time than an ASIC.

- More choices for mining. GPUs are designed for general-purpose computing, meaning they are not application-specific like an ASIC. They are not limited by algorithm, so if you want to mine proof-of-work altcoins like ZCash or Monero, you can do that with a GPU.

- Bios upgrades will extend the lifespan of your GPU, and you can always replace a GPU for a reasonable price.

Cons:

- If you want to mine BTC or LTC, a GPU simply cannot compete with an ASIC. Don’t even bother, there is just no way for it to be profitable.

- GPUs require more power. You are more likely to drive up your electric bill with this approach. You must always keep power costs in mind when mining if you want to make a profit.

- Not as powerful as an ASIC. In terms of sheer specialized processing power, an ASIC has the GPU outgunned.

Whether you go with ASIC or GPU mining, there are some things you will need to keep in mind. You will need constant, stable high-speed internet connectivity, as well as a stable power source— because you’re going to be using a lot of it. It must be kept on almost all the time, because whenever the machine is turned off or disconnected from the internet, you are no longer able to mine, and thus no longer earning money.

Place your computers or ASICs in a place where they will stay cool, because mining processors will create a lot of heat. For this reason, you should not try to mine with laptop; because it would need to be left running at basically 100% processing power for long periods time— something laptops are simply not designed to do. This will damage or destroy your laptop.

Cloud Mining

Does this all sound like way too much work? Cloud mining might be the right choice for you.

With cloud mining, there is no hardware setup on your part at all. You just pay a monthly fee for hashing power, and the miners hosted by the company do all the work for you. Genesis Mining is one of the largest. Sound a little too good to be true? Let’s look at the pros and cons.

Pros:

- Easiest, most stress-free way to get into crypto mining. No hardware setup or investment required by you.

Cons:

- With many cloud mining companies, you must purchase a membership contract, sometimes for periods of up to 24 months. Given that mining becomes progressively more difficult over time, it is possible that after a while your mining contract will no longer be profitable. (Some companies like NiceHash do allow you to cancel anytime, and allow you sell your hashing power in exchange for BTC.)

Calculating Profitability

With all this in mind, the question remains: is mining even worth your time and money?

It depends on how much money you are able invest into mining. If you are willing to put serious money into it, and fill up a warehouse with ASICs, it might be tempting to do it. But you’ll need to take electricity costs into account. It is quite possible to end up spending so much on power for the mining rigs that you are actually losing money by engaging in mining. This Energy Consumption Calculator makes it easy for you to figure how much you’ll be spending on electricity, based on how many watts your computer/ASIC will be using. Subtract your power costs per month, and that is your profitability.

Mining Economics

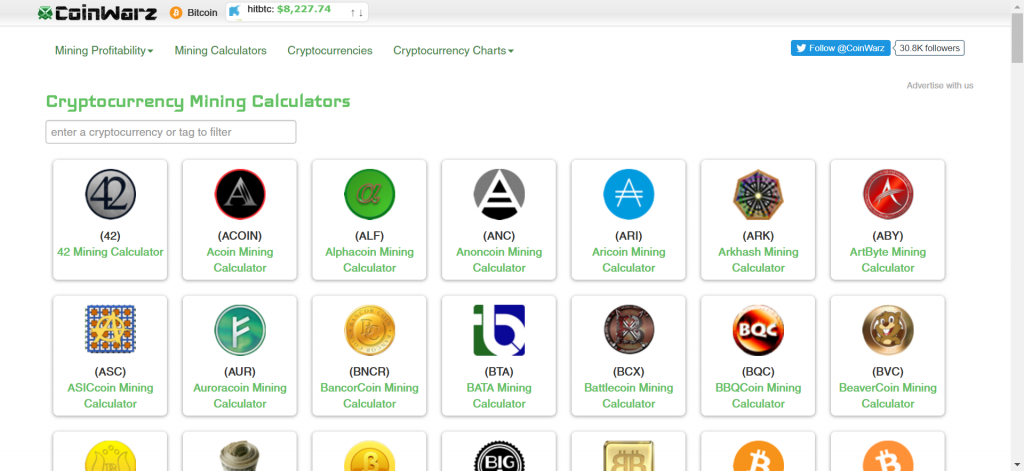

There are a number of fantastic websites which can calculate exactly how profitable mining will be for you based on your hardware. Some also offer reviews of different mining companies, pools, and more:

Which currency should you mine?

If you can keep your power costs low enough, and want LTC or BTC, then an ASIC rig would be a good choice. If you are sticking with a GPU in a desktop, you will want to consider mining a less competitive altcoin instead. Monero, ZCash, Dodgecoin and Vertcoin are popular altcoin mining options. (You can always trade them for BTC or LTC later using Changelly)

Even with GPUs, whether one coin or another is more profitable for you will depend on your hardware. Mining ZCash tends to be more profitable with GPUs made by Nvidia, while AMD GPUs are best for mining Monero. The sites listed above will help point you in the right direction.

Storing Your Earnings

Mining is hard work, so don’t keep your newly acquired coins on a centralized exchange that can be hacked or where you can be locked out of your own wallet. Keep them to a secure multi-currency software wallet or hardware wallet like a Nano Ledger S or Trezor hardware wallet.

Price tag

The Ledger nano s currently goes for around $99. This makes it cheap when compared to its competitor Trezor which is being sold for around $110.

Conclusion

We hope this was a helpful introduction to the world of cryptocurrency mining. This is a complicated topic, and if you choose to start mining, there will likely be some trial and error before you start making real money. But if you are tech-savvy and persistent, there is indeed money to be made!